Are annuities safe for retirement?

Annuities can be a safe option for retirement income, but their safety and suitability depend on various factors, and it's essential to understand both the advantages and limitations. Here are some considerations regarding the safety of annuities for retirement:

Advantages of Annuities:

Guaranteed Income: Annuities, particularly fixed and immediate annuities, offer guaranteed income streams, providing a stable source of income throughout your retirement years.

Principal Protection: Many annuities, including fixed and indexed annuities, come with principal protection, which means your initial investment is safeguarded. This can provide a sense of security, especially if you're concerned about market volatility.

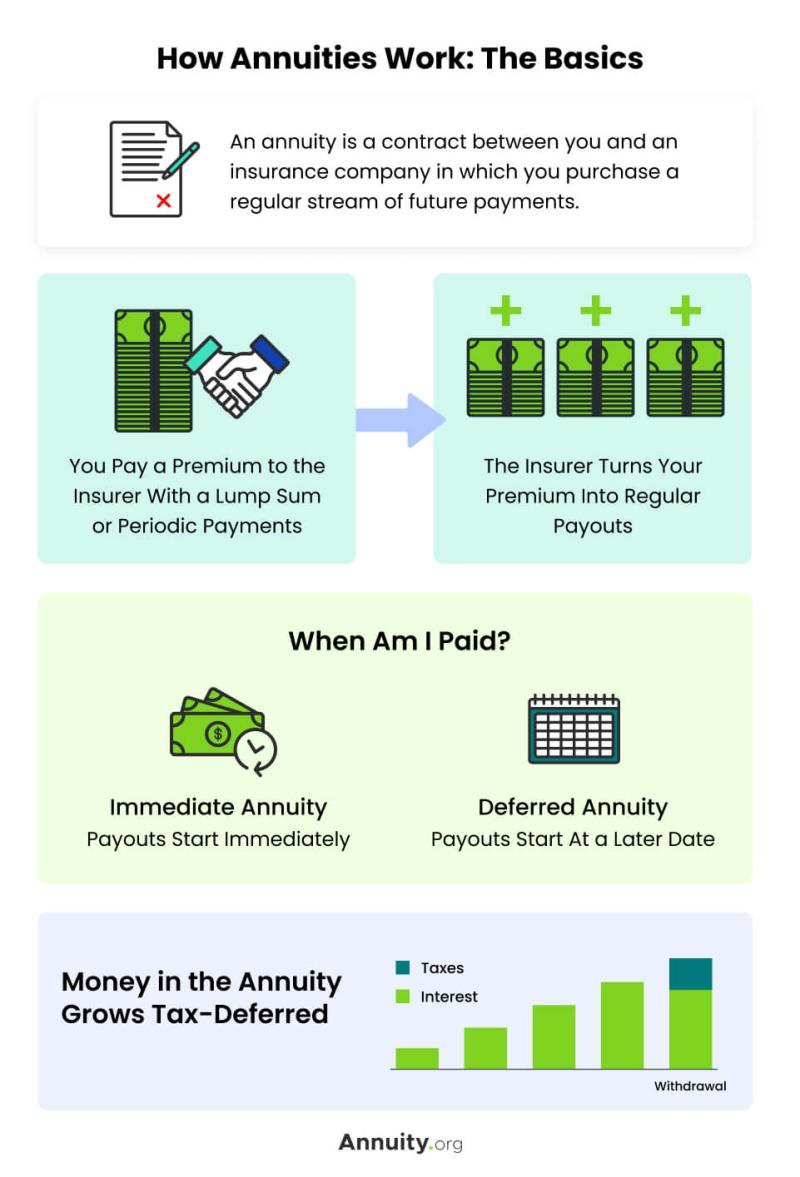

Tax Benefits: The growth within an annuity is tax-deferred, meaning you won't owe taxes on the interest or investment gains until you withdraw the funds. This can be advantageous for accumulating retirement savings.

Lifetime Income Options: Some annuities offer the option of lifetime income payments, ensuring you won't outlive your savings. This can help mitigate longevity risk in retirement.

Considerations and Limitations:

Lack of Liquidity: Annuities are typically designed for the long term and may not be suitable if you need access to your funds in an emergency. Early withdrawals or surrenders can result in penalties and fees.

Complexity: Annuities can be complex financial products, with various features, options, and fees. It's crucial to fully understand the terms and conditions before purchasing one.

Inflation Risk: Fixed annuities, in particular, may not keep pace with inflation, which can erode the purchasing power of your income over time.

Fees and Commissions: Annuities may come with fees, including sales commissions, administrative charges, and surrender charges. Be aware of the cost structure and how it may impact your returns.

Dependence on the Issuing Company: The safety of an annuity depends on the financial stability of the insurance company issuing it. It's important to choose a reputable and financially sound company to minimize the risk of default.

Market Risk (Variable Annuities): Variable annuities expose you to market risk because your investment is tied to the performance of underlying investments. If the investments within the annuity underperform, your income may be lower than expected.

Loss of Control: When you purchase an annuity, you typically give up control of the principal sum in exchange for income. This lack of control may not be suitable for everyone.

In summary, annuities can be a safe and valuable option for retirement income, particularly for those looking for guaranteed income and principal protection. However, it's crucial to carefully evaluate the type of annuity, its terms and conditions, and the financial strength of the issuing company. Additionally, consider your overall retirement strategy and how an annuity fits into your portfolio, as it may not be the best choice for everyone's retirement plan. Consulting with a financial advisor can help you determine whether an annuity aligns with your specific retirement goals and needs.

Retirement Security with Annuities: Assessing Safety

Annuities have long been considered a conservative and safe investment option, particularly for retirees seeking a steady stream of income. They offer a guaranteed return on investment, shielding policyholders from market fluctuations and ensuring a predictable income flow during their retirement years. However, it's crucial to understand the various types of annuities and their associated risks before making an informed decision.

Annuities in Retirement Planning: Safe or Risky?

The safety of annuities depends on the specific type of annuity and the issuing insurance company. Fixed annuities are generally considered the safest option, as they provide a guaranteed interest rate for a predetermined period. Variable annuities, on the other hand, offer the potential for higher returns but also carry more risk, as their value fluctuates based on market performance.

Understanding Annuities as a Retirement Savings Vehicle

Annuities can play a valuable role in retirement planning by providing a secure source of income and protecting against the risks of outliving one's savings. However, they are not without their drawbacks. Annuities typically have lower investment returns compared to other asset classes, and there may be surrender charges for early withdrawals.

Key Considerations for Annuity Investments

Type of annuity: Fixed annuities offer guaranteed returns, while variable annuities offer higher return potential but also carry more risk.

Insurance company: Choose a reputable and financially sound insurance company to ensure the security of your investment.

Annuity fees and charges: Understand all fees and charges associated with the annuity, including surrender charges and administrative fees.

Retirement goals: Determine how well the annuity aligns with your overall retirement goals and income needs.

Seek Professional Guidance

Consulting with a financial advisor can help you assess your individual circumstances and determine if annuities are a suitable addition to your retirement portfolio. They can guide you through the various options, explain the risks and benefits, and help you make informed decisions that align with your long-term financial goals.

Conclusion

Annuities can provide peace of mind and financial security during retirement. However, it's essential to understand the different types of annuities, their associated risks, and how they fit into your overall retirement plan. Seek professional advice to make informed decisions that safeguard your financial future.