What is the TC code for accounting adjustment?

In accounting and finance, the term "TC code" can vary depending on the context and the specific accounting system or software being used. "TC" could stand for "Transaction Code" or refer to something else entirely. The specific code for an accounting adjustment will also depend on the nature of the adjustment and the system you are using.

To find the appropriate TC code for an accounting adjustment, you should consult the accounting software or system documentation or speak with your financial department or accountant. The TC code for an adjustment may be specific to the system or organization and may not have a universal code applicable to all accounting contexts.

1. Significance of TC code in accounting

Transaction codes (TC codes) are alphanumeric codes that are used to identify and process specific accounting transactions in enterprise resource planning (ERP) systems. TC codes are used to record a wide variety of transactions, including sales, purchases, payments, and receipts. They can also be used to adjust accounting records, such as to correct errors or to account for changes in accounting estimates.

TC codes are important in accounting because they help to ensure that transactions are processed accurately and efficiently. By using TC codes, accountants can avoid having to manually enter data for each transaction, which can reduce the risk of errors. TC codes also help to ensure that transactions are posted to the correct accounts and that the accounting records are up-to-date.

2. How to make accounting adjustments using TC codes

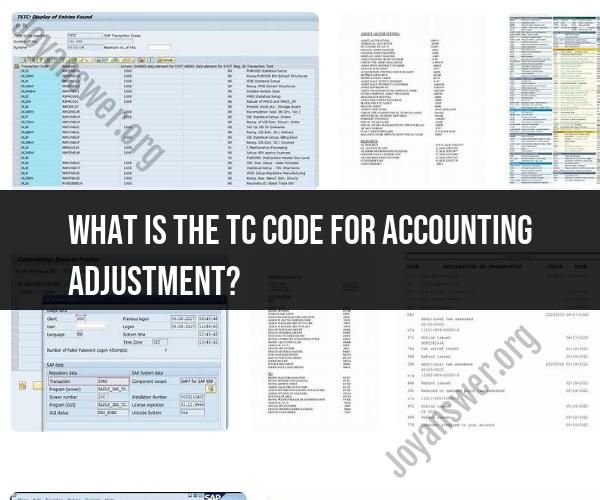

To make an accounting adjustment using a TC code, the accountant would first identify the appropriate TC code for the adjustment. This can be done by consulting the ERP system's documentation or by searching for the TC code in the system's help menu.

Once the correct TC code has been identified, the accountant would enter the TC code into the ERP system and then enter the necessary information to complete the adjustment. This information may include the account numbers to be affected, the amount of the adjustment, and a description of the adjustment.

3. Examples of common TC codes for accounting adjustments

Some common TC codes for accounting adjustments include:

- F-02: This TC code is used to record a journal entry. Journal entries are used to record transactions that do not fit into any of the standard transaction types.

- F-03: This TC code is used to post a document to the general ledger. Documents can include invoices, purchase orders, and payroll checks.

- F-04: This TC code is used to reverse a document. This is useful if a mistake was made when posting a document or if the document needs to be canceled.

- F-05: This TC code is used to post a clearing document. Clearing documents are used to reconcile accounts and to offset transactions against each other.

4. Process for recording accounting adjustments with TC codes

The process for recording accounting adjustments with TC codes is typically as follows:

- Identify the appropriate TC code for the adjustment.

- Enter the TC code into the ERP system.

- Enter the necessary information to complete the adjustment, such as the account numbers to be affected, the amount of the adjustment, and a description of the adjustment.

- Review the adjustment to ensure that it is correct.

- Post the adjustment to the accounting records.

5. How TC codes help maintain accurate financial records

TC codes help to maintain accurate financial records by ensuring that transactions are processed accurately and efficiently. TC codes also help to ensure that transactions are posted to the correct accounts and that the accounting records are up-to-date.

By using TC codes, accountants can avoid having to manually enter data for each transaction, which can reduce the risk of errors. TC codes also help to ensure that all transactions are processed consistently, which makes it easier to audit the financial records.

Additionally, TC codes can be used to generate reports on accounting activity. These reports can be used to identify trends, analyze performance, and make informed business decisions.

Overall, TC codes play an important role in maintaining accurate financial records. By using TC codes, accountants can improve the efficiency and accuracy of the accounting process, which can lead to better business outcomes.