How can I spend my money more wisely?

Optimizing Your Spending Habits: Strategies for Wiser Financial Choices

Financial well-being and security are built upon smart spending habits. In this guide, we'll explore strategies to optimize your spending habits, make wiser financial choices, and achieve your financial goals.

1. Create a Budget:

Start by tracking your income and expenses. Create a budget that outlines your monthly income, fixed expenses (e.g., rent/mortgage, utilities), and discretionary spending categories (e.g., dining out, entertainment). This provides a clear overview of your financial situation.

2. Set Clear Financial Goals:

Establish short-term and long-term financial goals. Whether it's paying off debt, saving for a vacation, or building an emergency fund, having clear objectives gives you a sense of purpose and motivation for your financial journey.

3. Differentiate Between Needs and Wants:

Distinguish between essential expenses (needs) and non-essential expenses (wants). Prioritize your needs and be mindful of your wants. Cut down on discretionary spending to allocate more funds to your financial goals.

4. Track Your Spending:

Use apps or spreadsheets to monitor your spending in real-time. This allows you to identify areas where you might be overspending and make necessary adjustments to your budget.

5. Build an Emergency Fund:

Having a financial safety net is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account. An emergency fund protects you from unexpected financial setbacks.

6. Reduce Debt:

Prioritize paying off high-interest debts, such as credit card balances. Create a debt repayment plan that allocates extra funds toward your outstanding debts, helping you become debt-free faster.

7. Automate Savings:

Set up automatic transfers to your savings or investment accounts. This "pay yourself first" approach ensures that you save before you have a chance to spend.

8. Shop Mindfully:

Before making a purchase, evaluate whether it aligns with your needs and goals. Look for discounts, compare prices, and avoid impulse buying. Consider shopping secondhand or refurbished for cost-effective options.

9. Review and Adjust Your Budget:

Regularly review your budget to ensure it reflects your current financial situation and goals. Adjust it as needed, especially when there are significant life changes or financial fluctuations.

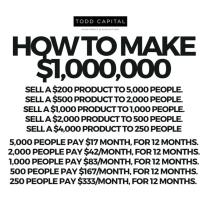

10. Invest Wisely:

Consider investing for long-term growth. Diversify your investments to spread risk and potentially earn higher returns over time. Consult a financial advisor to create an investment strategy tailored to your goals and risk tolerance.

11. Seek Professional Advice:

When facing complex financial decisions or planning for retirement, consider consulting a financial advisor. Their expertise can help you navigate intricate financial matters and optimize your financial choices.

Conclusion:

Optimizing your spending habits is a continuous process that leads to financial freedom and peace of mind. By following these strategies, you can make wiser financial choices, achieve your goals, and build a more secure financial future.

Remember, financial success is not about how much you earn, but how effectively you manage and allocate your resources. Start today, take control of your finances, and reap the rewards of a financially secure future.