Is Vanguard non profit or investor owned?

Vanguard is not a non-profit organization; it is an investor-owned company. The Vanguard Group is one of the world's largest investment management companies, known for its mutual funds and exchange-traded funds (ETFs). It was founded by John C. Bogle in 1975 and operates on a unique ownership structure.

Vanguard is owned by its funds, which in turn are owned by the shareholders of those funds. This structure is designed to align the interests of the company with those of its investors. Vanguard is known for its low-cost index funds and a client-owned structure that aims to minimize conflicts of interest between the company and its investors.

While Vanguard is not a non-profit, its focus on low costs and investor interests has made it a popular choice among those seeking cost-effective investment options. The company operates with the goal of providing long-term investment returns to its investors.

Unlocking Vanguard's Structure

Vanguard is a unique financial institution in that it is not owned by any outside shareholders. Instead, it is owned by the funds that it manages, which are in turn owned by the fund shareholders. This unique ownership structure is what allows Vanguard to charge some of the lowest fees in the industry.

Is Vanguard a Non-Profit?

No, Vanguard is not a non-profit organization. It is a for-profit company, but its profits are reinvested back into the company to lower fees for investors. This is in contrast to other mutual fund companies, which typically distribute their profits to their shareholders (in the form of dividends) or use them to pay their executives.

Understanding Vanguard's Ownership and Business Model

Vanguard's ownership structure is a key part of its business model. By eliminating the profit motive, Vanguard is able to focus on providing low-cost investing options for its clients. This has made Vanguard one of the largest and most successful mutual fund companies in the world.

Analyzing the implications of Vanguard's structure for investors

Vanguard's unique ownership structure has a number of implications for investors. Here are a few of the most important:

- Lower fees: Vanguard's low fees make it a great option for investors of all sizes. This is because Vanguard is able to pass on savings to its investors that other mutual fund companies would pocket as profit.

- Transparency: Vanguard is a very transparent company. It discloses all of its fees and expenses on its website, and it is not afraid to talk about its business model. This transparency is important for investors, as it allows them to make informed decisions about where to invest their money.

- Focus on clients: Vanguard's ownership structure gives it a strong incentive to focus on its clients. Since Vanguard is not owned by any outside shareholders, it is not under pressure to prioritize the interests of its executives or investors. This allows Vanguard to focus on providing low-cost, high-quality investment options for its clients.

Overall, Vanguard's unique ownership structure is a positive for investors. It allows Vanguard to charge some of the lowest fees in the industry, while also being transparent and focused on its clients. This makes Vanguard a great option for investors of all sizes.

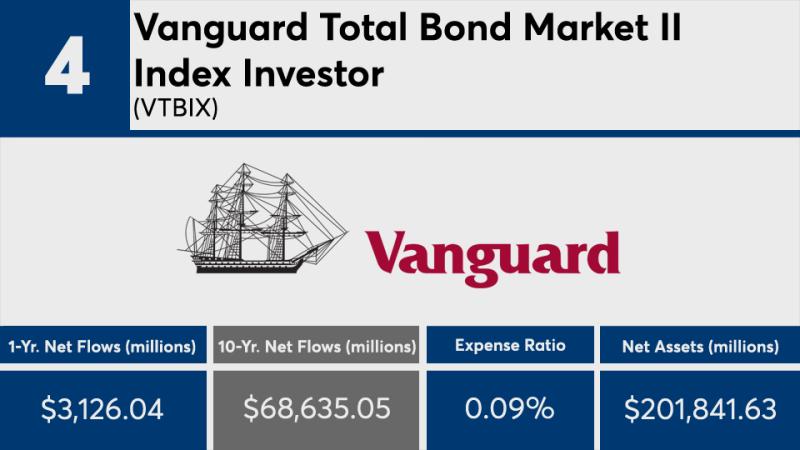

Image of Vanguard logo