How to estimate your mortgage payment?

Estimating your mortgage payment involves considering several factors, including the loan amount, interest rate, loan term, and property taxes. Here's a step-by-step guide to help you estimate your mortgage payment:

Determine Loan Amount: This is the total amount you plan to borrow for your mortgage. It's usually the home's purchase price minus your down payment.

Choose Loan Term: Decide on the length of your mortgage loan. Common terms are 15, 20, or 30 years. The loan term can affect your monthly payment amount.

Research Interest Rates: Check current interest rates from different lenders. Your credit score, loan amount, and market conditions can influence the rate you qualify for.

Use a Mortgage Calculator: Online mortgage calculators are handy tools that can help you estimate your monthly payment. Input your loan amount, interest rate, loan term, and any additional costs like property taxes and homeowners insurance.

Include Property Taxes and Insurance: Your mortgage payment often includes property taxes and homeowners insurance. Research the property tax rate in your area and obtain an insurance quote. Add these amounts to your monthly payment estimate.

Consider Private Mortgage Insurance (PMI): If your down payment is less than 20%, you may need to pay for private mortgage insurance. Factor in the cost of PMI when estimating your payment.

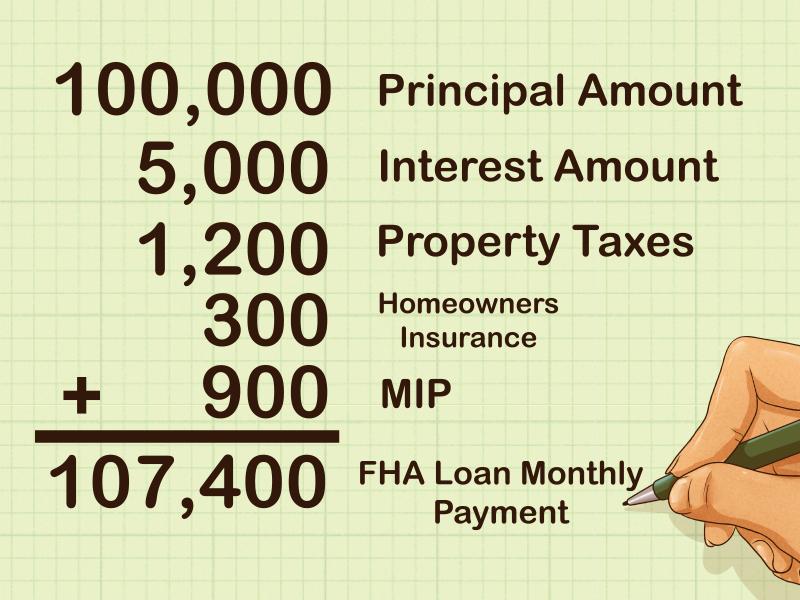

Calculate Monthly Payment: Use the mortgage calculator to get an estimate of your monthly payment. This should include principal, interest, property taxes, homeowners insurance, and, if applicable, PMI.

Factor in Homeowners Association (HOA) Fees: If your property is part of an HOA, include the monthly fees in your calculation.

Review Your Budget: Ensure that your estimated mortgage payment aligns with your budget. Consider other monthly expenses like utilities, maintenance, and living costs.

Consult with Lenders: Speak with mortgage lenders to get pre-approved and receive more accurate estimates. Lenders can provide detailed breakdowns of your potential monthly payments.

Remember, your actual mortgage payment may vary based on factors such as your credit score, the type of mortgage, and any changes in interest rates. It's crucial to shop around for the best mortgage terms and consult with financial professionals for personalized advice.

Managing your finances: A guide to estimating your mortgage payment

A mortgage is a large loan that you take out to buy a home. The loan is secured by the property, which means that the lender can take possession of the property if you don't repay the loan. Mortgage payments typically consist of principal, interest, taxes, and insurance (PITI).

Principal is the amount of money you borrowed.

Interest is the fee you pay to borrow the money. The interest rate is a percentage of the principal that you pay each year.

Taxes are the property taxes that you pay to the government. The amount of property taxes you pay depends on the value of your home and the tax rate in your area.

Insurance is homeowners insurance, which protects your home from damage caused by fire, theft, and other hazards.

Factors Influencing Mortgage Payments

There are a number of factors that can influence your mortgage payment, including:

- The amount of money you borrow: The more money you borrow, the higher your mortgage payment will be.

- The interest rate: The higher the interest rate, the higher your mortgage payment will be.

- The loan term: The longer the loan term, the lower your mortgage payment will be.

- The type of mortgage: There are different types of mortgages, such as fixed-rate mortgages and adjustable-rate mortgages (ARMs). Fixed-rate mortgages have a fixed interest rate for the life of the loan, while ARMs have an interest rate that can fluctuate.

- The down payment: The down payment is the amount of money you pay upfront when you buy a home. The more money you put down, the lower your mortgage payment will be.

How to Calculate Your Mortgage Payment

You can calculate your mortgage payment using a mortgage calculator or by speaking to a mortgage lender. To calculate your mortgage payment, you will need to know the amount of money you want to borrow, the interest rate, and the loan term.

Tips for budgeting and planning based on estimated mortgage payments

If you are considering buying a home, it is important to budget for your mortgage payment. Here are a few tips:

- Get pre-approved for a mortgage. This will give you an idea of how much you can afford to borrow.

- Factor in other expenses. In addition to your mortgage payment, you will also need to pay for property taxes, homeowners insurance, and other homeownership expenses.

- Create a budget. This will help you track your income and expenses so that you can make sure you can afford your mortgage payment.

- Make a plan for saving for a down payment. The more money you put down, the lower your mortgage payment will be.

Buying a home is a major financial decision. By following these tips, you can ensure that you are well-prepared for the financial responsibilities of homeownership.

Here are some additional tips for estimating your mortgage payment:

- Use a mortgage calculator. There are many mortgage calculators available online and in apps. These calculators can help you estimate your monthly mortgage payment based on the factors discussed above.

- Talk to a mortgage lender. A mortgage lender can provide you with more personalized advice and assistance. They can help you understand the different types of mortgages available and can help you apply for a mortgage.

By following these tips, you can get a better idea of how much you can afford to borrow and how much your monthly mortgage payment will be. This will help you make an informed decision about whether or not to buy a home.