Why is economic important to individual people?

Economics is highly significant for individuals for several reasons:

Budgeting and Financial Planning: Economics provides the foundational principles for budgeting and financial planning. Understanding economic concepts like income, expenses, savings, and investment helps individuals make informed financial decisions and manage their resources effectively.

Consumer Choices: Economics helps individuals make choices as consumers. Concepts like supply and demand, price elasticity, and consumer surplus influence purchasing decisions. People can make more rational choices by considering these economic factors.

Career and Income: Economics plays a crucial role in determining income levels and job opportunities. Understanding labor markets, wage determination, and economic trends can guide career choices and negotiation for better compensation.

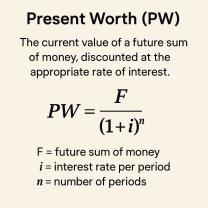

Investment and Retirement Planning: Economics guides investment decisions. Knowledge of interest rates, inflation, and investment options can help individuals grow their wealth and plan for retirement effectively.

Debt Management: Economic principles are relevant to managing debt. Interest rates, loan terms, and credit scores impact borrowing decisions. A solid understanding of these concepts can prevent excessive debt and financial strain.

Inflation and Purchasing Power: Understanding inflation rates and their impact on the purchasing power of money is crucial. Individuals need to assess whether their savings and investments will maintain their real value over time.

Taxes and Financial Obligations: Economics provides insights into taxation, including income taxes, property taxes, and sales taxes. Knowing how taxes work can help individuals minimize their tax liability legally.

Retirement and Social Security: Economic factors influence retirement planning and Social Security benefits. Individuals must consider factors like retirement age, benefits eligibility, and the long-term sustainability of retirement funds.

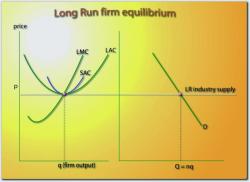

Entrepreneurship and Business Ventures: For those interested in entrepreneurship or starting a business, economics offers insights into market analysis, pricing strategies, and profit maximization.

Global Economic Trends: Understanding global economics is increasingly important in today's interconnected world. International trade, exchange rates, and geopolitical events can impact individual finances.

Savings and Emergency Funds: Economic knowledge encourages individuals to save and build emergency funds, providing financial security during unexpected events like medical emergencies or job loss.

Investing in Education: Economic considerations often play a role in decisions about investing in education and skill development. Individuals assess the potential return on investment (ROI) of education and training.

In summary, economics is essential for individuals because it equips them with the knowledge and tools needed to make informed financial decisions, plan for the future, and navigate a complex and dynamic economic landscape. It empowers people to maximize their financial well-being and achieve their financial goals.