What is the best monthly income fund?

Determining the "best" monthly income fund depends on your specific financial goals, risk tolerance, and investment preferences. There is no one-size-fits-all answer, as what may be the best fund for one person may not be suitable for another. Here are some steps to help you select the best monthly income fund for your needs:

Define Your Investment Goals: Start by clarifying your investment objectives. Are you looking for regular income, capital preservation, or long-term growth? Understanding your goals will guide your fund selection.

Risk Tolerance: Assess your risk tolerance. Different income funds come with varying levels of risk. Generally, higher potential returns are associated with higher risk. Consider how much volatility you are comfortable with.

Asset Allocation: Consider your overall asset allocation strategy. Income funds can invest in various asset classes, including bonds, stocks, real estate, and more. Make sure the fund's asset allocation aligns with your investment strategy.

Diversification: Look for funds that offer diversification within the income-generating assets they hold. Diversification can help reduce risk and enhance stability.

Expense Ratios: Pay attention to the expense ratio of the fund. Lower expenses can improve your overall returns over time. Compare expense ratios among similar funds.

Yield: Review the yield offered by the fund. Keep in mind that higher yields often come with higher risk. Ensure the yield meets your income needs.

Performance History: Analyze the fund's historical performance. Look for consistent returns over time, but remember that past performance is not indicative of future results.

Manager Expertise: Evaluate the fund manager's expertise and track record. An experienced manager can be more adept at navigating changing market conditions.

Credit Quality (For Bond Funds): If you're considering a bond income fund, assess the credit quality of the bonds in the portfolio. Higher-quality bonds typically have lower default risk.

Liquidity: Check the fund's liquidity. Ensure that you can easily buy and sell shares when needed.

Distribution Frequency: Confirm that the fund pays out income on a monthly basis, as you desire.

Tax Efficiency: Consider the tax implications of the fund's income distributions, especially if you're investing in a taxable account.

Read the Prospectus: Carefully read the fund's prospectus to understand its investment strategy, objectives, and any potential risks.

Seek Professional Advice: If you're uncertain about which fund is best for you, consider consulting a financial advisor who can provide personalized guidance based on your financial situation and goals.

It's important to remember that there is no guaranteed "best" monthly income fund, as investment choices depend on individual circumstances. Diversifying your investments and conducting thorough research can help you make an informed decision that aligns with your financial goals and risk tolerance.

Exploring the Best Monthly Income Funds for Financial Growth

Monthly income funds are a type of mutual fund or exchange-traded fund (ETF) that invests in a variety of assets, such as bonds, stocks, and real estate, with the goal of generating regular income for investors. Monthly income funds can be a good option for investors who are looking for a steady stream of income, such as retirees or those who are saving for a major purchase.

When choosing a monthly income fund, it is important to consider a number of factors, including:

- Investment objective: What is your investment objective? Are you looking for a fund that will generate a high level of income or one that will also provide capital appreciation?

- Risk tolerance: How much risk are you comfortable with? Monthly income funds can vary in terms of risk, so it is important to choose a fund that is appropriate for your risk tolerance.

- Fees: Mutual funds and ETFs charge a variety of fees. Be sure to compare the fees of different funds before making a decision.

Investment Options for Monthly Income: Fund Selection Guide

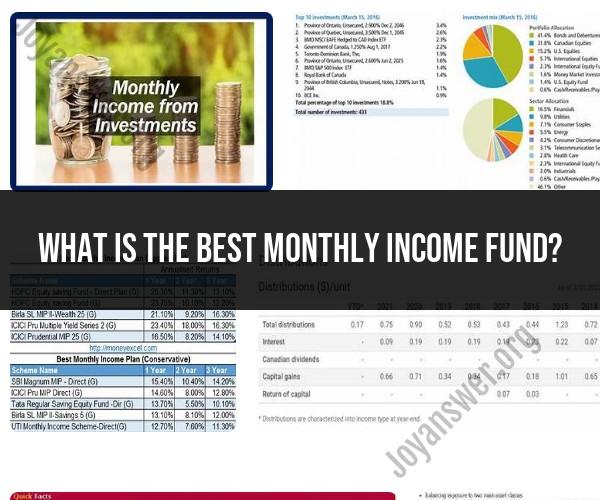

There are a number of different monthly income funds available to investors. Here are a few examples:

- Bond funds: Bond funds invest in bonds, which are essentially loans that investors make to governments or corporations. Bond funds are generally considered to be less risky than stock funds, but they also offer lower potential returns.

- Dividend stock funds: Dividend stock funds invest in stocks that pay regular dividends to shareholders. Dividend stock funds can be a good option for investors who are looking for a steady stream of income, but they are also subject to stock market volatility.

- Balanced funds: Balanced funds invest in a mix of stocks and bonds. This can help to reduce the overall risk of the fund, while still offering the potential for capital appreciation.

- Real estate investment trusts (REITs): REITs are companies that own or operate income-producing real estate. REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends.

Achieving Financial Stability with Top Monthly Income Funds

Monthly income funds can be a good way to achieve financial stability. By investing in a monthly income fund, you can generate a regular stream of income that can help you to meet your financial needs.

However, it is important to remember that monthly income funds are not without risk. The value of the fund can fluctuate, and you could lose money if you sell your shares when the fund is down. Additionally, monthly income funds may charge fees, which can reduce your overall return.

If you are considering investing in a monthly income fund, it is important to do your research and to speak with a financial advisor to see if a monthly income fund is right for you.

Here are some tips for choosing and investing in monthly income funds:

- Choose a fund that has a good track record of performance.

- Consider the fees charged by the fund.

- Invest for the long term. Monthly income funds can be a good way to generate a steady stream of income over time, but it is important to remember that the value of the fund can fluctuate in the short term.

- Rebalance your portfolio regularly. As your financial situation changes, you may need to rebalance your portfolio to ensure that it still meets your investment objectives and risk tolerance.

By following these tips, you can choose and invest in monthly income funds to help you achieve your financial goals.