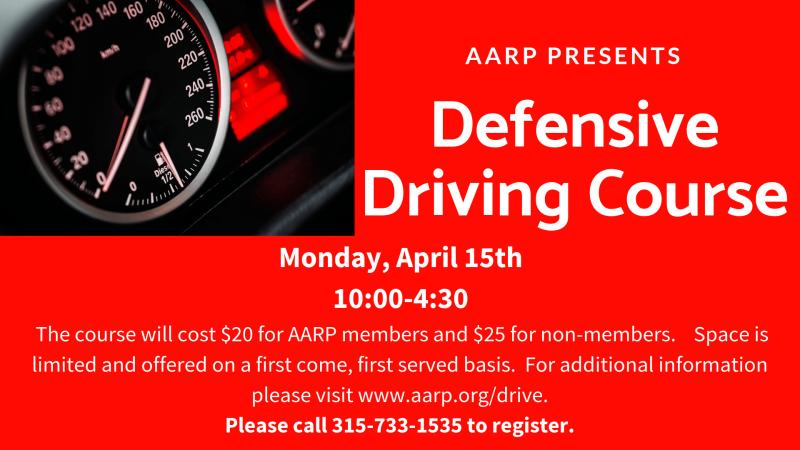

Do safe driving courses save drivers money on car insurance?

Yes, safe driving courses can potentially save drivers money on car insurance. Many insurance providers offer discounts to policyholders who have completed approved defensive driving or safe driving courses. These courses are designed to improve driving skills, enhance awareness of road safety, and reduce the likelihood of accidents.

Here are key points to consider:

Insurance Discounts:

- Insurance companies often provide discounts to drivers who voluntarily take defensive driving courses. The percentage of the discount varies by provider and location.

Eligibility Criteria:

- To qualify for the discount, you typically need to complete a course that is approved by your insurance company. It's important to check with your insurer to understand their specific requirements and which courses they accept.

Age and Driving Record:

- Discounts for completing safe driving courses may be more common for older drivers or individuals with a clean driving record. However, some insurers offer discounts to drivers of all ages.

Online vs. In-Person Courses:

- Many insurance companies accept both online and in-person defensive driving courses. Online courses can offer greater flexibility for participants.

Course Duration:

- Some insurers may require a specific duration or number of hours for the course to qualify for a discount. Ensure that the course you choose meets your insurer's criteria.

Periodic Renewal:

- Some insurers may require drivers to renew their safe driving course periodically to continue receiving the discount. Check with your insurer to understand any renewal requirements.

Points Reduction:

- In addition to potential insurance discounts, completing a safe driving course may also lead to a reduction in points on your driving record. However, this aspect varies by jurisdiction.

Check with Your Insurance Provider:

- To determine the specific savings and eligibility criteria, contact your insurance provider directly. Inquire about the availability of discounts, the accepted courses, and any documentation needed to prove course completion.

While safe driving courses can lead to insurance discounts, the extent of the discount and the specific rules governing eligibility can vary among insurance companies. It's crucial to communicate with your insurance provider to understand their policies, requirements, and potential cost savings associated with completing a safe driving course. Additionally, remember that policies and discounts can change, so it's a good idea to periodically review your insurance options and inquire about any available discounts.

Reducing Car Insurance Costs with Safe Driving Courses:

Safe driving courses can potentially reduce car insurance costs by demonstrating to the insurance company that you are a lower risk driver. This is because these courses teach defensive driving techniques and strategies, which can help you avoid accidents and traffic violations.

Here's how it works:

- Lower risk perception: Completing a safe driving course shows the insurance company that you are actively trying to improve your driving skills and reduce your risk of accidents.

- Defensive driving techniques: The course teaches you essential skills like hazard recognition, risk assessment, and safe driving practices, making you a more responsible and cautious driver.

- Reduced claims: Fewer accidents and violations translate to fewer claims filed against your insurance, making you a more desirable customer for the company.

Eligibility Criteria:

Eligibility requirements for receiving discounts on car insurance after completing safe driving courses vary depending on the insurance company and your state's regulations. However, some common criteria include:

- Age: Most discounts are offered to drivers over a certain age, typically 50 or 55.

- Driving record: You should have a clean driving record with no recent accidents or traffic violations.

- Course completion: You must successfully complete an approved safe driving course.

- State approval: The course must be approved by your state's Department of Motor Vehicles (DMV) or Insurance Department.

Typical Savings:

The amount of savings you can expect from completing a safe driving course varies depending on several factors, including:

- Your insurance company: Different companies offer different discount rates for completed courses.

- Your driving history: A clean driving record can lead to higher discounts.

- Type of course: Some courses offer larger discounts than others.

- State regulations: Some states mandate minimum discount amounts for completed courses.

Generally, you can expect to save between 5% and 15% on your car insurance premium. However, some drivers may see savings as high as 20% or more.

Remember:

- Contact your insurance company to inquire about their specific discount program and eligibility requirements.

- Ask about any restrictions or limitations on the type of safe driving course they accept.

- Obtain a certificate of completion from the course provider and submit it to your insurance company to claim the discount.

Completing a safe driving course is a worthwhile investment that can not only help you become a safer driver but also save you money on your car insurance.