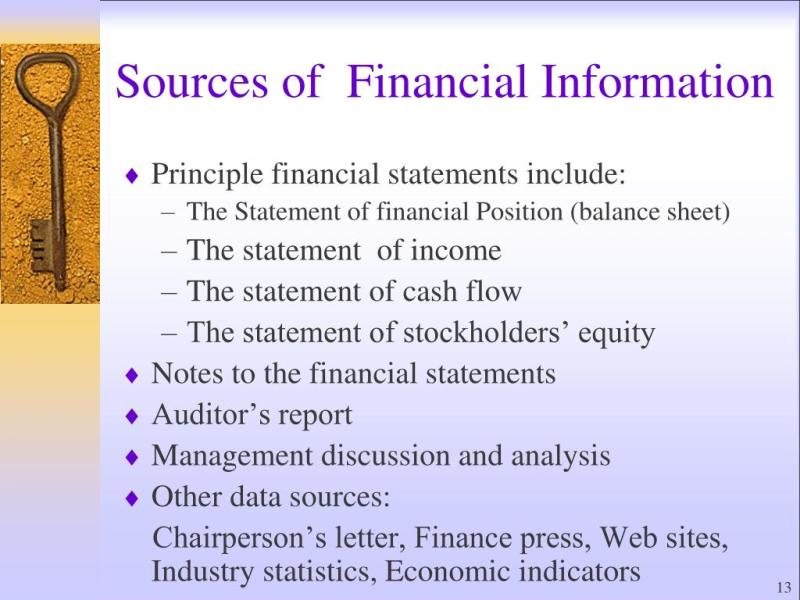

What are the best sources of financial information?

There are several reliable sources for financial information that cater to different needs and preferences. Here are some well-regarded sources:

Bloomberg:

- Bloomberg provides a comprehensive platform for financial news, analytics, and market data. It covers a wide range of financial instruments, including stocks, bonds, commodities, and more.

Reuters:

- Reuters is a global news organization that covers financial news, market data, and analysis. It is widely used by professionals in the finance industry.

The Wall Street Journal:

- The Wall Street Journal is a reputable source for financial news, business insights, and market analysis. It covers a broad spectrum of topics, including global markets, economics, and corporate news.

Financial Times:

- The Financial Times is an international daily newspaper that focuses on business and economic news. It provides in-depth analysis, commentary, and global coverage.

CNBC:

- CNBC is a television network that offers real-time financial news, market updates, and interviews with industry experts. Its website also provides articles and analysis.

Investopedia:

- Investopedia is an online resource that offers a wide range of educational content on finance and investing. It includes articles, tutorials, and a dictionary of financial terms.

Yahoo Finance:

- Yahoo Finance is a popular online platform that provides financial news, stock quotes, and interactive charts. It covers a variety of financial markets and instruments.

Morningstar:

- Morningstar is known for its research and analysis of investment funds, stocks, and other financial instruments. It provides ratings, reports, and insights.

MarketWatch:

- MarketWatch is a financial news website that covers markets, investing, personal finance, and retirement. It is part of the Dow Jones network.

SEC Filings (EDGAR):

- For information directly from companies, the U.S. Securities and Exchange Commission's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) database provides access to corporate filings.

Federal Reserve Economic Data (FRED):

- FRED, maintained by the Federal Reserve Bank of St. Louis, offers a wealth of economic data, indicators, and research tools.

Company Annual Reports:

- Directly accessing the annual reports of public companies is a valuable source for understanding their financial health, strategy, and performance.

Remember to critically evaluate information from any source and consider multiple perspectives to get a well-rounded view of the financial landscape. Additionally, financial professionals, advisors, and institutional research can provide tailored insights based on individual needs and goals.

How do financial analysts evaluate the credibility of information sources?

Financial analysts employ various methods to assess the credibility of information sources. Here are some key strategies they use:

1. Source Reputation:

- Author Expertise: Analysts assess the author's credentials and expertise in the specific field. They look for qualifications, experience, and past performance in providing accurate information.

- Publisher Reputation: The reputation of the publishing source is crucial. Analysts consider the organization's track record, editorial standards, and commitment to accuracy and objectivity.

- Peer-Review Process: Information sources subjected to rigorous peer review by other experts in the field are generally considered more trustworthy.

2. Information Content:

- Objectivity and Bias: Analysts evaluate the information for objectivity and potential bias. They look for neutral language, factual data, and transparent disclosure of potential conflicts of interest.

- Citation and References: Reliable sources cite their data and references, allowing analysts to verify the information and assess its origin.

- Internal Consistency and Plausibility: Information is examined for internal consistency and logical coherence. Analysts also compare it with other credible sources to assess its plausibility.

3. Verifiability and Timeliness:

- Data Verification: Analysts verify key data points through independent sources and cross-check them for accuracy and completeness.

- Timeliness: Analysts consider the timeliness of the information. Outdated information may not reflect current market conditions and can lead to inaccurate conclusions.

4. External Corroboration:

- Analysts consult other credible sources to corroborate the information and validate its claims. This provides further assurance of its reliability.

- Market Data and Indicators: Analysts compare the information with relevant market data and economic indicators to assess its consistency and validity.

Financial analysts often utilize a combination of these methods to assess the credibility of information sources. They may also consider factors specific to the industry or situation at hand. It's important to note that no single method is foolproof, and a critical approach is always necessary when evaluating financial information.

Here are some additional resources that may be helpful:

- CFA Institute: https://cfainstitute.org/

- Financial Times: https://www.ft.com/

- Bloomberg: https://www.bloomberg.com/

- Reuters: https://www.reuters.com/

By utilizing these resources and practicing sound judgment, financial analysts can become more adept at evaluating the credibility of information sources and making informed investment decisions.