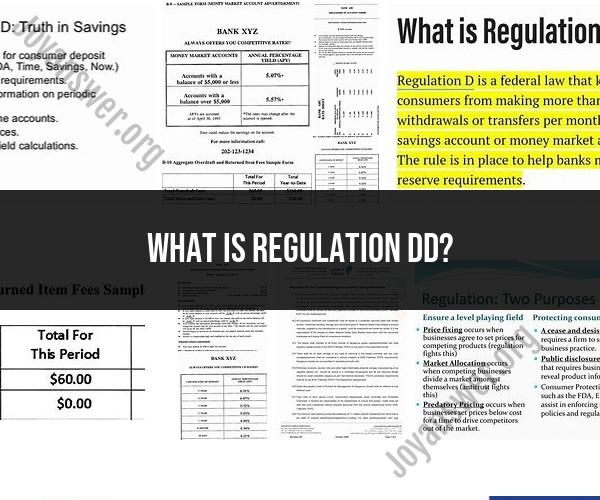

What is Regulation DD?

Regulation DD, also known as the Truth in Savings Act, is a federal regulation in the United States that governs the disclosure of terms and conditions for deposit accounts offered by financial institutions to consumers. It is designed to provide transparency and ensure that consumers receive clear and accurate information about the terms, fees, and interest rates associated with deposit accounts like savings accounts, checking accounts, certificates of deposit (CDs), and other similar products. Here is an overview of Regulation DD:

Purpose: The primary purpose of Regulation DD is to empower consumers by requiring financial institutions to provide standardized disclosures. These disclosures allow consumers to compare different deposit account offers, understand the costs and benefits of each account, and make informed decisions about where to place their money.

Disclosure Requirements: Regulation DD mandates that financial institutions provide specific information about deposit accounts to consumers. This information includes:

Annual Percentage Yield (APY): Financial institutions must prominently display the APY, which represents the effective annual rate of return, considering the compounding of interest.

Account Fees: Institutions must disclose any fees associated with the account, such as monthly maintenance fees, overdraft fees, ATM fees, and other charges.

Account Terms: Consumers should receive clear information about the terms and conditions of their accounts, including withdrawal restrictions, minimum balance requirements, and any penalties for early withdrawal or account closure.

Terms Changes: Regulation DD outlines procedures for notifying consumers when there are changes in the terms of their accounts. Financial institutions are generally required to provide advance notice before implementing changes.

Uniform Format: To make it easier for consumers to compare different account options, Regulation DD establishes a uniform format for presenting the required disclosures. This format helps consumers quickly find and understand key information.

Periodic Statements: Financial institutions are typically required to provide periodic account statements to consumers, summarizing account activity and disclosing certain information about the account, including interest earned and fees charged.

Enforcement: Regulatory agencies, such as the Consumer Financial Protection Bureau (CFPB), oversee compliance with Regulation DD. They have the authority to take enforcement actions against financial institutions that do not comply with the disclosure requirements.

By enforcing transparency and standardizing disclosures, Regulation DD aims to protect consumers from deceptive or unfair practices related to deposit accounts. It enables consumers to make informed choices about where to place their funds and helps them understand the true cost and benefits of various banking products.