What is the difference between preferred and common shares?

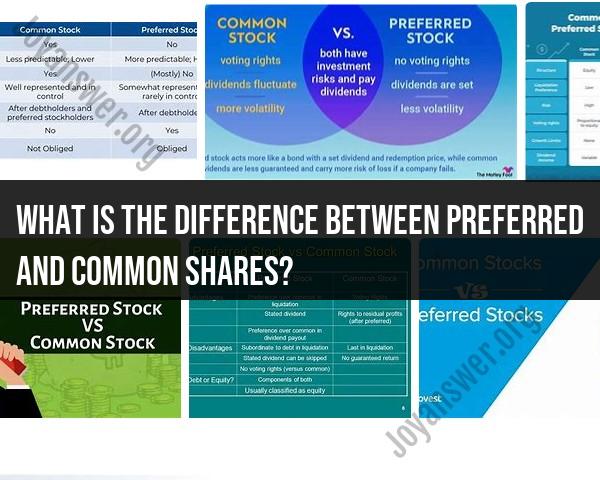

Preferred shares and common shares are two primary types of stock that companies issue to raise capital. They have distinct characteristics that give investors different rights and priorities. Here are the key differences between preferred shares and common shares:

1. Ownership and Voting Rights:

Common Shares: Common shareholders have ownership rights in the company and typically have the right to vote at shareholder meetings. Each common share usually carries one vote, allowing shareholders to have a say in corporate decisions, such as the election of the board of directors.

Preferred Shares: Preferred shareholders generally do not have voting rights. They don't typically participate in corporate decisions and cannot vote on matters like the election of directors.

2. Dividend Payments:

Common Shares: Common shareholders have the potential to receive dividends, but these dividends are typically discretionary. Companies may pay dividends to common shareholders, but they are not guaranteed and can be variable.

Preferred Shares: Preferred shareholders have a higher claim to dividends. Companies that issue preferred shares are typically obligated to pay dividends to preferred shareholders at a fixed rate. These dividends are typically higher than what common shareholders receive, and preferred shareholders have a priority over common shareholders when it comes to dividend payments.

3. Priority in Liquidation:

Common Shares: Common shareholders have the lowest priority in the event of the company's liquidation, bankruptcy, or dissolution. After paying off debts, bondholders, and preferred shareholders, whatever remains is distributed to common shareholders. Common shareholders are at the greatest risk of losing their investment in such scenarios.

Preferred Shares: Preferred shareholders have a higher priority than common shareholders in the event of the company's liquidation. They are typically entitled to receive their invested capital back before any distribution to common shareholders. This provides a degree of safety to preferred shareholders.

4. Convertibility:

Common Shares: Common shares are typically not convertible into other types of securities. Common shareholders may buy or sell their shares on the open market, but they do not have the option to convert their shares into another class.

Preferred Shares: Some preferred shares may be convertible. This means that preferred shareholders may have the option to convert their preferred shares into a specific number of common shares at a predetermined conversion ratio. This feature allows preferred shareholders to potentially benefit from the appreciation of common shares.

5. Risk and Reward:

Common Shares: Common shareholders generally have the potential for higher returns because they may benefit from the company's growth and capital appreciation. However, they also bear more risk, as they are last in line for dividends and assets in the event of financial difficulties.

Preferred Shares: Preferred shareholders have a more predictable income stream through fixed dividends. They are less exposed to the company's growth potential but enjoy more security in terms of income and asset protection.

In summary, common shares represent ownership with voting rights and the potential for higher returns but come with greater risk. Preferred shares, on the other hand, offer fixed dividends, a higher priority in liquidation, and less risk, but no voting rights. The choice between common and preferred shares depends on an investor's risk tolerance, income needs, and investment objectives. Companies often issue a combination of both common and preferred shares to meet various investor preferences and capital-raising goals.

Understanding the Distinction Between Preferred and Common Shares

Preferred shares and common shares are the two main types of shares that a company can issue. Preferred shareholders have certain rights and privileges that common shareholders do not, such as a higher claim to the company's assets and earnings in the event of bankruptcy. However, common shareholders typically have the right to vote on corporate matters, while preferred shareholders do not.

Key Differences Between Preferred and Common Stock

Here is a table summarizing the key differences between preferred and common stock:

| Feature | Preferred Stock | Common Stock |

|---|---|---|

| Claim to assets and earnings | Higher | Lower |

| Voting rights | None or limited | Yes |

| Dividends | Fixed or variable | Variable |

| Conversion | Can be convertible into common shares | Typically not convertible |

Which Type of Share Should I Choose for my Investment Portfolio?

The best type of share for your investment portfolio will depend on your individual investment goals and risk tolerance. If you are looking for a stable income stream, preferred shares may be a good option for you. However, if you are willing to take on more risk in exchange for the potential for higher returns, common shares may be a better choice.

What Are the Voting Rights Associated with Preferred and Common Shares?

Preferred shareholders typically have limited or no voting rights, while common shareholders have the right to vote on corporate matters such as the election of directors and mergers and acquisitions.

How Do Dividend Payments Differ for Preferred and Common Shareholders?

Preferred shareholders typically receive a fixed or variable dividend on a regular basis, such as quarterly or monthly. Common shareholders do not receive guaranteed dividends, but they may receive dividends if the company's board of directors declares them.

Conclusion

Preferred and common shares are both important types of securities that can play a role in a diversified investment portfolio. The best type of share for you will depend on your individual investment goals and risk tolerance.