What s The difference between online banks and credit unions?

Online banks and credit unions are both financial institutions that offer a variety of banking services, but there are key distinctions between the two in terms of ownership, structure, and certain services. Here are some of the primary differences:

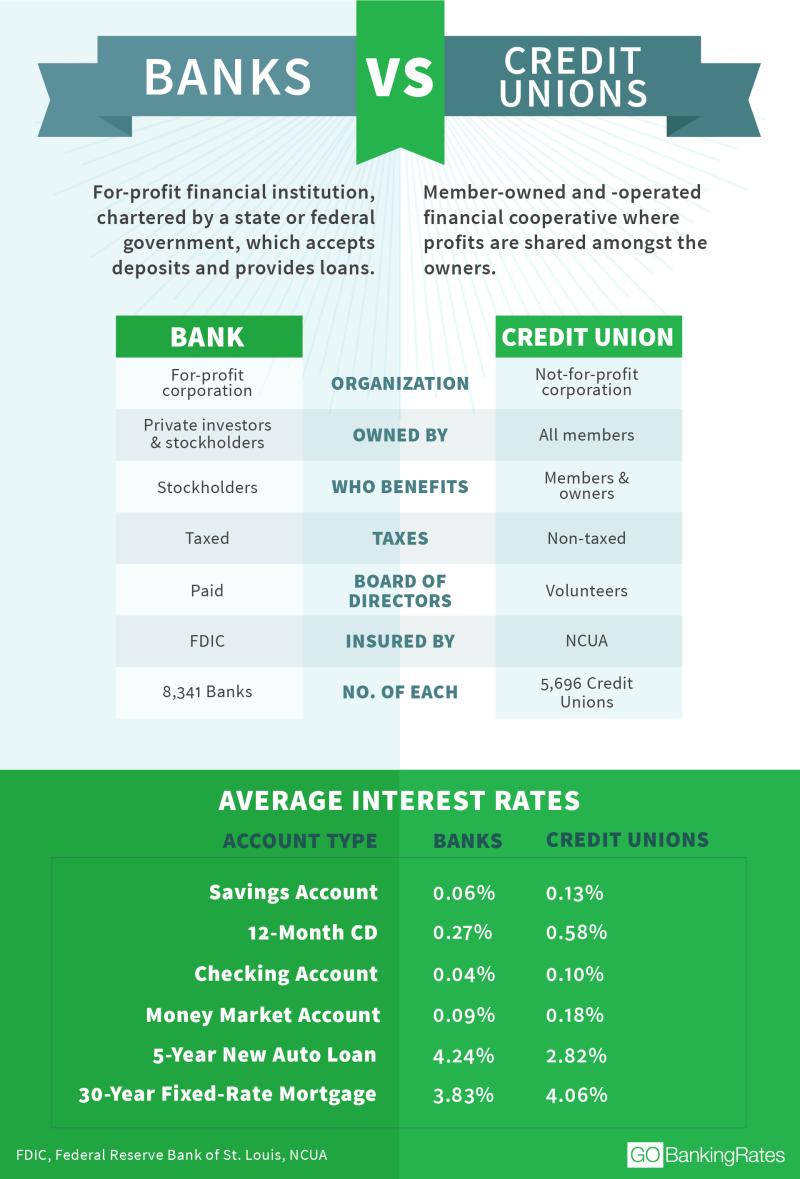

Ownership and Structure:

- Online Banks: Online banks are typically for-profit institutions owned by shareholders. They operate primarily or exclusively online, allowing customers to manage their accounts through internet banking platforms.

- Credit Unions: Credit unions are not-for-profit financial cooperatives owned by their members. Members of a credit union are also considered partial owners, and each member has an equal say in the credit union's governance, typically through voting rights.

Membership:

- Online Banks: Online banks are open to the general public. Anyone can open an account with an online bank, and there are usually no membership requirements.

- Credit Unions: Credit unions have membership requirements. To join a credit union, individuals often need to meet specific criteria, such as living in a particular geographic area, working for a certain employer, or belonging to a particular group or association.

Branch Presence:

- Online Banks: Online banks operate without physical branches. Customer interactions, including account management, transactions, and customer support, are primarily conducted online or over the phone.

- Credit Unions: While credit unions may have physical branches, especially in local communities, the number and locations of branches can vary widely. Some credit unions also provide online banking services.

Products and Services:

- Online Banks: Online banks typically offer a full range of banking services, including savings accounts, checking accounts, loans, credit cards, and other financial products. They often focus on providing competitive interest rates and low fees.

- Credit Unions: Credit unions offer similar services, including savings and checking accounts, loans, and credit cards. They may also have a community-oriented approach, offering personalized services and financial education to their members.

Fees and Interest Rates:

- Online Banks: Online banks may be known for offering competitive interest rates on savings accounts and CDs and may have lower fees compared to traditional banks.

- Credit Unions: Credit unions often emphasize member benefits, which can include lower fees, competitive interest rates, and a more personalized approach to banking.

Customer Focus:

- Online Banks: Online banks focus on providing convenient, technology-driven banking services, catering to customers who prefer managing their finances digitally.

- Credit Unions: Credit unions often emphasize a sense of community and may be more focused on providing personalized service to their members.

Ultimately, the choice between an online bank and a credit union depends on individual preferences, financial needs, and the importance of factors like community involvement and membership eligibility. Both types of institutions can provide valuable banking services, so it's essential to consider the specific offerings and characteristics of each when making a decision.

Sure, here are the answers to your questions about online banks and credit unions:

What are the primary distinctions between services offered by online banks and credit unions?

Online banks and credit unions both offer a wide range of financial services, including checking and savings accounts, loans, credit cards, and investment products. However, there are some key distinctions between the two types of institutions:

Ownership and structure: Online banks are typically subsidiaries of traditional banks, while credit unions are member-owned cooperatives. This means that credit unions are not-for-profit and return their earnings to their members in the form of lower fees and higher interest rates.

Branch network: Online banks typically have a limited or no branch network, while credit unions may have branches located throughout their communities. This can make it more convenient to access services in person at a credit union.

Customer service: Online banks typically offer customer service through online chat, phone, and email, while credit unions may also offer customer service in person at their branches.

How do online banks differ from credit unions in terms of membership and accessibility?

Membership: Online banks are typically open to anyone, while credit unions may have membership restrictions based on factors such as location, employment, or affiliation with a particular organization.

Accessibility: Online banks are typically accessible from anywhere with an internet connection, while credit unions may require in-person visits for certain services or transactions.

Are interest rates and fees different between online banks and credit unions?

Interest rates: Online banks typically offer higher interest rates on savings accounts and certificates of deposit (CDs) than credit unions. This is because online banks have lower overhead costs than traditional banks and credit unions.

Fees: Online banks typically have lower fees than credit unions, or no fees at all. This is because online banks do not have to maintain a network of physical branches.

What are the advantages and disadvantages of using online banks compared to credit unions?

Advantages of online banks:

Higher interest rates: Online banks typically offer higher interest rates on savings accounts and CDs.

Lower fees: Online banks typically have lower fees than credit unions, or no fees at all.

Convenient access: Online banks are accessible from anywhere with an internet connection.

Disadvantages of online banks:

Limited branch network: Online banks typically have a limited or no branch network.

Potential for fraud: Online banking can be more susceptible to fraud than traditional banking.

Advantages of credit unions:

Member-owned: Credit unions are member-owned cooperatives, which means that profits are returned to members in the form of lower fees and higher interest rates.

Community involvement: Credit unions are often involved in their local communities.

Personalized service: Credit unions may offer more personalized service than online banks.

Disadvantages of credit unions:

Lower interest rates: Credit unions typically offer lower interest rates than online banks.

Higher fees: Credit unions typically have higher fees than online banks.

Limited accessibility: Credit unions may have limited accessibility, especially for those who live outside of their service area.

How do online banks and credit unions prioritize customer service and community involvement differently?

Customer service: Online banks typically offer customer service through online chat, phone, and email. Credit unions may also offer customer service in person at their branches.

Community involvement: Online banks typically have less of a focus on community involvement than credit unions. Credit unions are often involved in their local communities through sponsorships, donations, and volunteer programs.

The best type of financial institution for you will depend on your individual needs and preferences. Consider the factors that are important to you and compare the offerings of different online banks and credit unions before making a decision.