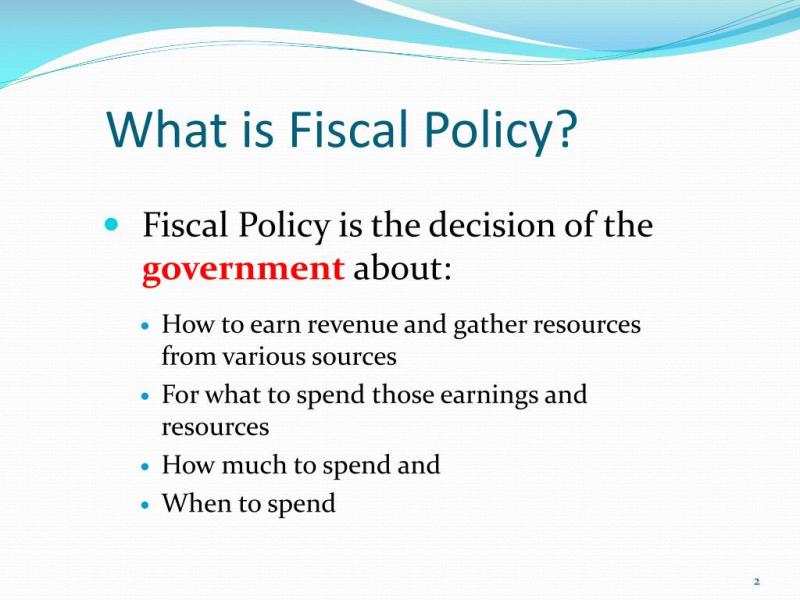

What is the aim of fiscal policy?

The primary objectives of fiscal policy are to influence the overall health and performance of an economy by using government spending and taxation. Fiscal policy aims to achieve several macroeconomic goals, and its implementation is crucial for stabilizing and promoting economic growth. The main objectives of fiscal policy include:

Stabilization of the Economy:

- Fiscal policy is often used to stabilize the economy during economic downturns or periods of high inflation. Through discretionary fiscal measures, governments aim to counteract economic fluctuations and achieve a stable and sustainable growth path.

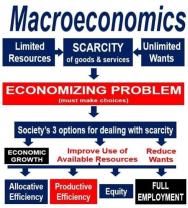

Economic Growth and Development:

- One of the key goals of fiscal policy is to support and promote economic growth. Governments use fiscal tools such as increased spending on infrastructure, education, and research to stimulate economic activity, create jobs, and enhance long-term productivity.

Full Employment:

- Fiscal policy seeks to achieve and maintain full employment by influencing aggregate demand in the economy. During periods of unemployment or economic slowdown, governments may increase spending to boost demand and create job opportunities.

Price Stability:

- Fiscal policy plays a role in maintaining price stability by influencing inflation rates. Governments can adjust tax rates or government spending to manage demand in the economy and prevent excessive inflation or deflation.

Income Distribution:

- Fiscal policy can be used to address issues of income inequality. Progressive taxation and targeted government spending programs can help redistribute income and reduce disparities among different income groups.

Public Services and Infrastructure Investment:

- Fiscal policy supports the provision of essential public services and infrastructure. Governments use fiscal measures to invest in areas such as education, healthcare, transportation, and communication, contributing to long-term economic development.

Counter-Cyclical Measures:

- Fiscal policy can be counter-cyclical, meaning that it is used to offset the natural fluctuations in the business cycle. During economic downturns, governments may increase spending or reduce taxes to stimulate demand, while during periods of economic expansion, they may pursue policies to cool down an overheated economy.

Debt Management:

- Fiscal policy is also concerned with managing government debt. Governments use fiscal measures to ensure that the level of public debt remains sustainable, balancing the need for investment with fiscal responsibility.

Promoting Investment:

- Fiscal policy aims to create a favorable environment for private sector investment. Policies such as tax incentives for businesses, research and development credits, and other measures can encourage investment, innovation, and entrepreneurship.

External Stability:

- Fiscal policy can influence a country's external balance by managing trade deficits or surpluses. Governments may use fiscal measures to address imbalances in the current account and promote external stability.

It's important to note that the effectiveness of fiscal policy depends on various factors, including the economic context, the timing of interventions, and coordination with monetary policy. Additionally, fiscal policy goals may vary among countries based on their unique economic circumstances and policy priorities.

What objectives does fiscal policy aim to achieve?

Fiscal policy, which involves government spending and taxation decisions, aims to achieve several key objectives:

Economic Stability:

- Promote economic growth: This often involves increased government spending on infrastructure, education, and research, or tax cuts to stimulate private investment and consumption.

- Control inflation: Government may raise taxes or decrease spending to reduce aggregate demand and control inflation.

- Minimize unemployment: Lowering taxes or increasing spending can boost economic activity and job creation.

Price Stability:

- Maintain stable prices: Fiscal policy can help prevent both inflation and deflation, which can disrupt economic activity.

- Ensure affordability of essential goods and services: Targeted government spending or tax subsidies can make key goods and services more accessible to low-income individuals.

Social and Equity Objectives:

- Reduce poverty and income inequality: Progressive taxation structures, income-support programs, and investment in social services can help redistribute wealth and create a more equitable society.

- Promote education and healthcare: Government spending on these sectors can improve human capital and social well-being.

- Protect the environment: Environmental taxes and subsidies can incentivize sustainable practices and discourage pollution.

Long-Term Growth and Development:

- Invest in infrastructure and human capital: This can ensure sustainable economic growth and competitiveness in the long run.

- Support technological innovation: Government funding for research and development can contribute to technological advancements and economic progress.

- Manage debt sustainably: Balancing government spending and revenue is crucial to avoid excessive debt burden that can hinder future economic growth.

It's important to note that achieving these objectives can be challenging and sometimes involve trade-offs. For example, stimulating economic growth through increased spending may lead to higher inflation, while controlling inflation through tighter fiscal policy might temporarily increase unemployment.

Therefore, effective fiscal policy requires careful consideration of various factors and a balance between different objectives. The specific goals and priorities of fiscal policy may also vary depending on the current economic conditions and the government's broader political and social agenda.

I hope this explanation clarifies the key objectives of fiscal policy. If you have any further questions or would like to explore specific aspects of fiscal policy in more detail, please feel free to ask!