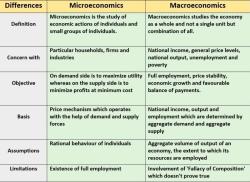

What is fiscal package?

A fiscal package refers to a set of measures or policies implemented by a government to influence the overall direction of its economy through changes in its fiscal stance, particularly in terms of government spending and taxation. These packages are often designed to stimulate economic activity, counteract economic downturns, and achieve specific macroeconomic objectives. Fiscal packages are a key component of fiscal policy, one of the tools governments use to manage the economy.

The components of a fiscal package can vary but typically include a combination of the following:

Government Spending:

- Increased government spending on public projects, infrastructure, social programs, and other areas to boost economic activity.

Taxation:

- Changes in tax policies, such as tax cuts or tax credits, to stimulate consumer spending, encourage investment, and support businesses.

Subsidies and Transfers:

- Direct financial support or subsidies provided to certain industries, sectors, or individuals to address specific economic challenges or promote targeted activities.

Incentives for Businesses:

- Measures aimed at encouraging businesses to invest, expand, and hire, such as tax incentives, credits for research and development, or other business-friendly policies.

Social Programs:

- Expanding or enhancing social programs, unemployment benefits, or other forms of assistance to support individuals and families during economic downturns.

Infrastructure Investment:

- Increased spending on infrastructure projects, such as transportation, energy, and technology, to stimulate job creation and economic growth.

Debt Relief:

- Policies aimed at providing relief to individuals or businesses facing financial distress, including debt restructuring or forgiveness programs.

Monetary Policy Coordination:

- Collaboration with monetary authorities, such as central banks, to ensure a coordinated approach that aligns fiscal and monetary policies for maximum impact.

Emergency Funds:

- Establishing funds to address specific crises or emergencies, providing resources for rapid response and recovery efforts.

Fiscal packages are often deployed in response to economic challenges, such as recessions, financial crises, or external shocks. They can be expansionary, aiming to stimulate economic growth during a downturn, or contractionary, seeking to cool down an overheated economy and control inflation.

The effectiveness of a fiscal package depends on various factors, including its size, timing, and the specific economic conditions it aims to address. Governments may adjust their fiscal packages based on the evolving economic situation and policy goals. Fiscal packages are an important tool in the broader toolkit of economic policymakers, along with monetary policy and other measures, to achieve economic stability and growth.

What comprises a fiscal package in economic terms?

In economic terms, a fiscal package refers to a coordinated set of government spending and tax measures designed to achieve specific economic goals. It's an umbrella term encompassing different tools used to influence the economy through fiscal policy. Here's a breakdown of what typically comprises a fiscal package:

Spending Measures:

- Increased government spending: This can involve injecting money into various sectors like infrastructure, education, healthcare, social welfare programs, or green energy initiatives. The aim is to boost aggregate demand, stimulate economic activity, and create jobs.

- Direct payments to individuals or businesses: These can be one-time or recurring checks, grants, or subsidies aimed at providing immediate relief to specific groups affected by economic hardship or stimulating consumer spending.

- Tax breaks and incentives: This could involve temporary or permanent reductions in income taxes, sales taxes, or specific industry taxes to incentivize investment, hiring, or specific economic activities.

Taxation Measures:

- Tax increases: Raising taxes, particularly on higher-income earners or specific goods and services, can generate additional revenue for government spending or reduce budget deficits.

- Changes in tax structures: Adjustments to tax brackets, deductions, or credits can influence income distribution, incentivize certain behaviors, or promote social objectives.

- Tax holidays or temporary deferrals: This could involve temporarily suspending or delaying tax payments for specific businesses or individuals to provide immediate relief and cash flow improvement.

Additional Components:

- Debt management: Fiscal packages may also include strategies for managing government debt, such as issuing new bonds, restructuring existing debt, or debt buybacks.

- Regulatory changes: Policy adjustments beyond direct spending and taxes, such as deregulation or subsidies, can also be part of a broader fiscal package to achieve specific economic goals.

The specific composition of a fiscal package will vary depending on several factors, including:

- The current economic situation: Is the economy in a recession, experiencing inflation, or facing specific sectoral challenges?

- The government's priorities: What are the short- and long-term economic goals the government aims to achieve?

- Political considerations: Balancing different stakeholders' interests and navigating political consensus often plays a role in shaping the package.

Overall, understanding the various components of a fiscal package provides insight into the government's economic intervention strategies and their potential impacts.

I hope this explanation clarifies what comprises a fiscal package in economic terms. If you have any further questions or want to explore specific aspects of fiscal packages in different contexts, feel free to ask!