How do you calculate income for mortgage?

Calculating income for a mortgage involves determining your gross income and considering various factors to arrive at the amount that lenders use to assess your ability to repay a mortgage. Here's a general guide on how income for a mortgage is calculated:

1. Gross Income:

- Start with your gross income. This includes your total income before deductions, such as taxes and other withholdings.

- Include all reliable sources of income, such as salary, bonuses, overtime, alimony, child support, rental income, and any other regular sources.

2. Verification of Employment:

- Lenders often require verification of employment to confirm your income. This may involve providing pay stubs, W-2 forms, tax returns, or other documentation.

3. Stable Income:

- Lenders prefer stable and consistent income. If your income includes bonuses or overtime, lenders may consider an average over time to account for fluctuations.

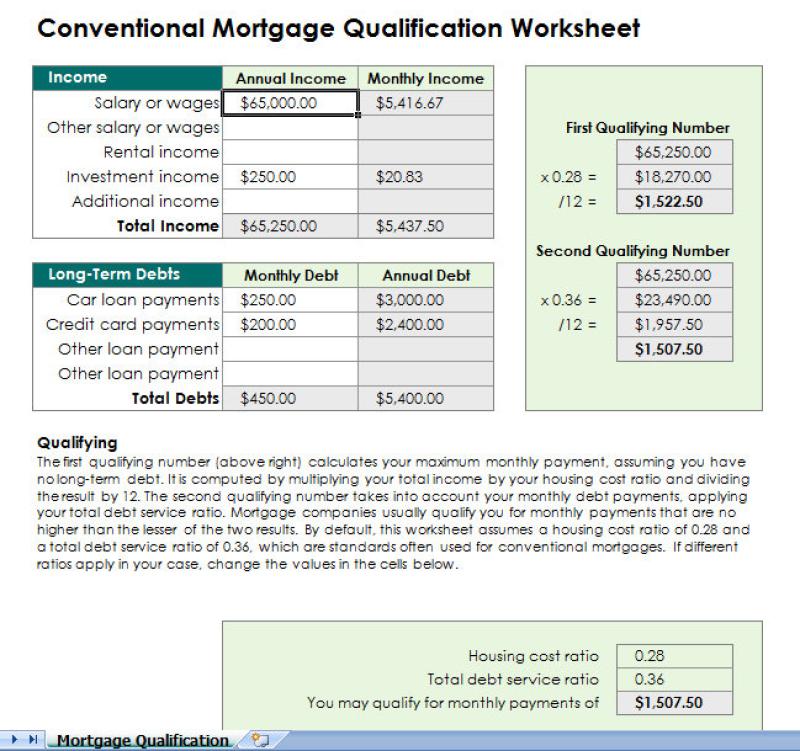

4. Debt-to-Income Ratio (DTI):

- Lenders use the debt-to-income ratio to assess your ability to manage monthly mortgage payments. The DTI is calculated by dividing your total monthly debt payments by your gross monthly income.

- Mortgage lenders typically have maximum DTI ratios, often around 43%, which includes all debt payments, not just the mortgage.

5. Housing Expense Ratio:

- The housing expense ratio focuses specifically on the portion of your income that goes towards housing costs. It includes the mortgage payment, property taxes, insurance, and sometimes homeowners association (HOA) fees.

- Lenders may have guidelines on the maximum percentage of income that can be allocated to housing expenses.

6. Residual Income:

- For certain loans, such as VA loans, lenders may assess residual income. This is the income remaining after accounting for major monthly expenses, including the mortgage payment.

7. Self-Employed Individuals:

- If you're self-employed, lenders may request additional documentation, such as profit and loss statements or business tax returns, to verify your income.

8. Down Payment and Loan Amount:

- The amount of down payment you can make and the size of the loan you're seeking may influence income requirements. A larger down payment can sometimes compensate for a lower income.

9. Credit Score:

- While not directly related to income, a higher credit score can positively impact your mortgage application and may provide more flexibility in income requirements.

10. Loan Programs:

- Different loan programs (FHA, VA, conventional) may have varying income requirements. Government-backed loans may have more flexible guidelines.

It's important to note that the specific income calculation methods can vary between lenders and loan programs. Consulting with a mortgage professional or loan officer is advisable to get accurate information based on your individual financial situation and the lending criteria of the institution.

Calculating Income for Mortgage Applications:

Here's how lenders calculate your income for mortgage purposes:

1. Income Sources:

Lenders consider various income sources, including:

- Salary and wages: Regular income from your employer, documented by W-2 forms.

- Commissions and bonuses: If these are a substantial and consistent part of your income, they may be included.

- Self-employment income: Typically averaged over the past two years using tax returns and business financial statements.

- Rental income: Documented through lease agreements and rent receipts.

- Investment income: Interest, dividends, and capital gains may be included with appropriate documentation.

2. Verification Methods:

Lenders use various methods to verify your income:

- W-2 forms: Verified directly with your employer through IRS services or submitted copies.

- 1099 forms: Reviewed for consistency and potential adjustments based on industry standards.

- Tax returns: Used to verify self-employment income and investment income.

- Bank statements: Reviewed for regular income deposits and overall financial stability.

- Employment verification: Contacting your employer to confirm employment status and income.

3. Formula for Gross Income:

Lenders generally calculate your gross monthly income by:

- Salaried Employees: Annual salary / 12 months

- Hourly Employees: Hourly wage * 2080 hours (40 hours per week * 52 weeks) / 12 months

- Self-employed: Average annual income from tax returns / 12 months

- Other Sources: Average monthly income from documented sources

4. Adjustments for Deductions and Benefits:

Lenders may adjust your gross income for specific deductions and benefits:

- Pre-tax deductions: Health insurance, retirement contributions, and other pre-tax deductions may be subtracted.

- Tax adjustments: Lenders may adjust your income based on estimated taxes owed.

- Benefits: Certain benefits like employer-provided housing or car allowances may be added to income.

5. Consideration of Income Stability and Reliability:

Lenders evaluate the consistency and reliability of your income over time. They may consider factors like:

- Employment history: Stable employment with consistent income is preferred.

- Seasonal income: Seasonal income sources may require averaging or adjustments.

- Self-employment income: Lenders may be more cautious with self-employment income due to its potential fluctuations.

Overall, calculating income for mortgage applications involves a comprehensive analysis of your income sources, verification methods, appropriate formulas, and adjustments for deductions and benefits. The lender ultimately aims to assess your financial stability and ability to repay the mortgage.

It's recommended to consult with a mortgage professional to discuss your specific income situation and understand how it might affect your loan application and eligibility. They can provide guidance and ensure your income is accurately presented to maximize your chances of approval.