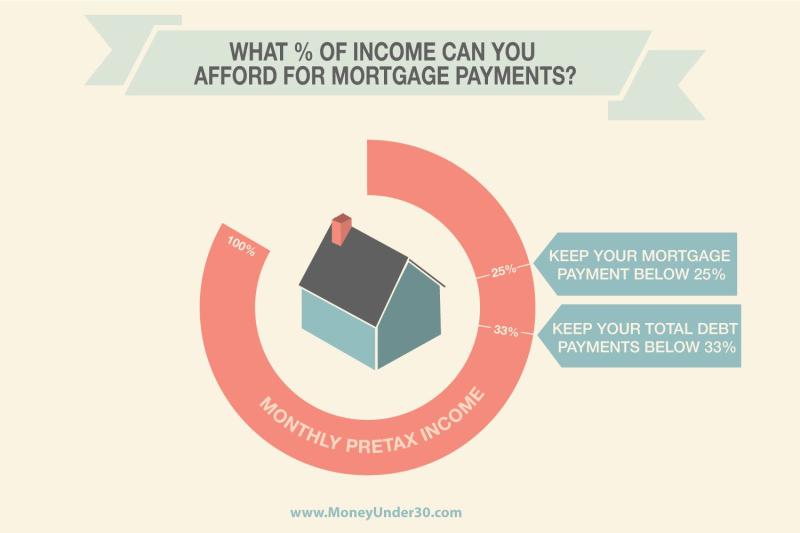

What percentage of your income should go toward a mortgage?

The percentage of your income that should go toward a mortgage is a key factor in determining housing affordability. Financial experts often recommend adhering to certain guidelines to maintain a balanced budget and avoid financial strain. One common guideline is the 28/36 rule. According to this rule:

Front-End Ratio (28%):

- The suggested maximum percentage of your gross monthly income that should be allocated to housing costs, including mortgage principal, interest, property taxes, and homeowners insurance, is typically 28%.

Back-End Ratio (36%):

- The recommended maximum percentage of your gross monthly income that should go toward all debt payments, including housing costs (as described above) plus other debts such as credit card payments, car loans, and student loans, is typically 36%.

These ratios provide a framework for evaluating the affordability of a mortgage in the context of your overall financial situation. However, individual circumstances and preferences can vary, and it's essential to consider your own financial goals, lifestyle, and other financial obligations.

Here are the steps to calculate the recommended mortgage payment:

Determine Gross Monthly Income:

- Start with your gross monthly income, which is your income before taxes and deductions.

Calculate Front-End Ratio (28%):

- Multiply your gross monthly income by 0.28 to find the suggested maximum housing cost.

Calculate Back-End Ratio (36%):

- Multiply your gross monthly income by 0.36 to find the suggested maximum total debt payments.

Determine Mortgage Payment:

- Subtract other debt payments from the total suggested maximum debt payments to find the suggested maximum housing cost.

It's important to note that while these guidelines provide a useful starting point, individual circumstances vary. Consider factors such as your overall financial goals, lifestyle, and potential future changes in income when determining what percentage of your income should go toward a mortgage. Additionally, other costs associated with homeownership, such as maintenance and utilities, should be considered to create a comprehensive budget.

Recommended Mortgage Payment Allocation and its Impact on Financial Stability

1. Recommended Portion of Income for Mortgage Payments:

There are two commonly cited guidelines for the percentage of income to allocate towards mortgage payments:

a) 28% Rule: This traditional rule recommends spending no more than 28% of your gross income (before taxes) on your monthly mortgage payment, including principal, interest, taxes, and insurance (PITI).

b) 36% Rule (Debt-to-Income Ratio): This rule suggests keeping your total monthly debt payments, including mortgage, car loans, student loans, etc., below 36% of your gross income.

However, it's important to remember:

- These are just general recommendations and may not be suitable for everyone.

- Your individual circumstances, including income, debt, savings, dependents, and desired lifestyle, should be carefully considered when determining an appropriate mortgage payment allocation.

2. Impact of Mortgage Payment Percentage on Financial Stability:

A higher percentage of income allocated towards mortgage payments can have both positive and negative impacts on your financial stability:

Potential Positive Impacts:

- Faster homeownership: Paying more towards your mortgage can shorten the loan term and save you money on interest in the long run.

- Increased home equity: Building equity faster provides greater financial security and access to potential loan options.

- Reduced risk of default: Having a lower debt-to-income ratio makes you less susceptible to financial hardship and better equipped to weather economic downturns.

Potential Negative Impacts:

- Reduced financial flexibility: High mortgage payments limit your ability to save for other goals, such as retirement, emergencies, or children's education.

- Increased stress and strain: Financial pressure from high mortgage payments can lead to stress and anxiety.

- Limited lifestyle options: You may have to restrict spending on other necessities and discretionary expenses.

Finding the right balance:

The key is to find a balance that allows you to afford your desired home while maintaining sufficient financial flexibility and security. This involves considering your income, debts, savings, and future plans.

Additional factors to consider:

- Down payment: A larger down payment reduces the loan amount and lowers your monthly mortgage payment.

- Interest rate: Lower interest rates lead to lower monthly payments and can significantly impact your overall cost of borrowing.

- Fixed vs. adjustable rate mortgages: Fixed rates provide stability, but adjustable rates can offer lower initial payments.

- Property taxes and homeowner's insurance: These recurring costs should be factored into your budget.

Seeking professional advice:

Consulting with a financial advisor or mortgage lender can help you determine the appropriate mortgage payment amount and ensure a financially sustainable homeownership journey.