What is the connection between inflation and CPI?

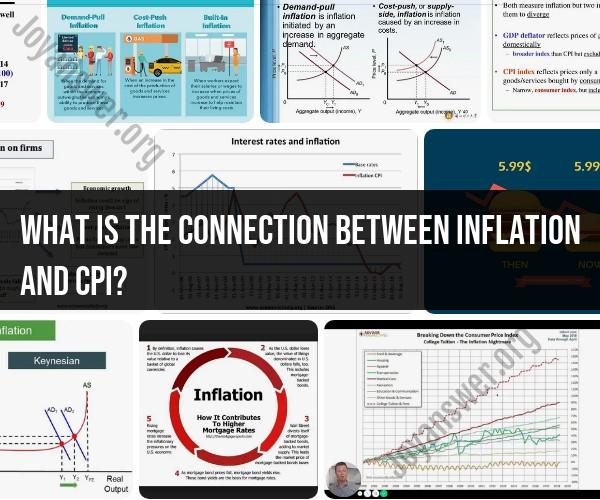

The Consumer Price Index (CPI) and inflation are closely related, and CPI is a key tool used to measure and monitor inflation. Here's how they are connected:

Definition of CPI: The CPI is a statistical measure that tracks the changes in the prices of a fixed basket of goods and services over time. It is used to gauge the average price change experienced by urban consumers. The basket typically includes a range of goods and services that represent what a typical household purchases.

Inflation Measurement: Inflation is the rate at which the general price level of goods and services in an economy rises, resulting in a decrease in the purchasing power of a currency. The CPI is one of the primary tools used to measure inflation. It does this by comparing the current cost of the basket of goods and services to the cost of that same basket in a base period. The difference between these two costs is the inflation rate.

Inflation Indicators: The CPI serves as an indicator of inflation trends. If the CPI rises over time, it suggests that, on average, the prices of goods and services in the basket have increased, which indicates inflation. If the CPI falls, it suggests deflation, which is a decrease in the general price level. If the CPI remains relatively stable, it indicates low or no inflation.

Economic Impact: Inflation has a significant impact on an economy. High and unpredictable inflation can erode the purchasing power of consumers, reduce the real value of savings and investments, and distort economic decision-making. Central banks often use CPI data to make monetary policy decisions, aiming to maintain price stability and control inflation.

CPI Components: The CPI is typically composed of various categories of goods and services, including food, housing, transportation, healthcare, education, and more. Changes in the prices of these items can have different weights in the CPI, reflecting their relative importance in a typical consumer's budget.

Inflation Drivers: The CPI can also help identify the drivers of inflation. It allows economists and policymakers to analyze which specific goods and services are experiencing price increases and to what extent. This information can be valuable for making economic policy decisions.

Core CPI: In addition to the overall CPI, there's a measure called "core CPI," which excludes volatile items like food and energy. Core CPI is often used to get a better sense of the underlying inflation trend, as food and energy prices can be subject to significant short-term fluctuations.

In summary, the CPI is a key economic indicator that quantifies changes in the prices of a representative basket of goods and services. It is a vital tool for measuring and monitoring inflation, which is a crucial economic concept with significant implications for consumers, businesses, and policymakers. By tracking CPI data, economists and central banks can assess the health of an economy, make informed policy decisions, and help maintain price stability.

The Relationship Between Inflation and CPI Explained

Inflation is a general increase in prices and a decrease in the purchasing power of money. The Consumer Price Index (CPI) is a measure of inflation that tracks the prices of a basket of goods and services commonly purchased by households.

The CPI is calculated by the Bureau of Labor Statistics (BLS) on a monthly basis. The BLS collects price data from over 23,000 retail outlets across the United States. The CPI is then calculated using a weighted average of the prices of the goods and services in the basket.

Consumer Price Index (CPI): Understanding Inflation Metrics

The CPI is the most widely used measure of inflation in the United States. It is used by the government, businesses, and consumers to track changes in prices and to make economic decisions.

The CPI is also used to calculate the cost of living adjustment (COLA) for Social Security benefits and other government programs. The COLA is an annual adjustment that is intended to help keep up with rising prices.

How CPI Measures Inflation: Components and Methodology

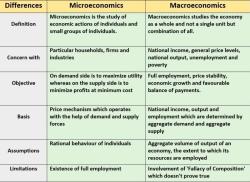

The CPI basket of goods and services is divided into eight major categories:

- Food and beverages

- Housing

- Apparel

- Transportation

- Medical care

- Recreation

- Education and communication

- Other goods and services

Each category is weighted based on its importance in the household budget. For example, the housing category has the largest weight because it is typically the largest expense for households.

The CPI is calculated by comparing the prices of the goods and services in the basket to their prices in a base period. The base period is currently 2019.

Inflation's Impact on Personal Finance and Investments

Inflation can have a significant impact on personal finance and investments. When inflation rises, the purchasing power of money decreases. This means that people can buy less with the same amount of money.

Inflation can also impact investment returns. If inflation is high, the value of investments may not keep up with the rising cost of living.

Strategies for Managing Money During Inflation

There are a number of things that people can do to manage their money during inflation:

- Invest in assets that tend to appreciate in value during inflation. This includes assets such as stocks, real estate, and commodities.

- Pay down debt. The value of debt decreases during inflation, so it is a good time to pay down high-interest debt.

- Increase your savings rate. This will help you to have more money to purchase goods and services in the future.

- Budget carefully. Inflation can make it difficult to make ends meet, so it is important to budget carefully and track your spending.

Inflation is a complex topic, but it is important to understand its impact on personal finance and investments. By following the tips above, people can manage their money more effectively during times of inflation.