Is a home equity loan better than refinancing?

The decision between a home equity loan and refinancing depends on your financial goals, needs, and the specific circumstances of your situation. Both options have their pros and cons, and the better choice for you will depend on factors such as your current mortgage terms, interest rates, financial objectives, and the amount of equity you have in your home. Here's a comparison to help you make an informed decision:

Home Equity Loan:

Pros:

- Fixed Interest Rate: Home equity loans often come with fixed interest rates, providing stability in your monthly payments.

- Lump Sum Payment: You receive a lump sum of money upfront, which can be useful for specific one-time expenses like home renovations or debt consolidation.

- No Impact on Existing Mortgage: Taking out a home equity loan doesn't affect the terms of your existing mortgage.

Cons:

- Higher Interest Rates: Home equity loan interest rates may be higher than your current mortgage rate.

- Additional Monthly Payment: You'll have an additional monthly payment on top of your existing mortgage.

Refinancing:

Pros:

- Lower Interest Rates: Refinancing allows you to potentially secure a lower interest rate, reducing your overall borrowing costs.

- Consolidation of Debts: You can consolidate multiple debts into a single mortgage payment.

- Adjustable Terms: Refinancing allows you to change the term of your mortgage, potentially lowering monthly payments or paying off the loan faster.

Cons:

- Closing Costs: Refinancing typically involves closing costs, which can offset the potential savings from a lower interest rate.

- Extended Loan Term: If you refinance to lower monthly payments, you might end up extending the overall term of your loan.

- Variable Interest Rates: If you choose an adjustable-rate mortgage (ARM), your interest rate could increase over time.

Factors to Consider:

- Current Interest Rates: Compare the interest rates on home equity loans and refinancing options to see which one offers a better rate.

- Financial Goals: Clarify your financial objectives. If you need a lump sum for a specific purpose, a home equity loan may be more suitable. If you want to reduce monthly payments or pay off the loan faster, refinancing may be the better choice.

- Equity Position: The amount of equity you have in your home will impact the options available to you.

- Loan Terms: Consider the terms of the loan, including interest rates, repayment period, and any fees involved.

Conclusion:

There's no one-size-fits-all answer, and the "better" option depends on your individual circumstances. Consult with a financial advisor or mortgage professional to assess your situation, compare costs, and determine which option aligns better with your financial goals and needs.

Financing decisions: Is a home equity loan better than refinancing?

Whether a home equity loan or refinancing is better for you depends on your individual circumstances and financial goals. Here is a comparison of the two options:

Home equity loan

- A home equity loan is a second mortgage that you take out on top of your existing mortgage.

- You can borrow up to 80% of the equity in your home, minus the amount you still owe on your mortgage.

- Home equity loans typically have fixed interest rates and terms, ranging from 5 to 30 years.

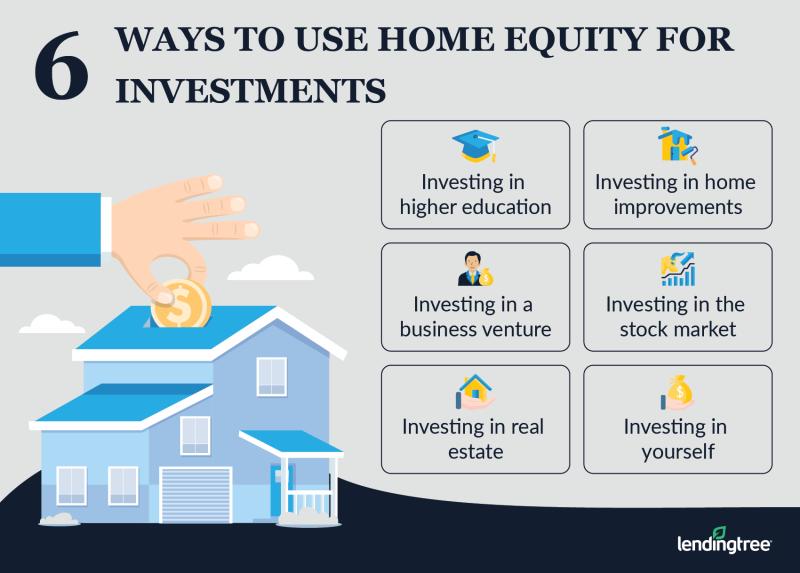

- You can use the proceeds from a home equity loan for any purpose, such as home repairs, debt consolidation, or education expenses.

Refinancing

- Refinancing is the process of replacing your existing mortgage with a new one.

- You can refinance to get a lower interest rate, shorter term, or different loan type.

- You can also refinance to cash out some of your equity.

- When you refinance, you will need to pay closing costs, which can be several thousand dollars.

Which option is better for you?

If you need access to cash quickly and have a good credit score, a home equity loan may be a good option. Home equity loans are typically easier to qualify for than refinancing.

If you want to lower your monthly mortgage payments or save money on interest, refinancing may be a better option. However, it is important to factor in the closing costs when deciding whether or not to refinance.

Comparing the benefits and drawbacks of home equity loans and refinancing

Here is a more detailed comparison of the benefits and drawbacks of home equity loans and refinancing:

Home equity loan

Benefits:

- Easy to qualify for

- Can be used for any purpose

- Fixed interest rate and term

Drawbacks:

- Higher interest rate than mortgage

- Second mortgage, so you may have two monthly payments

- Closing costs

Refinancing

Benefits:

- Lower interest rate

- Shorter term

- Different loan type

- Cash out equity

Drawbacks:

- Closing costs

- Need to qualify for new mortgage

Tips for homeowners in making informed decisions about their financing options

Here are some tips for homeowners in making informed decisions about their financing options:

- Shop around and compare rates from multiple lenders.

- Get pre-approved for a home equity loan or refinance before you start shopping for a home.

- Consider your financial goals and budget when choosing the best financing option for you.

- Talk to a financial advisor to get personalized advice.

It is also important to note that the current interest rate environment is very fluid. Interest rates are rising, so it is important to lock in a low interest rate if you are considering a home equity loan or refinance.