Where to get the best personal loan?

Finding the best personal loan involves careful research and consideration of various factors. Here are some tips and considerations to help you find the best personal loan for your needs:

Check Your Credit Score:

- Start by checking your credit score. Your credit score plays a significant role in the interest rate and terms you'll be offered. If your credit score is high, you're more likely to qualify for lower interest rates.

Compare Lenders:

- Research multiple lenders, including banks, credit unions, online lenders, and peer-to-peer lending platforms. Each type of lender may offer different rates and terms. Compare their offers to find the best fit.

Interest Rates:

- Interest rates are a crucial factor. Look for lenders offering competitive interest rates based on your credit score. Even a small difference in the interest rate can result in significant savings over the life of the loan.

Fees and Charges:

- Be aware of any fees associated with the loan, such as origination fees, prepayment penalties, and late payment fees. Choose a loan with minimal fees to save on the overall cost.

Loan Terms:

- Consider the loan term. Longer loan terms can result in lower monthly payments but may cost more in interest over time. Shorter terms may have higher monthly payments but can save you money on interest.

Loan Amount:

- Determine the loan amount you need and ensure the lender offers loans in the desired range. Avoid borrowing more than necessary to minimize interest costs.

Secured vs. Unsecured Loans:

- Personal loans can be either secured or unsecured. Secured loans require collateral (such as a vehicle or savings account), while unsecured loans do not. Secured loans may offer lower interest rates but involve the risk of losing collateral if you default.

Repayment Options:

- Check if the lender offers flexible repayment options, such as biweekly payments or the ability to make extra payments without penalties. These options can help you pay off the loan faster and reduce interest costs.

Customer Service and Support:

- Consider the lender's reputation for customer service. Responsive and helpful customer support can make the borrowing process smoother.

Online Reviews and Ratings:

- Research the lender's online reviews and ratings from previous customers to get an idea of their customer experience and satisfaction.

Prequalification:

- Many lenders offer prequalification, which allows you to see potential loan offers without affecting your credit score. This can help you compare loan terms from multiple lenders before making a final decision.

Loan Purpose:

- Be honest about the purpose of the loan. Some lenders specialize in specific loan purposes, such as debt consolidation, home improvement, or medical expenses. Find a lender that caters to your needs.

Loan Documentation:

- Be prepared with the necessary documentation, such as proof of income, employment information, and financial statements, to streamline the loan application process.

Credit Unions:

- Consider joining a credit union, as they often offer competitive rates and more flexible lending terms to their members.

Rate Shopping:

- When comparing loan offers, try to do your rate shopping within a short time frame (e.g., two weeks). Multiple credit inquiries for the same type of loan are typically treated as a single inquiry, minimizing the impact on your credit score.

Read the Fine Print:

- Carefully read the loan agreement, including the terms and conditions. Make sure you understand all the terms before signing.

By considering these factors and shopping around for the best personal loan, you can find a loan that suits your financial needs and budget. Remember that the best personal loan for one person may not be the same for another, as it depends on individual circumstances and preferences.

Finding the Best Personal Loan Providers

Securing a personal loan can be a beneficial financial decision, providing access to funds for various needs, such as debt consolidation, home renovations, or unexpected expenses. However, with numerous lenders offering personal loans, finding the most suitable option requires careful consideration.

Comparing Personal Loan Options from Different Lenders

When comparing personal loan options, consider the following factors:

Interest rates: Interest rates significantly impact the overall loan cost. Compare interest rates from multiple lenders to find the lowest rate available.

Loan terms: Loan terms determine the repayment period and monthly payments. Choose a loan term that aligns with your financial situation and repayment capacity.

Fees and charges: Some lenders may charge origination fees, prepayment penalties, or late fees. Understand all applicable fees before committing to a loan.

Lender reputation: Research the lender's reputation and customer reviews to ensure they are trustworthy and provide quality service.

Eligibility criteria: Review the lender's eligibility criteria, including minimum credit score, income requirements, and employment verification.

Factors to Consider When Choosing a Personal Loan

Several factors influence the choice of a personal loan:

Loan purpose: Clearly define the purpose of the loan to determine the required amount and repayment timeframe.

Creditworthiness: Your credit score plays a crucial role in determining interest rates and loan terms. Improve your credit score before applying to secure favorable terms.

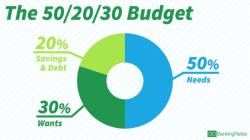

Debt-to-income ratio (DTI): Lenders consider DTI, the percentage of your monthly income that goes towards debt payments. A lower DTI indicates better financial stability.

Collateral: Secured personal loans require collateral, such as a car or savings account, which can lower interest rates.

Pre-approval: Obtain pre-approval from multiple lenders to compare offers and understand your borrowing power.

Getting the Most Favorable Terms on Your Personal Loan

Here are tips for securing the most favorable terms on your personal loan:

Shop around and compare offers from multiple lenders.

Negotiate interest rates and fees with the lender.

Consider a cosigner with good credit to improve your chances of approval and lower interest rates.

Increase your credit score before applying for a loan.

Maintain a steady income and employment history.

Customer Reviews and Recommendations for Top Personal Loan Providers

Customer reviews and recommendations can provide valuable insights into lender experiences and reputations. Consider reputable online review platforms and seek recommendations from friends or family members who have recently secured personal loans.

Remember, the best personal loan for you will depend on your specific financial situation, needs, and goals. Carefully evaluate your options, compare terms, and negotiate before making a decision.