How do you figure out your income tax?

Figuring out your income tax involves several steps, including determining your taxable income, applying the appropriate tax rates, and considering deductions and credits. Here's a comprehensive guide on how to calculate your income tax:

Gather Income Information:

- Start by gathering all sources of income for the tax year. This may include wages, salary, self-employment income, rental income, investment income, and any other sources of taxable income.

Calculate Gross Income:

- Calculate your gross income by adding up all your sources of income. This is the total income before any deductions.

Determine Adjusted Gross Income (AGI):

- AGI is calculated by subtracting certain adjustments or "above-the-line" deductions from your gross income. These deductions might include contributions to retirement accounts, student loan interest, and alimony payments.

Apply Taxable Income Deductions:

- Subtract any deductions you qualify for from your AGI to calculate your taxable income. Common deductions include the standard deduction or itemized deductions, such as mortgage interest, state and local taxes, and charitable contributions.

Identify Your Filing Status:

- Your filing status (e.g., Single, Married Filing Jointly, Head of Household) affects your tax brackets and deductions. Choose the status that best applies to your situation.

Determine Your Taxable Income:

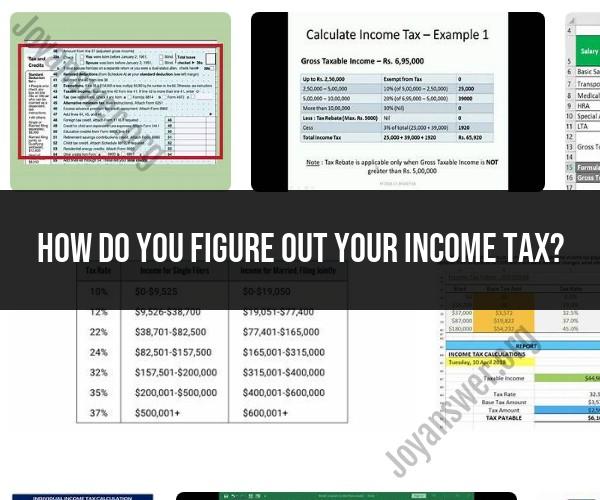

- Use the tax brackets applicable to your filing status to determine the income tax you owe. Tax brackets specify the percentage of your income that is subject to taxation. As your income increases, you may move into a higher tax bracket.

Calculate Your Tax Liability:

- Multiply your taxable income by the tax rate for your bracket to calculate your tax liability. This is the amount you owe before any tax credits are applied.

Consider Tax Credits:

- Tax credits directly reduce your tax liability. Common tax credits include the Child Tax Credit, Earned Income Tax Credit, and education credits. Subtract the total credits you qualify for from your tax liability.

Calculate Your Final Tax Owed or Refund:

- Subtract your tax credits from your tax liability to determine your final tax owed. If your credits exceed your liability, you will receive a tax refund. If your liability is greater, you'll need to pay the remaining balance.

File Your Tax Return:

- Complete the appropriate tax forms (e.g., Form 1040, 1040A, or 1040EZ) and submit your tax return to the IRS by the tax filing deadline. You can file electronically or by mail.

Pay Any Owed Taxes:

- If you owe taxes, pay the amount due by the filing deadline to avoid penalties and interest charges. You can pay online, by check, or through various other payment methods.

Keep Records:

- Maintain records of your tax returns, supporting documentation, and receipts for at least three years. These records can be helpful in case of an audit or to answer any tax-related questions.

It's important to note that tax laws can change, and tax calculations may become more complex depending on your financial situation. Consider seeking assistance from a tax professional or using tax preparation software to ensure accurate calculations and compliance with tax regulations.

Making Sense of Income Tax: How to Calculate Your Tax Liability

Income tax is a tax that is levied on the income of individuals and businesses. The amount of income tax that you owe depends on your income, tax bracket, and deductions.

Tax Calculation Made Simple: Step-by-Step Guide to Figuring Out Income Tax

To calculate your income tax liability, you will need to follow these steps:

- Determine your gross income. Your gross income is the total amount of income that you received during the year. This includes income from wages, salaries, commissions, bonuses, tips, investments, and self-employment.

- Subtract your deductions. Deductions are expenses that you can reduce your taxable income by. Some common deductions include the standard deduction, itemized deductions, and student loan interest.

- Calculate your adjusted gross income (AGI). Your AGI is your gross income minus your deductions.

- Determine your tax bracket. Your tax bracket is based on your AGI and your filing status. There are seven tax brackets for single filers and six tax brackets for married filing jointly filers.

- Calculate your taxable income. Your taxable income is your AGI minus your exemptions. Exemptions are deductions that you can take for yourself, your spouse, and your dependents.

- Calculate your income tax liability. Your income tax liability is calculated by multiplying your taxable income by your tax rate. Your tax rate is based on your tax bracket.

Your Tax Responsibility: Calculating Your Annual Income Tax

It is important to calculate your income tax liability accurately to avoid underpaying or overpaying your taxes. If you underpay your taxes, you may be subject to penalties and interest. If you overpay your taxes, you will receive a refund when you file your tax return.

Here are some additional tips for calculating your income tax:

- Keep good records of your income and expenses. This will make it easier to calculate your income tax liability at the end of the year.

- Use a tax preparation software program. Tax preparation software programs can help you to calculate your income tax liability accurately and quickly.

- Hire a tax professional. If you are unsure about how to calculate your income tax liability, you can hire a tax professional to help you.

Conclusion

Calculating your income tax liability can be a complex task, but it is important to do it accurately to avoid penalties and interest. By following the steps above and using the tips provided, you can calculate your income tax liability accurately and efficiently.