What are the responsibilities of financial manager?

Financial managers play a crucial role in an organization's financial health and strategy. Their responsibilities encompass a range of financial activities aimed at maximizing shareholder value and ensuring the organization's financial stability. Here are some key responsibilities of financial managers:

Financial Planning:

- Develop and implement financial plans and strategies aligned with the organization's goals.

- Prepare budgets, forecasts, and financial projections to guide decision-making.

Financial Reporting:

- Prepare accurate and timely financial reports, including income statements, balance sheets, and cash flow statements.

- Ensure compliance with accounting standards and regulations.

Risk Management:

- Identify and assess financial risks, including market risks, credit risks, and operational risks.

- Develop strategies to mitigate and manage these risks.

Capital Budgeting:

- Evaluate investment opportunities and capital projects to determine their financial feasibility and potential return on investment.

- Make recommendations regarding capital allocation and resource utilization.

Financial Analysis:

- Conduct financial analysis to assess the financial performance of the organization.

- Analyze financial trends, variances, and key performance indicators.

Cash Management:

- Manage cash flow and liquidity to ensure the organization has adequate funds to meet its operational and strategic needs.

- Implement effective cash management strategies.

Cost Management:

- Monitor and control costs to optimize operational efficiency.

- Identify cost-saving opportunities without compromising quality or performance.

Financial Compliance:

- Ensure compliance with financial regulations, accounting standards, and tax laws.

- Coordinate with auditors and regulatory authorities during audits.

Financial Strategy Development:

- Contribute to the development of the organization's overall financial strategy.

- Align financial objectives with broader business goals and strategies.

Investor Relations:

- Communicate financial results and strategies to shareholders, investors, and financial analysts.

- Participate in meetings, conferences, and calls with investors.

Treasury Management:

- Manage the organization's financial assets, including cash, investments, and working capital.

- Optimize the balance between risk and return in financial portfolios.

Tax Planning:

- Develop and implement tax strategies to minimize the organization's tax liability.

- Stay informed about changes in tax laws and regulations.

Negotiations and Contracts:

- Participate in financial negotiations, such as vendor contracts, mergers, acquisitions, and partnerships.

- Ensure favorable financial terms in contractual agreements.

Team Leadership:

- Supervise and lead financial teams, including accountants, financial analysts, and budget specialists.

- Provide guidance and support for professional development.

Ethical and Legal Compliance:

- Uphold ethical standards in financial decision-making and reporting.

- Ensure that financial practices comply with relevant laws and regulations.

Financial managers need a combination of financial expertise, strategic thinking, and leadership skills to successfully fulfill these responsibilities and contribute to the financial success of the organization.

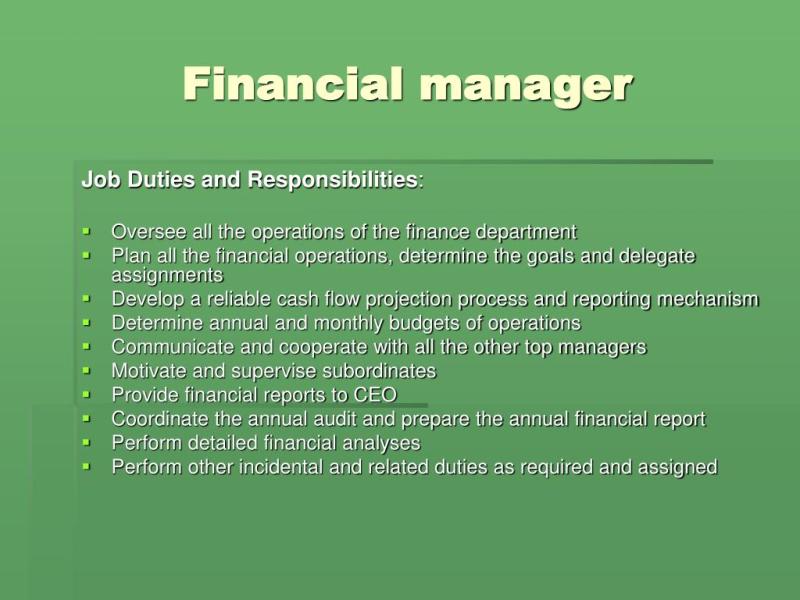

What are the core duties of a financial manager?

Financial managers play a crucial role in organizations of all sizes, overseeing the financial aspects of their operations. Their responsibilities encompass a wide range of activities, from financial planning and budgeting to risk management and investment decisions. Here's a comprehensive overview of the core duties of a financial manager:

Financial Planning and Budgeting: Financial managers are responsible for developing and implementing strategic financial plans that align with the organization's overall goals and objectives. They analyze financial data, identify opportunities and challenges, and create detailed budgets that outline revenue projections, expense forecasts, and cash flow management plans.

Financial Reporting and Analysis: Financial managers oversee the preparation and analysis of financial reports, including balance sheets, income statements, and cash flow statements. These reports provide valuable insights into the organization's financial health, performance, and position. Financial managers interpret and analyze these reports to identify trends, assess risks, and make informed decisions.

Investment Decisions: Financial managers play a key role in making investment decisions that align with the organization's risk tolerance and financial goals. They evaluate potential investment opportunities, assess risks and potential returns, and make recommendations to senior management on capital allocation and investment strategies.

Risk Management: Financial managers are responsible for identifying, assessing, and mitigating financial risks faced by the organization. They develop risk management strategies to protect the organization's assets, financial stability, and reputation. This includes managing credit risk, market risk, operational risk, and other financial risks.

Financial Oversight and Compliance: Financial managers ensure that the organization's financial activities comply with all applicable laws, regulations, and accounting standards. They oversee internal controls, financial reporting processes, and compliance with tax laws and regulations.

Financial Modeling and Forecasting: Financial managers use financial modeling techniques to develop forecasts and projections for the organization's financial performance. These forecasts help management make informed decisions about resource allocation, investments, and future growth strategies.

Performance Management: Financial managers monitor the organization's financial performance against established goals and objectives. They identify areas for improvement, develop corrective action plans, and track progress towards achieving financial targets.

Financial Communication: Financial managers communicate financial information to various stakeholders, including senior management, investors, lenders, and employees. They prepare clear and concise financial reports, presentations, and analyses to inform decision-making and maintain transparency.