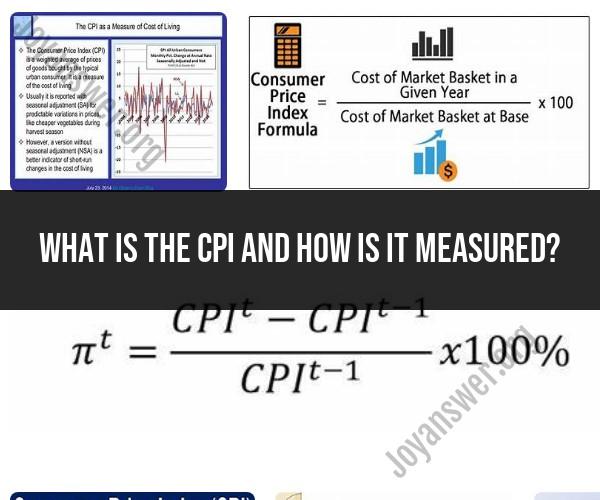

What is the CPI and how is It measured?

The Consumer Price Index (CPI) is a widely used economic indicator that measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. In simpler terms, it helps track inflation or the increase in the cost of living by examining how the prices of a fixed set of goods and services change from year to year.

Here's how the CPI is measured and why it's significant:

Measurement of CPI:

Basket of Goods and Services: The CPI is based on a "basket" of goods and services that represent the typical spending patterns of an average urban consumer. This basket includes items like food, clothing, rent, medical care, transportation, and entertainment.

Price Collection: Government agencies or statistical organizations collect price data for these items on a regular basis. They visit stores, conduct surveys, and analyze market prices to determine the cost of the items in the basket.

Base Year: The CPI calculation uses a designated "base year" as a reference point. The prices of the items in the basket are collected and averaged for this base year.

Current Year Prices: In subsequent years, the prices of the same items in the basket are collected and averaged. The percentage change in the average prices from the base year to the current year represents the inflation rate.

Calculation: The CPI is calculated using the following formula:

CPI = (Cost of Basket in Current Year / Cost of Basket in Base Year) x 100

The result is expressed as an index number, with the base year having an index of 100. Changes in the CPI from the base year value indicate the direction and magnitude of inflation or deflation.

Significance of CPI:

The Consumer Price Index is significant for several reasons:

Measuring Inflation: The CPI is one of the primary tools used to measure inflation in an economy. By tracking changes in consumer prices, policymakers, economists, and businesses can assess the overall health of the economy and make informed decisions.

Cost of Living Adjustments: Many wage and benefit agreements, such as Social Security and labor contracts, use the CPI as a basis for cost-of-living adjustments (COLAs). When the CPI increases, it often triggers increases in wages, pensions, and other payments to help individuals keep up with rising prices.

Economic Policy: Central banks and governments use CPI data to inform their economic policies. High inflation rates can erode the purchasing power of money, while low or negative inflation (deflation) can have adverse economic effects. Policymakers aim to maintain stable prices to promote economic growth and stability.

Investment and Financial Planning: Investors and financial analysts use CPI data to assess the impact of inflation on investment returns, interest rates, and the real value of assets. It helps individuals make informed financial decisions and plan for the future.

Comparing Regions and Periods: The CPI allows for comparisons of price levels and inflation rates between different regions, cities, and time periods, providing valuable information for businesses, policymakers, and researchers.

Overall, the Consumer Price Index is a crucial economic indicator that helps individuals, businesses, and governments understand and respond to changes in the cost of living and the broader economic landscape.

Deciphering the Consumer Price Index (CPI) and Its Measurement Methods

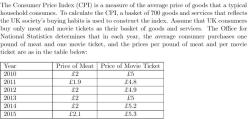

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by consumers for a representative basket of consumer goods and services. It is calculated by the Bureau of Labor Statistics (BLS) on a monthly basis. The CPI is one of the most important economic indicators, and it is used by a variety of stakeholders, including policymakers, businesses, and consumers.

To calculate the CPI, the BLS collects data on the prices of a wide range of goods and services, including food, clothing, housing, transportation, and healthcare. The BLS uses this data to create a "market basket" of goods and services that is representative of the spending habits of urban consumers. The prices of the goods and services in the market basket are tracked over time, and the CPI is calculated as the percentage change in the price of the market basket from one period to the next.

The Role of CPI in Economic Analysis and Policy

The CPI is used by policymakers to track inflation, which is the rate at which prices for goods and services are rising. Inflation can have a significant impact on the economy, and it is important for policymakers to have accurate data on inflation in order to make informed decisions about economic policy.

The CPI is also used by businesses to make decisions about pricing and investment. Businesses use the CPI to track the cost of their inputs and to forecast the future demand for their products and services.

Consumers use the CPI to track the cost of living and to make informed decisions about their spending. Consumers can use the CPI to budget for their expenses and to compare the prices of goods and services over time.

Influential Factors in CPI Calculation and Reporting

There are a number of factors that can influence the calculation and reporting of the CPI. These factors include:

- The selection of the market basket: The market basket of goods and services used to calculate the CPI is updated periodically to reflect changes in consumer spending habits.

- The frequency of price collection: The BLS collects data on the prices of goods and services on a monthly basis. However, the frequency of price collection can vary for different goods and services.

- The treatment of quality changes: The BLS attempts to adjust the prices of goods and services to account for quality changes. However, this can be a difficult task, and it can lead to some inaccuracies in the CPI.

Overall, the CPI is a valuable tool for understanding inflation and the cost of living. However, it is important to understand the factors that can influence the calculation and reporting of the CPI.