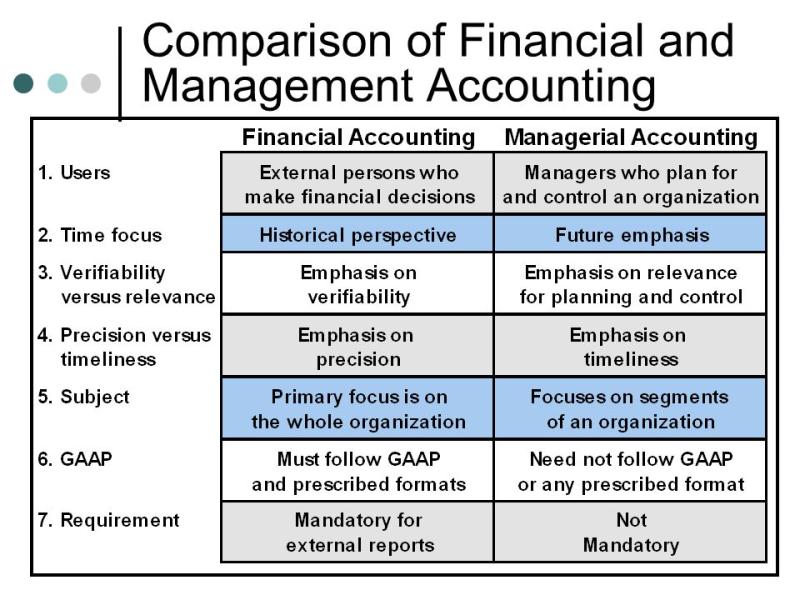

What are the differences between financial accounting and management accounting?

Financial accounting and management accounting serve different purposes within the realm of accounting, focusing on distinct aspects of business operations. Here are the key differences between the two:

Financial Accounting:

External Reporting:

- Audience: Targeted towards external stakeholders like investors, creditors, regulators, and the public.

- Purpose: Primarily concerned with presenting financial information about a company's performance, position, and cash flows to external parties.

- Regulatory Compliance: Governed by specific accounting standards (e.g., GAAP or IFRS) to ensure accuracy and transparency in financial reporting.

- Timeframe: Generally historical in nature, reporting past performance over specific periods (quarterly, annually).

Financial Statements:

- Key Outputs: Produces standardized financial statements such as income statements, balance sheets, cash flow statements, and statements of equity.

- Objectivity: Emphasizes objectivity and reliability of financial data to provide an accurate view of a company's financial health.

- Data Precision: Focuses on precision in reporting financial figures adhering to accounting principles and standards.

Decision-Making Impact:

- External Decisions: External stakeholders use financial statements to make investment, lending, or regulatory decisions regarding the company.

Management Accounting:

Internal Decision Support:

- Audience: Primarily serves internal management, including executives, managers, and decision-makers within the organization.

- Purpose: Aids in planning, controlling, decision-making, and performance evaluation within the organization.

- Flexibility: Not bound by strict accounting standards, allowing for more flexibility in reporting tailored information.

Management Reports:

- Key Outputs: Generates reports like budgets, forecasts, cost analyses, variance reports, and other customized reports as needed by management.

- Emphasis on Relevance: Focuses on providing relevant, timely, and forward-looking information to aid in decision-making.

Decision-Making Impact:

- Internal Decisions: Supports internal decision-making processes, enabling managers to plan, strategize, allocate resources, and control costs effectively.

Overall Difference:

Financial accounting is more concerned with providing historical financial information to external stakeholders for decision-making, while management accounting is geared towards internal managerial needs, facilitating planning, control, and decision-making within the organization.

Both forms of accounting play crucial roles in a company's overall accounting framework, albeit with distinct objectives and audiences.

What distinguishes financial accounting from management accounting?

While both financial accounting and management accounting deal with financial information, they have distinct purposes, audiences, and methodologies. Here's a breakdown of their key differences:

Purpose:

- Financial Accounting: Focuses on reporting financial information to external stakeholders like investors, creditors, and regulatory bodies. This information helps them assess the financial health and performance of the company and make informed decisions about investments, loans, and regulations.

- Management Accounting: Provides financial information and analysis to internal stakeholders like managers, executives, and department heads. This information helps them make informed decisions about planning, budgeting, resource allocation, performance evaluation, and other operational aspects of the business.

Audience:

- Financial Accounting: Primarily targets external stakeholders who do not have access to detailed internal information. The reports are standardized and follow specific accounting principles to ensure consistency and comparability across different companies.

- Management Accounting: Primarily targets internal stakeholders who are involved in the day-to-day operations of the business. The reports are often tailored to specific needs and can be more detailed and flexible than financial accounting reports.

Methodology:

- Financial Accounting: Follows established accounting principles and standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These principles ensure consistency and comparability of financial information across different companies.

- Management Accounting: Utilizes various analytical tools and techniques, such as cost accounting, budgeting, variance analysis, and forecasting. These tools help managers understand the financial implications of their decisions and make better-informed choices.

Timeliness:

- Financial Accounting: Reports are typically issued quarterly and annually. The information is historical and focuses on the past performance of the company.

- Management Accounting: Reports can be generated more frequently, even daily or weekly. The information can be both historical and forward-looking, providing insights into future trends and potential outcomes.

Accuracy and Precision:

- Financial Accounting: Emphasizes accuracy and precision in financial reporting to ensure fair and reliable information for external stakeholders.

- Management Accounting: May prioritize timeliness and relevance over absolute accuracy, as the information is primarily intended for internal decision-making.

Focus:

- Financial Accounting: Focuses on the overall financial health and performance of the company. Reports typically include information about assets, liabilities, income, expenses, and shareholder equity.

- Management Accounting: Can focus on specific aspects of the business, such as product profitability, cost analysis, operational efficiency, and customer profitability. This information helps managers make informed decisions about specific areas of the business.

Conclusion:

Financial accounting and management accounting are complementary disciplines that play vital roles in the financial management of any organization. Understanding their key differences helps individuals choose the appropriate information and analysis for their specific needs and make informed decisions.