How do I change an employee from hourly to salary?

Changing an employee from an hourly wage to a salary involves a process that should be conducted thoughtfully and in compliance with labor laws. Here are the steps to consider and the key considerations in making this transition:

1. Review Employment Agreements and Laws:

- Start by reviewing the employee's current employment agreement or contract, as well as relevant labor laws and regulations in your jurisdiction. Ensure that changing an employee's pay structure is permissible and does not violate any employment contracts, collective bargaining agreements, or legal requirements.

2. Assess the Employee's Role:

- Evaluate the employee's role and responsibilities to determine if the transition from hourly to salary is appropriate. Salaried positions are typically associated with exempt status, which means the employee may not be eligible for overtime pay. Ensure the role meets the criteria for exempt status based on job duties and applicable laws.

3. Calculate the Salary:

- Determine the salary you will offer to the employee. This should be a negotiated amount based on factors such as market rates, the employee's skills and experience, and the budget of the organization. It should also meet or exceed the minimum salary threshold required for exempt status, as specified by labor laws (e.g., the Fair Labor Standards Act in the United States).

4. Communicate the Change:

- Schedule a meeting with the employee to discuss the transition. Clearly explain the reasons for the change, such as greater responsibility, commitment, or the desire for stability. Present the new salary offer and the effective date of the change.

5. Address Benefits and Terms:

- Discuss any changes in benefits, including paid time off, health insurance, retirement contributions, and other perks. Ensure that the employee fully understands the impact of the transition on their overall compensation package.

6. Prepare a Written Agreement:

- Document the changes in the employee's terms of employment in a written agreement or an updated employment contract. Include details about the new salary, exempt status, job responsibilities, and any other relevant terms. Both the employer and the employee should sign this agreement.

7. Comply with Notice and Legal Requirements:

- Adhere to any legal notice requirements or employment laws related to changing employment terms. For example, in some jurisdictions, there may be a notice period or other statutory requirements when making changes to employment terms.

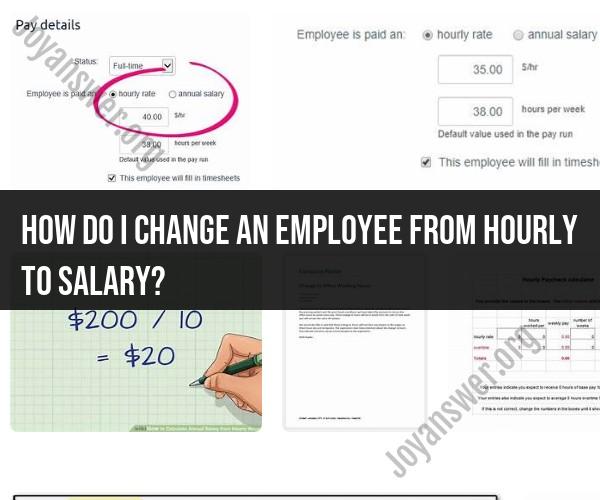

8. Update Payroll and Recordkeeping:

- Adjust your payroll system to reflect the employee's new salary. Ensure that timekeeping and recordkeeping practices comply with applicable labor laws. Payroll should accurately reflect the employee's exempt status and be prepared to manage salary payments accordingly.

9. Provide Training and Resources:

- If the employee will take on new responsibilities, offer any necessary training or resources to support their success in the role.

10. Maintain Communication:

- Continue to communicate with the employee regularly to ensure they are adjusting well to the new arrangement and address any questions or concerns they may have.

Remember that the specific process may vary depending on your organization, location, and applicable labor laws. It's essential to involve HR professionals or legal experts when making significant changes to an employee's compensation structure to ensure full compliance and transparency throughout the transition.

Switching from Hourly to Salary: How to Transition an Employee

Transitioning an employee from hourly to salary pay can be a complex process, but it can also be a rewarding one. By following these steps, you can ensure a smooth and successful transition:

- Communicate with the employee. The first step is to communicate with the employee about the transition. Explain why you are considering the change, and what the new salary and benefits package will be. Be sure to answer any questions the employee may have.

- Get the employee's consent. Once you have communicated with the employee, you need to get their consent to the transition. If the employee does not agree to the change, you will need to respect their decision.

- Update the employee's payroll records. Once you have the employee's consent, you need to update their payroll records. This includes changing their pay status from hourly to salary, and updating their salary and benefits information.

- Provide the employee with training. If the employee is new to salary pay, you may want to provide them with some training. This training can cover topics such as time management, budgeting, and benefits.

- Monitor the employee's performance. After the transition, it is important to monitor the employee's performance to ensure that they are meeting expectations. If the employee is not meeting expectations, you may need to provide them with additional support or training.

Employee Compensation Changes: Navigating the Hourly to Salary Shift

There are a few things to keep in mind when navigating the hourly to salary shift:

- Salary calculation. When calculating a salary for an hourly employee, you will need to consider their average hourly wage, as well as any benefits that you are offering. You may also want to consider the employee's experience and qualifications.

- Benefits package. When converting an employee to salary, you will need to decide what benefits package you will offer them. Salaried employees are typically eligible for benefits such as health insurance, paid time off, and retirement savings plans.

- Overtime pay. Salaried employees are not typically eligible for overtime pay. However, there are some exceptions to this rule. For example, salaried employees who work in certain industries may be eligible for overtime pay if they work more than 40 hours in a week.

HR Guidelines: Converting Employees from Hourly to Salaried Status

There are a few HR guidelines that you should be aware of when converting employees from hourly to salaried status:

- Fair Labor Standards Act (FLSA). The FLSA is a federal law that sets minimum wage and overtime pay requirements for employees. The FLSA also defines who is eligible for overtime pay.

- State laws. Some states have their own laws that govern employee compensation. Be sure to check your state laws to ensure that you are in compliance.

- Employee contracts. If the employee has an employment contract, you will need to review the contract to see if it contains any provisions related to salary or benefits.

By following these steps and guidelines, you can ensure a smooth and successful transition for employees switching from hourly to salary pay.