How to make a budget plan template?

Creating a budget plan template involves designing a document that outlines your financial goals, income, expenses, and savings. Here's a step-by-step guide to help you create a budget plan template:

Step 1: Identify Your Financial Goals

- List Your Financial Goals:

- Determine short-term and long-term financial goals such as saving for emergencies, paying off debt, or saving for a vacation.

Step 2: Gather Financial Information

Collect Income Information:

- List all sources of income, including your salary, bonuses, freelance work, or any other income streams.

Identify Expenses:

- Categorize your expenses into fixed (e.g., rent, mortgage) and variable (e.g., groceries, entertainment). Include bills, debt payments, and discretionary spending.

Step 3: Choose a Spreadsheet Software

- Select Spreadsheet Software:

- Use spreadsheet software like Microsoft Excel, Google Sheets, or another tool of your choice.

Step 4: Create a New Document

- Open a New Spreadsheet:

- Open a new document in your chosen spreadsheet software.

Step 5: Set Up Columns and Rows

Label Columns:

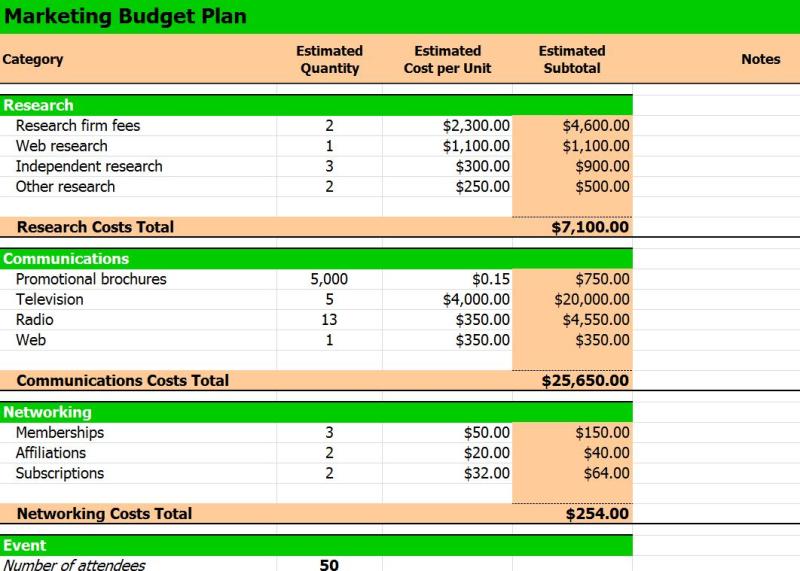

- Create columns for Income, Expenses, Categories, Planned Amount, Actual Amount, and Difference.

Label Rows:

- Label rows for each income source, expense category, and financial goal.

Step 6: Input Formulas

- Add Formulas for Calculations:

- Use formulas to calculate the total income, total expenses, and the difference between them.

Step 7: Set Budget Categories

- Define Categories:

- Create categories for different types of expenses such as housing, utilities, groceries, transportation, entertainment, and savings.

Step 8: Allocate Budget Amounts

- Allocate Budget Amounts:

- Assign planned amounts for each category based on your financial goals and priorities.

Step 9: Track Actual Spending

- Track Actual Spending:

- Regularly update the actual amounts spent in each category. This can be done weekly, bi-weekly, or monthly.

Step 10: Monitor and Adjust

- Review and Adjust:

- Regularly review your budget to see how closely your actual spending aligns with your planned budget. Adjust as needed based on changing circumstances.

Step 11: Include Savings Goals

- Add Savings Goals:

- Include sections for short-term and long-term savings goals. Allocate funds toward these goals within your budget.

Step 12: Format and Customize

- Format and Customize:

- Format the document for clarity and ease of use. Use colors, bold fonts, or other formatting options to highlight key information.

Step 13: Save and Update Regularly

- Save Your Template:

- Save your budget plan template on your computer or cloud storage. Create a backup for added security.

Tips:

Be Realistic: Ensure that your budget is realistic and aligns with your financial situation.

Track All Expenses: Include even small expenses to get an accurate picture of your spending habits.

Review Periodically: Regularly review and adjust your budget based on changes in income, expenses, or financial goals.

Use Budgeting Apps: Consider using budgeting apps that can automate some of the tracking processes.

Customize the template to suit your specific needs and financial situation. Regularly updating and sticking to your budget plan will help you manage your finances effectively.

1. Creating a Budget Plan Template:

A budget plan template is a customizable framework that helps you organize, track, and manage your income and expenses effectively. It provides a structured approach to creating a realistic financial plan that aligns with your financial goals.

Steps to Create a Budget Plan Template:

Define Your Financial Goals: Start by identifying your short-term and long-term financial objectives. This could include saving for a down payment on a house, paying off debt, or achieving a specific savings target.

Estimate Your Income: Gather your income statements, pay stubs, and any other relevant documents to determine your total monthly income. This includes your salary, wages, bonuses, investment earnings, and any other forms of regular income.

Categorize Expenses: List down all your expenses, including both fixed and variable expenses. Fixed expenses are recurring and predictable, such as rent, mortgage payments, car payments, and utilities. Variable expenses can fluctuate from month to month, such as groceries, transportation, entertainment, and dining out.

Assign Expense Amounts: Estimate the average monthly amount you spend on each expense category. Use past expenses as a reference and consider any upcoming changes or adjustments.

Calculate Your Budget Surplus or Deficit: Subtract your total expenses from your total income. If the result is positive, you have a surplus, which can be allocated towards savings or debt repayment. If the result is negative, you have a deficit, and you'll need to adjust your expenses or find ways to increase your income.

Review and Adjust: Regularly review your budget and make adjustments as needed. Your financial situation and priorities may change over time, so it's important to keep your budget flexible and adaptable.

2. Components of a Comprehensive Budget Plan Template:

A comprehensive budget plan template should include the following components:

Income Breakdown: A section to list and track all sources of income, including salaries, wages, bonuses, investment earnings, and any other forms of regular income.

Expense Categories: A breakdown of expenses into categories, such as housing, transportation, groceries, utilities, personal care, entertainment, and debt payments.

Monthly Expense Tracking: A table or spreadsheet to track expenses for each category on a monthly basis.

Budget Surplus or Deficit Calculation: A section to calculate the difference between total income and total expenses, indicating whether there's a surplus or deficit.

Financial Goals Tracking: A section to track progress towards financial goals, such as savings targets, debt repayment goals, and investment performance.

Notes and Adjustments: A space for additional notes, adjustments, or any other relevant information related to your budget.

3. Online Resources and Templates for Budget Planning:

Several online resources and templates are available for budget planning. Here are a few popular options:

Mint: A comprehensive personal finance app that provides a budgeting tool, expense tracking, and financial goal setting features.

Personal Capital: A free online financial management tool that offers a budgeting dashboard, cash flow tracking, and investment analysis capabilities.

Google Sheets Budget Template: A free Excel-like spreadsheet template that allows you to customize and manage your budget.

Microsoft Office Budget Templates: A collection of pre-designed budget templates for various purposes, such as personal, business, or project-specific budgeting.

NerdWallet Budget Template: A customizable budget worksheet that includes instructions, formulas, and charts for effective budgeting.