What stocks have the biggest dividends?

The stocks with the highest dividend yields can change over time and are influenced by various factors, including company performance, economic conditions, and interest rates. However, it's important to note that the stock market is dynamic, and the landscape can change. Here are a few examples:

Real Estate Investment Trusts (REITs): Many REITs are known for offering high dividend yields because they are required to distribute a significant portion of their income to shareholders to maintain their tax-advantaged status. Examples include Annaly Capital Management (NLY) and AGNC Investment Corp. (AGNC).

Energy Companies: Some energy companies, especially in the oil and gas sector, historically had high dividend yields. ExxonMobil (XOM) and Chevron Corporation (CVX) were examples, although the energy sector can be volatile.

Telecommunication Companies: Certain telecom companies are known for providing stable dividends. AT&T (T) and Verizon Communications (VZ) are examples.

Utilities: Utilities are often considered defensive stocks, and some offer relatively high dividend yields. Companies like Duke Energy (DUK) and Southern Company (SO) are known for their dividends.

Consumer Staples: Companies in the consumer staples sector, such as Procter & Gamble (PG) and Coca-Cola (KO), often provide steady dividends.

Pharmaceutical Companies: Some pharmaceutical companies, like Pfizer (PFE) and Johnson & Johnson (JNJ), have a history of paying competitive dividends.

Please keep in mind that the dividend landscape can change due to economic and market conditions. It's essential to conduct up-to-date research and consider the financial health and outlook of the companies before investing in stocks based solely on their dividend yields. Additionally, high dividend yields may indicate financial distress or other risks, so a balanced approach to stock selection and diversification is advisable when building an investment portfolio. Consulting with a financial advisor or conducting thorough research is recommended before making investment decisions.

Exploring Stocks with High Dividend Yields

Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders in the form of cash payments. Dividend investing involves building a portfolio of stocks with high dividend yields to generate a steady stream of income.

Dividend Investing: Strategies for Maximizing Your Earnings

Dividend investing can be an effective strategy for generating long-term income, but it requires careful planning and execution. Here are some key strategies to consider:

Identify Dividend-Paying Companies: Research companies that have a history of paying consistent dividends and have a strong financial track record.

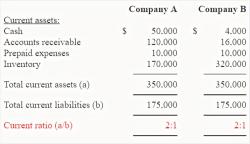

Evaluate Dividend Yield: Dividend yield is the annual dividend payment per share divided by the current share price. A high dividend yield indicates a higher return on investment, but it's important to consider the company's overall financial health and growth prospects.

Consider Dividend Payout Ratio: The dividend payout ratio is the percentage of a company's earnings that it pays out as dividends. A high payout ratio may indicate that the company is returning a significant portion of its profits to shareholders, but it's also important to ensure that the company is retaining enough earnings to continue growing its business.

Analyze Dividend Growth: Companies that consistently increase their dividends are attractive to dividend investors. Look for companies with a history of dividend growth and a strong track record of profitability.

Diversify Your Portfolio: Invest in a variety of dividend-paying companies from different industries and sectors to reduce risk and enhance overall portfolio stability.

Factors to Consider When Choosing Stocks with High Dividends

When selecting stocks with high dividends, consider the following factors:

Company Financials: Evaluate the company's financial health, including its debt-to-equity ratio, earnings growth rate, and cash flow. A strong financial position indicates the company's ability to continue paying dividends.

Industry Trends: Analyze the industry in which the company operates. Companies in stable and growing industries are more likely to maintain consistent dividend payments.

Dividend History: Look for companies with a long history of paying dividends. A consistent dividend record indicates the company's commitment to shareholder returns.

Future Growth Prospects: Consider the company's potential for future growth. Companies with strong growth prospects are more likely to increase their dividends over time.

Management Track Record: Evaluate the management team's experience and track record in managing the company and allocating capital. A strong management team is crucial for maintaining financial discipline and ensuring dividend payments.

Analyzing the Risks Associated with High Dividend Stocks

While dividend investing can be a rewarding strategy, it's important to understand the associated risks:

Dividend Cuts: Companies may reduce or eliminate their dividends if they encounter financial difficulties.

Market Volatility: Dividend stocks are not immune to market fluctuations. Share prices can decline, affecting the overall value of your investment.

Interest Rate Sensitivity: Dividend stocks may become less attractive when interest rates rise, as investors can earn higher returns from safer investments like bonds.

Reinvestment Risk: Dividend reinvestment plans (DRIPs) automatically reinvest dividends into additional shares, but this can increase your exposure to market volatility.

Tax Implications: Dividend payments are considered taxable income, which can impact your overall tax liability.

Creating a Diversified Dividend Portfolio for Long-Term Income

To build a diversified dividend portfolio for long-term income, consider the following steps:

Define Your Investment Goals: Determine your desired income stream and risk tolerance.

Research and Analyze Companies: Carefully evaluate potential investments based on factors like financials, industry trends, dividend history, and growth prospects.

Allocate Assets: Distribute your investments across a variety of dividend-paying companies from different industries and sectors.

Rebalance Regularly: Review your portfolio periodically and rebalance as needed to maintain your desired asset allocation.

Seek Professional Guidance: Consult with a financial advisor if you need assistance in building and managing a diversified dividend portfolio.

Remember, dividend investing is a long-term strategy that requires patience and discipline. By carefully selecting dividend-paying companies, diversifying your portfolio, and managing risk, you can potentially generate a steady stream of income from your investments.