What are the learning objectives of the Financial Statement Analysis Course?

Navigating a financial statement analysis course involves understanding the course content, objectives, and key concepts related to analyzing financial statements to make informed business decisions. Here's an overview of what you might encounter in such a course:

Course Overview:A financial statement analysis course is designed to equip students with the skills to interpret and analyze financial statements, such as balance sheets, income statements, and cash flow statements. The course focuses on assessing a company's financial performance, profitability, liquidity, and solvency. It's beneficial for individuals pursuing careers in finance, accounting, investing, and corporate management.

Learning Objectives:

Understanding Financial Statements: Learn to read and interpret financial statements to extract relevant information about a company's financial position and performance.

Financial Ratios: Understand how to calculate and interpret various financial ratios that provide insights into a company's liquidity, efficiency, profitability, and leverage.

Profitability Analysis: Analyze a company's profitability by examining key metrics like gross profit margin, operating profit margin, and net profit margin.

Liquidity and Solvency: Evaluate a company's ability to meet short-term and long-term obligations by assessing liquidity ratios (current ratio, quick ratio) and solvency ratios (debt-to-equity ratio, interest coverage ratio).

Cash Flow Analysis: Understand the importance of cash flows and analyze a company's cash flow statement to assess its ability to generate and manage cash.

Financial Statement Adjustments: Learn how to make adjustments to financial statements to enhance comparability and accuracy, such as adjusting for non-recurring items.

Industry and Peer Analysis: Compare a company's financial performance to industry averages and peer companies to identify strengths and weaknesses.

Forecasting and Valuation: Gain insights into forecasting future financial performance and using financial statement analysis for valuation purposes.

Course Content:The course might cover the following topics:

- Introduction to financial statement analysis and its importance.

- Overview of financial statements: balance sheet, income statement, cash flow statement.

- Calculating and interpreting financial ratios.

- Analyzing liquidity, efficiency, profitability, and solvency.

- Understanding the DuPont analysis for assessing return on equity.

- Cash flow analysis and the importance of free cash flow.

- Evaluating working capital management and capital structure decisions.

- Forecasting financial statements and using them for valuation.

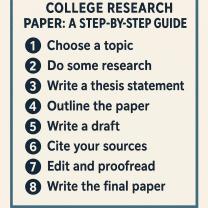

Assessment:You'll likely be assessed through assignments, quizzes, exams, and perhaps a final project where you analyze the financial statements of a real company.

Practical Applications:The skills acquired in this course are applicable in various careers, including financial analysis, investment banking, corporate finance, consulting, and entrepreneurship. You'll be able to analyze companies, assess risks, and make informed financial decisions.

Additional Resources:To excel in the course, you might use textbooks, online resources, financial software, and real financial statements for analysis practice.

Remember that course specifics can vary by institution, and the information provided here is a general overview. To get accurate information about a specific financial statement analysis course, refer to your course syllabus, materials, and your instructor's guidance.