How do you calculate a teacher pension?

Calculating a teacher pension is a multi-step process that involves various factors, including the teacher's years of service, salary history, and the specific pension formula used by the teacher's retirement system. Teacher pension systems can vary by state and jurisdiction, so the exact calculations may differ. Below is a general guide outlining the key steps involved in calculating a teacher pension:

Step 1: Determine Eligibility

- Years of Service:

- Verify the minimum years of service required to qualify for a pension. This is often referred to as the vesting period, and it varies by retirement system.

Step 2: Gather Salary Information

- Final Average Salary:

- Determine the teacher's final average salary (FAS). FAS is typically calculated based on the average salary over a certain number of years, often the highest consecutive three to five years of earnings.

Step 3: Understand the Pension Formula

- Pension Formula:

- Each pension system has its own formula for calculating the pension amount. Common formulas include:

- Defined Benefit Plan: This formula may involve multiplying the FAS by a percentage based on the number of years of service.

- Years of Service Credit: Pension benefits often accrue based on years of service credit. For example, a formula might be: (Percentage of FAS) x (Years of Service) x (Service Credit Factor).

- Each pension system has its own formula for calculating the pension amount. Common formulas include:

Step 4: Apply the Pension Formula

- Calculate Annual Pension:

- Use the pension formula to calculate the annual pension benefit. This is the amount the retiree will receive each year in retirement.

Step 5: Consider Additional Factors

Cost-of-Living Adjustments (COLA):

- Some pension plans provide cost-of-living adjustments to pensions to account for inflation. Understand how and when COLAs are applied.

Spousal Benefits:

- Consider whether the pension plan provides spousal benefits, such as joint and survivor options, which may reduce the pension amount but provide continued benefits for a surviving spouse.

Example Calculation:

As an example, let's consider a simplified formula for a defined benefit pension plan:

- FAS: $60,000

- Years of Service: 25

- Service Credit Factor: 2.0%

- Pension Factor: 1.5%

In this example, the teacher's annual pension would be $22,500.

Note:

Some pension systems may have additional factors, such as age at retirement, early retirement penalties, and other adjustments that can impact the final pension calculation.

The specific details of the pension plan, including the formula and rules, should be obtained from the teacher's retirement system or plan administrator.

It's important for teachers to familiarize themselves with the specific rules and calculations of their retirement system, and if needed, consult with the retirement system representatives for personalized guidance. Teachers should also be aware of any changes to pension rules and regularly review their retirement plan details.

Calculating a teacher's pension involves several factors, including their years of service, average salary, and the pension multiplier or formula used by their state or retirement plan. The specific calculation method may vary depending on the region, but the general principles remain consistent.

1. Formula for Calculating Teacher Pension

The most common formula for calculating a teacher's pension is:

Pension = Years of Service × Average Salary × Pension Multiplier

Where:

Years of Service: The total number of years a teacher has worked in a qualifying teaching position.

Average Salary: The average of a teacher's highest-earning years, typically the last 3 or 5 years of their career.

Pension Multiplier: A factor determined by the state or retirement plan, usually ranging from 1.5% to 2.5%.

2. Factors Contributing to Pension Amount

The following factors significantly influence the amount of a teacher's pension:

Years of Service: The longer a teacher works, the higher their pension will be.

Average Salary: Teachers with higher salaries will receive a higher pension.

Pension Multiplier: The value of the pension multiplier affects the proportional increase in pension benefits based on years of service and average salary.

Early Retirement: Early retirement may reduce the overall pension amount due to fewer years of service and a lower average salary.

State or Retirement Plan: Different states and retirement plans may have varying pension formulas, multipliers, and eligibility requirements.

3. Variations in Pension Calculation Methods

While the general formula for calculating teacher pensions remains consistent, there are variations in specific methods and factors used by different regions. Some states or retirement plans may consider additional factors such as:

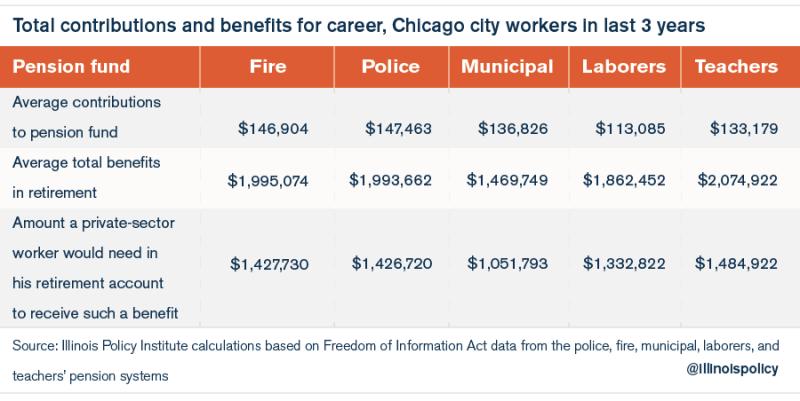

Contributions made by the teacher and employer

Cost-of-living adjustments

Disability benefits

Survivor benefits

It's important for teachers to familiarize themselves with the specific pension calculation method applicable to their state or retirement plan to accurately estimate their future retirement benefits.