What kind of economics does Steve kornholt teach?

Here’s a clear answer regarding Steve Kornholt’s teaching focus in economics:

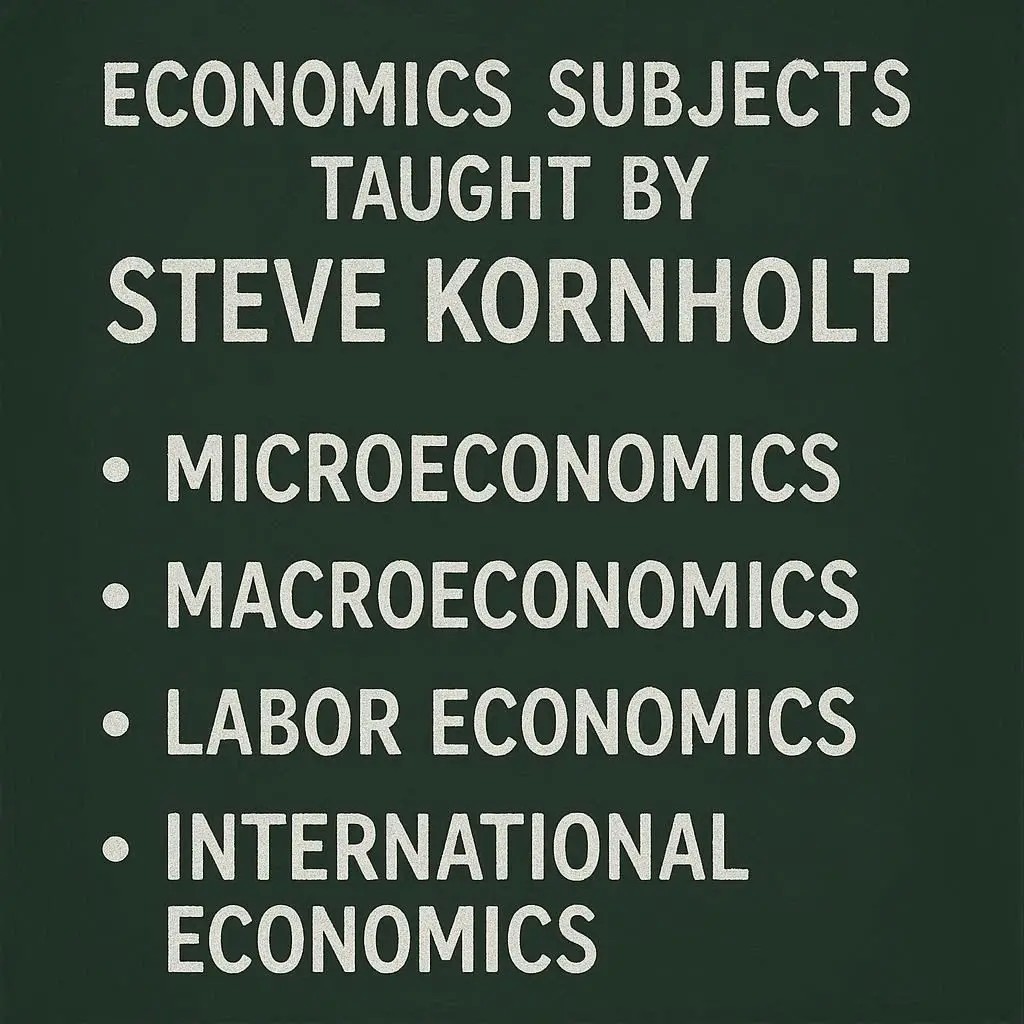

Economics Subjects Taught by Steve Kornholt

Steve Kornholt specializes in modern microeconomics and macroeconomics, covering topics such as:

Principles of Microeconomics – supply and demand, market structures, consumer behavior, production, and cost analysis.

Principles of Macroeconomics – GDP, inflation, unemployment, fiscal and monetary policy, and economic growth.

Applied Economics – practical applications in business, finance, and public policy.

Economic Analysis Tools – graphs, models, and real-world data interpretation.

Summary:

Steve Kornholt focuses on providing students with a strong foundation in both micro and macroeconomics, with an emphasis on practical, real-world applications.

Here’s a visual chart-style breakdown of the economics subjects taught by Steve Kornholt:

Steve Kornholt – Economics Subjects Overview

| Category | Topics Covered | Focus |

|---|---|---|

| Microeconomics | Supply & demand, market structures, consumer behavior, production & costs | Understanding individual markets & firms |

| Macroeconomics | GDP, inflation, unemployment, fiscal & monetary policy, economic growth | Studying the economy as a whole |

| Applied Economics | Business decisions, finance applications, public policy | Real-world economic problem solving |

| Economic Analysis Tools | Graphs, models, statistical data interpretation | Analytical skills for economic reasoning |

Summary:

Steve Kornholt’s courses provide a comprehensive foundation in micro and macroeconomics, reinforced with applied examples and analytical tools to prepare students for real-world economic challenges.

You may be looking for information about Hyman Minsky, a key figure in post-Keynesian economics, as there are no prominent economists named Steve Kornholt with a similar economic theory. Minsky's work is centered on the inherent financial instability of capitalist economies.

1. Hyman Minsky's Economic Theories and Criticisms

Hyman Minsky's economic theories are part of the post-Keynesian school of thought. His work is primarily known for its focus on the financial system's role in causing economic instability, a perspective often ignored by mainstream neoclassical economics.

2. Post-Keynesian Economics and Its Relation to Minsky's Work

Post-Keynesian economics is a school of thought that builds on and remains closer to the original ideas of John Maynard Keynes than other schools, like the New Keynesian approach.

The principle of effective demand: It's a key determinant of economic activity in both the short and long run.

Fundamental uncertainty: The future is unknowable, which leads to liquidity preference (the desire to hold cash) and "animal spirits" (investor confidence).

The monetary production economy: The economy is a system of cash flows, not a barter system.

Minsky's work is central to the post-Keynesian understanding of financial markets. He took Keynes's ideas on uncertainty and liquidity preference a step further by creating a framework that explains how these concepts lead to systemic financial crises.

3. The "Financial Instability Hypothesis"

Minsky's most significant contribution is the financial instability hypothesis (FIH).

Hedge Finance: The most conservative stage. Borrowers' cash flows are sufficient to cover both the principal and interest payments on their debt.

Speculative Finance: Borrowers' cash flows can cover interest payments, but they must borrow or roll over debt to pay off the principal.

Ponzi Finance: The most fragile stage. Borrowers' cash flows cannot cover even the interest payments, so they must borrow more to make both interest and principal payments.

This is unsustainable and requires a constant rise in asset values.

As the economy progresses from hedge to Ponzi finance, the financial system becomes increasingly fragile.

4. How Minsky's Economic Perspective Differs from Neoclassical Economics

Minsky's perspective fundamentally differs from neoclassical economics, which largely dominates mainstream economic thought.

Financial System: Neoclassical models often treat the financial system as a neutral "veil" that simply facilitates transactions. Minsky, in contrast, argues that the financial system is an active and dynamic force that is inherently prone to instability and is a primary driver of the business cycle.

Equilibrium: Neoclassical economics is based on the concept of general equilibrium, where markets self-correct and tend toward a stable, full-employment equilibrium. Minsky's FIH explicitly rejects this, arguing that the economy is a deviation-amplifying system that moves away from equilibrium.

Shocks: Mainstream models often attribute business cycles to external shocks (e.g., changes in technology or oil prices). Minsky's theory, however, explains that the business cycle is an inherent feature of a capitalist economy and is driven by internal dynamics, particularly the financial system's evolution.

5. Books Written by Hyman Minsky

While Minsky wrote numerous influential papers, his key ideas are detailed in his books, including:

John Maynard Keynes (1975): A biography of Keynes that provides insight into Minsky's own interpretation of Keynesian theory.

Can "It" Happen Again?: Essays on Instability and Finance (1982): A collection of essays that further develops his financial instability hypothesis.

Stabilizing an Unstable Economy (1986): Considered his most important work, where he synthesizes his theories into a comprehensive framework for understanding and managing economic instability.

A great way to learn about the FIH is by watching this video, as it explains the three stages of Minsky's model in a very clear way.

Minsky's Financial Instability Hypothesis I A Level and IB Economics - YouTube