Tax Considerations for Gross-Up Payments: What You Need to Know

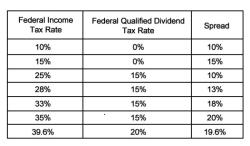

Explore the tax implications of gross-up payments and understand their taxable nature. Get clarity on how gross-up payments are treated from a taxation perspective.

Read more

Explore the tax implications of gross-up payments and understand their taxable nature. Get clarity on how gross-up payments are treated from a taxation perspective.

Read more

Learn about the tax implications of gross-up payments and whether they are taxable. Gain insight into how gross-up amounts may affect your tax obligations.

Read more

Learn about the tax implications of MUB (iShares National Muni Bond ETF) dividends and how they are treated for tax purposes.

Read more

Understand when and how taxes are due on Series EE Savings Bonds, helping you navigate your financial obligations.

Read more

Learn about the exemption status of municipal bonds from the Alternative Minimum Tax (AMT) and its implications for investors.

Read more

Learn about the tax considerations and implications of selling lottery payments for a lump sum, including potential tax liabilities and strategies for minimizing them.

Read more

Explore the state tax policies in Louisiana, including income taxes and other relevant information for taxpayers.

Read more

Gain insights into whether an early retirement withdrawal is considered taxable income. Learn about potential tax liabilities and exceptions related to early withdrawal penalties.

Read more

Explore the concept of stamp duty on insurance policies and its impact on financial transactions.

Read more

Clarify the distinction between stamp duty and penalties, highlighting their respective roles in taxation and legal consequences.

Read more

Explore the various types of legal instruments on which stamp duty is leviable, providing a comprehensive overview of taxation regulations.

Read more

September 4, 2025

August 30, 2025

June 21, 2024

September 21, 2025

September 17, 2025

September 16, 2025

January 24, 2024

January 11, 2024