How do managers use accounting for decision making?

Accounting plays a critical strategic role in decision-making within organizations. It provides managers with essential financial information and insights that guide various aspects of the business. Here are insights into the strategic role of accounting in decision-making for managers:

1. Financial Planning and Budgeting:

- Accounting helps managers set financial goals and create budgets. It provides historical financial data that can be used to forecast future income, expenses, and cash flows.

2. Cost Control and Management:

- Managers use accounting data to analyze costs associated with different aspects of the business. This information helps in identifying cost-saving opportunities and optimizing resource allocation.

3. Investment Decisions:

- Accounting provides information on the financial health of the organization. Managers rely on financial statements, ratios, and projections to make informed decisions about investments in new projects, equipment, or acquisitions.

4. Pricing Strategies:

- Accounting data informs pricing decisions. Managers need to consider costs, competition, and market demand when setting product or service prices.

5. Performance Evaluation:

- Accounting enables managers to assess the performance of various departments, projects, or teams. Key performance indicators (KPIs) are often derived from financial data to evaluate efficiency and effectiveness.

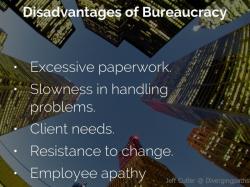

6. Risk Management:

- Financial risk assessment is an integral part of decision-making. Managers use accounting information to identify potential financial risks and develop strategies to mitigate them.

7. Resource Allocation:

- Accounting helps in allocating resources efficiently. Managers can prioritize investments, allocate funds to different departments, and make decisions regarding hiring, training, and capital expenditures based on financial data.

8. Strategic Planning:

- Accounting information feeds into strategic planning. It provides insights into the financial implications of various strategic options, helping organizations choose the most viable path forward.

9. Tax Planning and Compliance:

- Managers use accounting to ensure compliance with tax regulations and to optimize tax strategies. Accounting helps in tracking income, expenses, and deductions accurately.

10. Performance Measurement and Benchmarking:- Accounting data allows managers to measure their organization's financial performance over time. Benchmarking against industry standards or competitors can help identify areas for improvement.

11. Investor and Stakeholder Relations:- For publicly traded companies, accounting data is crucial for building trust with investors and stakeholders. Transparent and accurate financial reporting is essential for maintaining credibility.

12. Cash Flow Management:- Managers closely monitor cash flow statements to ensure the organization has sufficient liquidity to meet short-term obligations and fund operations.

13. Compliance and Ethics:- Accounting systems and practices must adhere to ethical standards and regulatory requirements. Managers must ensure that financial reporting is accurate, transparent, and complies with accounting standards.

14. Decision-Making Support:- Ultimately, accounting provides managers with reliable data and analysis to support informed decision-making. It helps in evaluating the financial impact of various options and making choices that align with the organization's goals and objectives.

In summary, accounting is not just a record-keeping function; it is a strategic tool that empowers managers to make informed decisions that drive the financial success and sustainability of their organizations. Accounting information is essential for planning, control, evaluation, and strategic thinking across all levels of management.