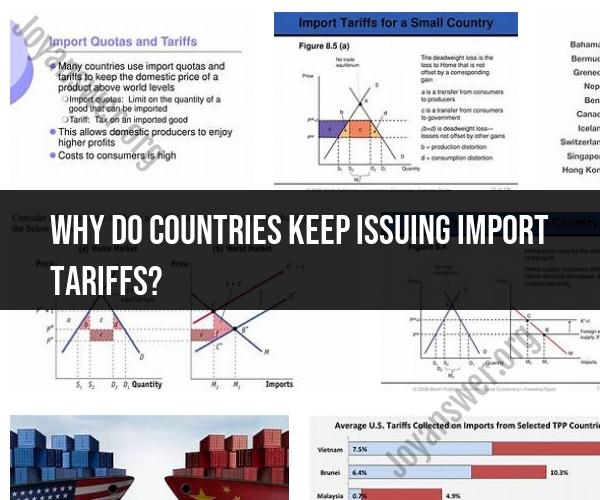

Why do countries keep issuing import tariffs?

Countries may issue import tariffs, which are taxes or duties imposed on imported goods, for various economic and strategic reasons. Here are some common reasons why countries implement import tariffs:

Protecting Domestic Industries: One of the primary reasons for imposing tariffs is to protect domestic industries from foreign competition. By making imported goods more expensive through tariffs, domestic industries can remain competitive and continue to produce goods locally. This protection is often applied to industries deemed essential for national security or economic stability.

Promoting Domestic Employment: Tariffs can help preserve or create jobs within a country by shielding domestic producers from foreign competition. When domestic industries thrive, they tend to hire more workers and support employment in related sectors, such as transportation and manufacturing.

Generating Government Revenue: Import tariffs are a source of government revenue. The revenue collected from tariffs can be used to fund public services, infrastructure projects, and various government initiatives.

Balancing Trade Deficits: Some countries use tariffs as a tool to address trade imbalances. By imposing tariffs on imports from countries with which they have trade deficits, they aim to reduce the trade gap and protect their own industries.

Encouraging Investment: Tariffs can encourage foreign companies to establish local operations or invest in domestic industries. This can lead to technology transfer, job creation, and increased economic activity within the country.

Countering Dumping: Tariffs are sometimes used to combat the practice of "dumping," in which foreign producers sell goods in a foreign market at prices lower than their production costs or the prices they charge in their home market. Anti-dumping tariffs can protect domestic industries from unfair competition.

Protecting Health and Safety: Import tariffs can be applied to ensure that imported products meet domestic health and safety standards. This helps safeguard consumers and domestic industries from potentially unsafe or substandard goods.

Environmental Concerns: Tariffs may be imposed on products that do not meet environmental standards or practices, encouraging the adoption of environmentally friendly production methods and products.

Strategic Trade Policy: Governments may use tariffs as part of a broader trade policy to achieve strategic objectives, such as fostering certain industries, negotiating trade agreements, or influencing the behavior of trading partners.

Retaliation: In response to tariffs imposed by another country, a nation may implement retaliatory tariffs on the products of that country. This tit-for-tat approach can lead to trade disputes and negotiations.

National Security: Import tariffs can be implemented to protect industries that are considered vital to national security, such as defense-related manufacturing or critical infrastructure.

It's important to note that while tariffs can achieve these objectives, they can also have negative consequences, such as higher consumer prices, reduced international trade, and potential retaliatory actions from trading partners. The use of tariffs is often a complex and contentious issue, and governments must carefully consider the economic and diplomatic implications of their tariff policies.

The persistence of import tariffs is a complex issue with a variety of factors contributing to their continuation. Some of the most common reasons include:

- Protecting domestic industries from foreign competition: Tariffs can make imported goods more expensive, giving domestic producers a competitive advantage. This can help to protect domestic jobs and investment.

- Generating revenue for the government: Tariffs can be a significant source of revenue for governments. This revenue can be used to fund government programs and services.

- Retaliating against other countries' trade policies: When one country imposes tariffs on another country's goods, the second country may retaliate by imposing tariffs on the first country's goods. This can lead to a trade war, which can harm both economies.

- Promoting national security interests: Tariffs can be used to protect certain industries that are considered to be essential to national security, such as the defense industry.

- Achieving social or environmental goals: Tariffs can be used to promote social or environmental goals, such as protecting domestic workers from unfair labor practices or reducing carbon emissions.

It is important to note that the use of import tariffs is not without controversy. Some economists argue that tariffs are harmful to the economy as they can lead to higher prices for consumers and businesses. They also argue that tariffs can reduce trade and investment, which can harm both the domestic economy and the global economy.

However, governments continue to use import tariffs for a variety of reasons. In some cases, the benefits of tariffs may outweigh the costs. For example, if a tariff helps to protect a domestic industry that is considered to be essential to national security, the government may be willing to accept the higher prices that consumers and businesses pay.

In other cases, governments may use tariffs as a bargaining chip in trade negotiations. For example, a country may impose tariffs on another country's goods in order to pressure that country to lower its own tariffs.

Overall, the persistence of import tariffs is due to a variety of factors. Governments weigh the costs and benefits of tariffs carefully before deciding whether or not to impose them.