What benefits does New York Life offer?

New York Life, a leading life insurance company in the United States, provides a comprehensive package of employee benefits. However, the specific details of these benefits can vary based on factors such as job position, location, and individual circumstances. It's essential to check with the company directly or refer to the latest information available on their official website or through their HR department for the most up-to-date and accurate details. That said, here are some common employee benefits that companies like New York Life often offer:

Health Insurance: Coverage for medical, dental, and vision care to help employees maintain their health and well-being.

Life Insurance: As a life insurance company, New York Life may provide life insurance coverage for employees, which could include basic life insurance and options for additional coverage.

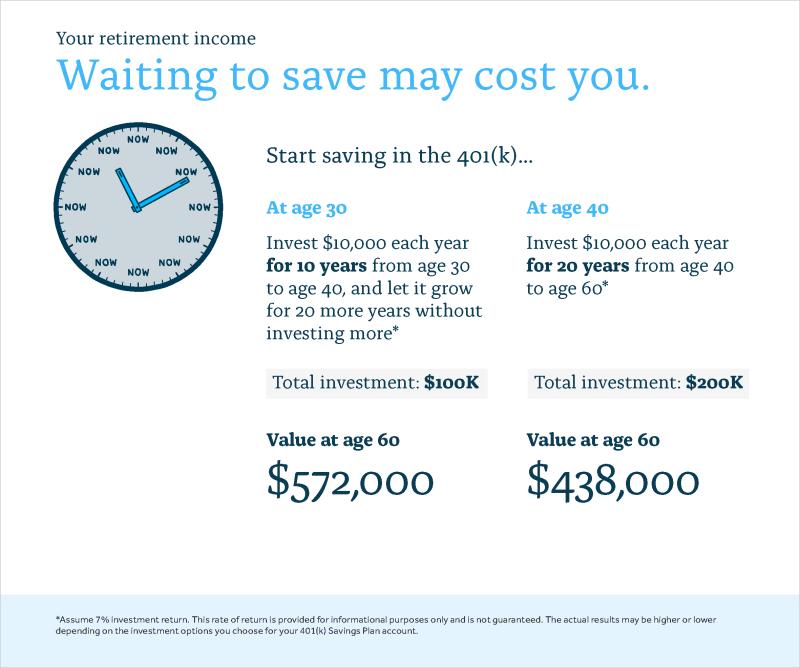

Retirement Plans: Options such as a 401(k) plan to help employees save for their retirement with possible employer contributions or matching.

Paid Time Off (PTO): Vacation days, holidays, and sick leave to support work-life balance and overall well-being.

Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs): Pre-tax accounts that allow employees to set aside funds for eligible medical expenses.

Employee Assistance Program (EAP): Counseling and support services for employees and their families to address personal or work-related challenges.

Tuition Assistance or Professional Development: Programs that support employees in continuing their education or developing new skills relevant to their job.

Wellness Programs: Initiatives to promote employee health and well-being, which may include fitness programs, wellness challenges, and resources for a healthy lifestyle.

Commuter Benefits: Assistance with commuting costs, such as pre-tax contributions for public transportation or parking expenses.

Employee Discounts: Discounts on company products and services or partnerships with external businesses.

Family and Parental Leave: Support for employees who need time off for family-related reasons, including the birth or adoption of a child.

Keep in mind that benefit offerings can change, and the specifics may vary. Employees are encouraged to review the latest benefits information provided by New York Life or consult with their HR department for the most accurate details related to their employment.

What are the various benefits offered by New York Life?

New York Life offers a wide range of benefits to its employees, including:

Healthcare:

- Medical, dental, and vision insurance

- Health and wellness programs

- Flexible spending accounts (FSAs)

- Health advocacy services

Financial Security:

- Competitive salary and bonus structure

- 401(k) savings plan with company match

- Pension plan (for eligible employees)

- Disability insurance

- Life insurance

Work-Life Balance:

- Paid time off (PTO)

- Vacation and sick leave

- Paid parental leave

- Flexible work arrangements

- Employee assistance program (EAP)

Additional Benefits:

- Tuition reimbursement

- Employee discounts

- On-site amenities

- Professional development opportunities

- Opportunities to volunteer in the community

Here's a breakdown of the different categories of benefits offered by New York Life:

Benefits for Employees:

- Medical Coverage: New York Life offers several medical plan options to choose from, all of which cover a wide range of services.

- Dental Coverage: New York Life's dental plan provides coverage for preventive care, basic restorative services, and major dental procedures.

- Vision Coverage: New York Life's vision plan provides coverage for routine eye exams, eyeglasses, and contact lenses.

- Spending Accounts: Employees can contribute pre-tax dollars to FSAs to cover qualified medical, dental, and vision expenses.

- Pension Plan: Eligible employees participate in a defined benefit pension plan, which provides a guaranteed monthly benefit at retirement.

- 401(k) Savings Plan: New York Life offers a 401(k) savings plan with a company match, allowing employees to save for retirement on a pre-tax basis.

- Income Protection: New York Life provides group life insurance and disability insurance to help protect employees' income in the event of death or disability.

Benefits for Group Insurance:

- Group term life insurance: This provides a death benefit to the employee's beneficiaries.

- Group disability insurance: This provides income protection to the employee if they are unable to work due to a disability.

- Group accident insurance: This provides coverage for accidental death and dismemberment.

- Group dental insurance: This provides coverage for dental care.

- Group vision insurance: This provides coverage for vision care.

Additional Benefits:

- Absence Assist: This program helps employees manage their absences and return to work as soon as possible.

- NYL GBS Life Assistance Program (LAP): This program provides confidential counseling and support services to employees and their families.

- NYL GBS Secure Travel: This program provides medical and security assistance to employees traveling on business.

It's important to note that the specific benefits offered may vary depending on the employee's job location, position, and other factors. Employees should refer to their benefits enrollment materials or contact their HR representative for more information about the benefits available to them.

Please let me know if you have any other questions about the benefits offered by New York Life.