Can a bond have a negative yield?

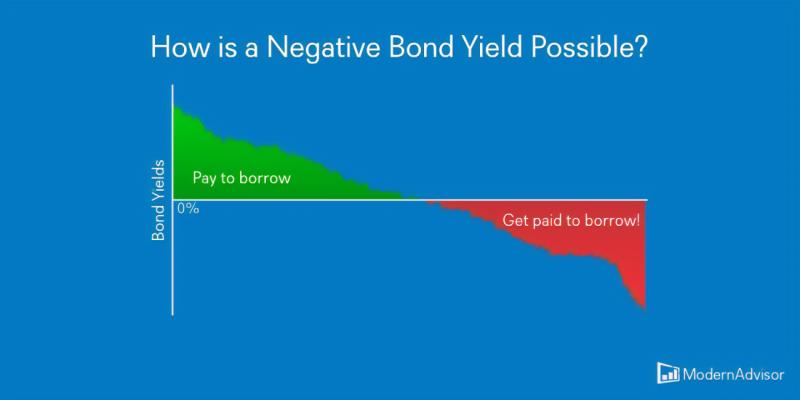

Yes, it is possible for a bond to have a negative yield, and this situation is known as a negative yield or negative yield to maturity (YTM). The yield on a bond is a measure of the return an investor can expect to receive if they hold the bond until it matures. The yield is expressed as a percentage of the bond's face value.

Here are a few scenarios in which a bond might have a negative yield:

High Demand for Safe Assets:

- During periods of economic uncertainty or financial crises, investors often seek safe-haven assets. Government bonds, especially those issued by financially stable countries, are considered safe. High demand for these bonds can drive prices up and yields down, possibly leading to negative yields.

Central Bank Policies:

- Central banks, in an effort to stimulate economic activity or combat deflation, may implement monetary policies that result in extremely low or negative interest rates. In such environments, yields on bonds, including government bonds, may turn negative.

Market Expectations:

- If investors anticipate that interest rates will fall even further, they may be willing to accept negative yields on bonds in the expectation that they can sell the bonds at an even higher price in the future.

Inflation-Adjusted Yields:

- In some cases, negative nominal yields may still represent positive real yields when adjusted for inflation. This can occur when investors expect inflation to erode the purchasing power of money, and they are willing to accept a nominal loss in return for the preservation of real value.

Negative yields can present challenges for investors, especially those who rely on fixed-income investments for income. In a negative yield environment, investors are essentially paying for the perceived safety of holding certain bonds.

It's important to note that while negative yields on government bonds have occurred in various countries, the concept of negative yields challenges traditional assumptions about the time value of money and the idea that an investment should provide a positive return for the risk taken. Investors should carefully consider the economic and financial conditions, as well as their own investment goals and risk tolerance, when evaluating bonds with negative yields.

Can a bond have a negative yield, and what does it indicate?

Yes, a bond can have a negative yield. This means that an investor who buys the bond will receive less money in interest payments and principal than they paid for it.

A negative bond yield can indicate a number of things, including:

- Investors are willing to accept a guaranteed loss in order to preserve their capital. This can happen during times of economic uncertainty or financial crisis.

- Central banks are using negative interest rates to stimulate the economy. This can make it more expensive to hold cash and encourage investors to buy other assets, such as bonds.

- Investors are betting that interest rates will fall in the future. This means that they are willing to buy bonds at a premium now, knowing that they will be able to sell them for a profit later.

How does negative bond yield impact investors and financial markets?

Negative bond yields can have a number of impacts on investors and financial markets.

For investors, negative bond yields can make it more difficult to generate income and achieve their financial goals. This is because they are essentially paying to lend money to borrowers.

For financial markets, negative bond yields can lead to distortions in asset prices and make it more difficult for businesses and governments to raise money.

Are there circumstances where negative bond yields are considered normal?

Negative bond yields are not considered normal. They are typically a sign of economic distress or unusual market conditions.

However, negative bond yields have become more common in recent years. This is due to a number of factors, including central bank policies, low inflation, and global economic uncertainty.

In some cases, negative bond yields may be seen as a sign of a healthy economy. For example, if negative bond yields are accompanied by strong economic growth and low unemployment, it may indicate that businesses are investing and consumers are spending.

Overall, negative bond yields are a complex phenomenon with a variety of potential impacts. Investors should carefully consider the risks and rewards before investing in negative-yielding bonds.