Do US banks offer mortgages on foreign property?

US banks typically offer mortgages for properties located within the United States. They may have limited options or restrictions when it comes to financing properties located in foreign countries. Here are some key points to consider regarding mortgages on foreign property from US banks:

Limited Availability: Most US banks primarily focus on domestic lending and may not have extensive programs for financing properties abroad. They are more likely to offer mortgages for properties within the United States.

Foreign Mortgage Lenders: If you are interested in purchasing a property in a foreign country, it is often more practical to explore mortgage options provided by local banks or financial institutions in that specific country. These lenders may have a better understanding of the local real estate market and regulations.

International Banking Services: Some large US banks offer international banking services that can assist with foreign property purchases. These services may include foreign currency accounts, international wire transfers, and financial advice for global investments. However, mortgage lending for foreign properties may not be a primary service.

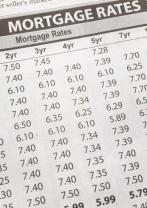

Terms and Conditions: If a US bank does offer mortgages for foreign properties, be prepared for potentially different terms and conditions compared to domestic mortgages. Interest rates, down payment requirements, and eligibility criteria may vary.

Currency Exchange Risk: When financing a property in a foreign country, consider the currency exchange risk. Fluctuations in exchange rates can impact the cost of your mortgage payments if you are earning income in US dollars and making payments in a different currency.

Legal and Regulatory Considerations: Purchasing property in a foreign country can involve complex legal and regulatory considerations. It's essential to consult with legal and financial professionals who are knowledgeable about the specific country's laws and real estate practices.

Local Mortgage Brokers: In some cases, it may be beneficial to work with a local mortgage broker or financial advisor in the foreign country where you intend to purchase property. They can help you navigate the local mortgage market and find suitable financing options.

Before pursuing a mortgage for a foreign property, it's advisable to thoroughly research the specific country's real estate market, seek legal advice, and consult with both US-based and local financial experts to understand the options available to you. Keep in mind that financing a property in a foreign country can be a complex process, and due diligence is essential to make informed decisions.