What documents are needed to sell real property?

When selling real property (real estate), various documents are required to facilitate a legally sound and transparent transaction. The specific documents needed can vary based on factors such as the location, type of property, and individual circumstances. However, here is a general checklist of essential documents commonly required for selling real property:

Deed to the Property: The deed is the primary document that proves ownership of the property. The seller needs to provide a valid deed to transfer ownership to the buyer.

Title Report or Title Insurance: A title report or title insurance policy is essential to verify that the property's title is clear of any liens, encumbrances, or claims that could affect the sale. Buyers typically require this to ensure they are receiving a clean title.

Property Survey: A survey of the property's boundaries and structures can be important to define the property lines and identify any encroachments or boundary disputes. Some buyers may request a recent property survey.

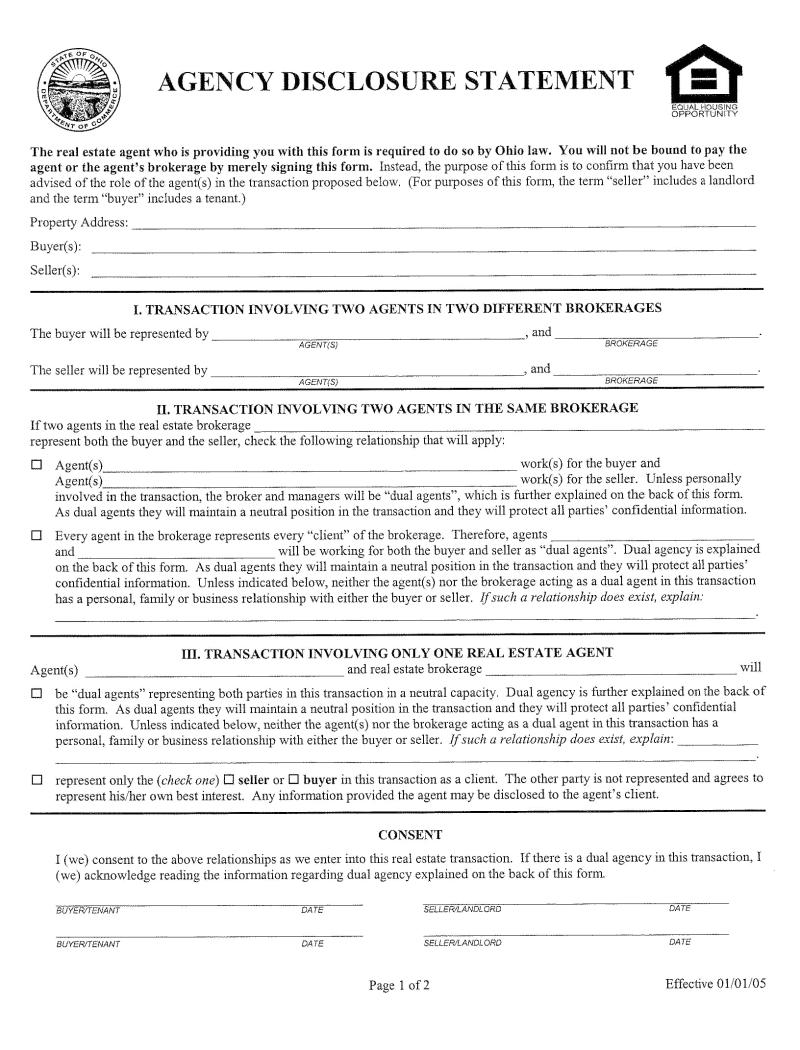

Property Disclosure Statement: Sellers are often required to provide a property disclosure statement, detailing known defects, issues, or material facts about the property. This helps potential buyers make informed decisions.

Purchase Agreement (Sales Contract): The purchase agreement is a legally binding contract outlining the terms and conditions of the sale, including the purchase price, closing date, and any contingencies.

Real Estate Listing Agreement: If the property is listed with a real estate agent, the listing agreement outlines the terms of the agency relationship, including the agent's commission.

Loan Payoff Information: If the property has an existing mortgage, the seller should provide information on the loan, including the outstanding balance, account number, and the lender's contact details.

Property Tax Records: Property tax records provide information on the current tax assessment, property tax payments, and any tax liens associated with the property.

HOA Documents: If the property is part of a homeowners association (HOA), the seller should provide HOA documents, including financial statements, bylaws, rules, and regulations, to the buyer.

Utility Bills and Records: Copies of utility bills and records can be helpful for the buyer to understand the property's utility expenses and service providers.

Certificate of Occupancy: In some areas, a certificate of occupancy may be required to confirm that the property complies with local building codes and zoning regulations.

Insurance Information: The seller may provide information about property insurance, including the current policy, coverage details, and any recent insurance claims.

Home Warranty Information: If the property includes a home warranty, the seller should provide details of the warranty coverage and terms.

Mandatory Disclosures: Depending on the jurisdiction, there may be specific mandatory disclosures related to environmental hazards, lead-based paint, radon, or other issues that the seller must provide to the buyer.

Legal Identification: Valid identification documents, such as a driver's license or passport, may be required for the seller to confirm their identity in the sale transaction.

Power of Attorney (if applicable): If the seller is not available to sign documents in person, a power of attorney may be needed to authorize another individual to act on their behalf.

Closing Statement: A closing statement, also known as a settlement statement or HUD-1, provides an itemized breakdown of the financial aspects of the transaction, including closing costs, prorated expenses, and the distribution of funds.

It's important for sellers to work closely with their real estate agent, attorney, or other professionals involved in the transaction to ensure that all required documents are in order and that the sale proceeds smoothly and in compliance with local laws and regulations. Additionally, the specific requirements can vary by location and the type of property, so it's advisable to consult with local authorities or legal professionals for guidance on the necessary documentation.

Required Documentation for Selling Real Property

Selling a property involves a series of steps and the preparation of various documents to ensure a smooth and legal transaction. The specific documents required may vary depending on local laws and the nature of the property, but some essential documents are typically needed for most real estate sales.

What Paperwork is Essential When Selling Real Estate?

Here's a list of essential documents typically required when selling real estate:

Title Deed: The title deed proves ownership of the property and is crucial for transferring ownership to the buyer.

Property Survey: A property survey outlines the property's boundaries, easements, and potential encroachments, ensuring clear property lines and potential issues.

Property Appraisal: A recent appraisal by a qualified appraiser determines the fair market value of the property, aiding in setting an appropriate asking price.

Disclosures: Sellers are legally obligated to disclose any known defects or issues with the property, such as structural problems, environmental hazards, or past renovations without permits.

Home Inspection Report: A home inspection provides a comprehensive assessment of the property's condition, identifying any potential repairs or maintenance needs.

Mortgage Payoff Statement: If the property has a mortgage, the seller needs to obtain a payoff statement from the lender, indicating the outstanding balance and any prepayment penalties.

Property Tax Records: Property tax records are essential for evaluating the property's tax history and ensuring that all taxes are paid up to date.

Homeowners Insurance Policy: If the property has homeowners insurance, the policy documents should be provided to the buyer, detailing coverage and potential claims.

HOA Documents: If the property is part of a homeowners association (HOA), the seller must provide the buyer with HOA documents, including rules, regulations, and fees.

Purchase Agreement: The purchase agreement is a legally binding contract between the buyer and seller, outlining the terms of the sale, including the purchase price, closing date, and contingencies.

Navigating the Paper Trail: Documents Needed for Real Property Sales

Gathering and organizing these documents can be a time-consuming process. It's advisable to start early and maintain a secure file system to keep track of all necessary paperwork. Consulting with a real estate attorney can ensure that all required documents are prepared correctly and that the sale process complies with local regulations.

Conclusion

The documentation required for selling real property plays a crucial role in ensuring a successful and legally sound transaction. By understanding the essential documents and preparing them diligently, sellers can navigate the paper trail effectively and protect their interests throughout the sale process.