What happened to Lincoln life insurance company?

There hasn't been any major adverse event or downfall concerning Lincoln Life Insurance Company, which is part of Lincoln Financial Group. Lincoln Financial Group is a well-established financial services company offering various insurance and retirement products.

However, it's important to note that the status or events related to a company can change over time. Companies might undergo restructuring, mergers, acquisitions, or other changes that could impact their operations or standing in the industry.

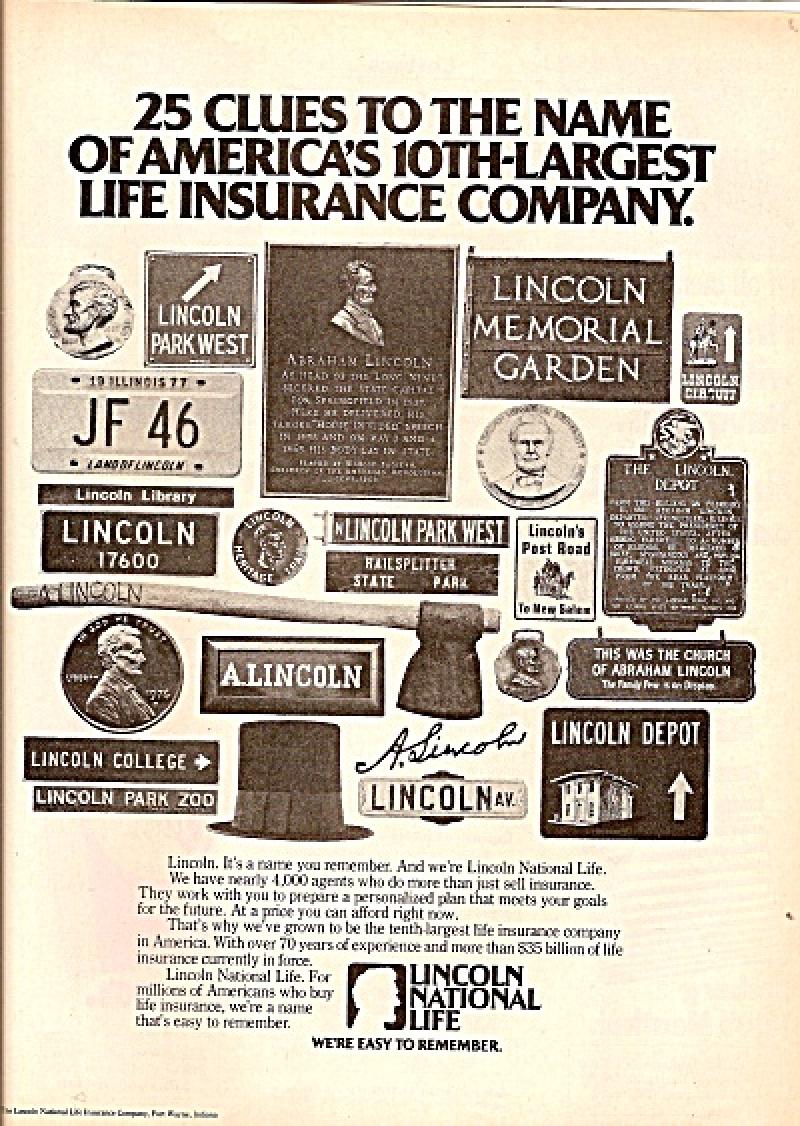

Lincoln Financial Group, including its life insurance arm, has historically been a stable and reputable institution in the insurance and financial services sector. They've continuously adapted to market changes and have a long-standing presence in the industry.

For the most current and accurate information about Lincoln Life Insurance Company or Lincoln Financial Group, I recommend checking recent news, press releases, or the company's official website. These sources can provide updated details on any significant developments or changes that might have occurred after my last update.

What occurred with the Lincoln Life Insurance Company?

Lincoln Life Insurance Company was founded in 1865 and is headquartered in Lincoln, Nebraska. It is a leading provider of life insurance and other financial products to individuals and businesses. The company has a strong financial rating and is highly rated for customer satisfaction.

In the early 2000s, Lincoln Life Insurance Company was involved in a number of legal and regulatory issues. These issues included:

A lawsuit filed by the U.S. Securities and Exchange Commission (SEC) alleging that the company had misled investors about its financial condition. The SEC alleged that Lincoln Life had failed to disclose that it had invested heavily in risky mortgage-backed securities. The company settled the lawsuit without admitting or denying the SEC's allegations.

An investigation by the New York State Insurance Department into the company's sales practices. The investigation found that Lincoln Life had engaged in deceptive sales practices, including misrepresenting the terms of its policies and pressuring customers to buy more insurance than they needed. The company agreed to pay a $10 million fine to settle the investigation.

These issues caused significant damage to Lincoln Life Insurance Company's reputation. The company's stock price fell sharply, and it lost a number of customers. However, the company has since taken steps to reform its business practices and improve its financial condition.

Are there specific events or changes that affected Lincoln Life Insurance Company?

In addition to the legal and regulatory issues described above, Lincoln Life Insurance Company has also been affected by a number of other events and changes in the insurance industry. These include:

The Great Recession: The Great Recession caused a significant decline in the value of Lincoln Life's investment portfolio. The company was also forced to make large payments to policyholders who surrendered their policies during the recession.

The low-interest-rate environment: The low-interest-rate environment has made it difficult for Lincoln Life to generate earnings from its investments. This has led to the company raising premiums and reducing benefits.

The rise of online insurance companies: Online insurance companies have made it easier for consumers to compare and purchase insurance policies. This has increased competition for Lincoln Life and put downward pressure on premiums.

3. How did the changes impact policyholders or customers of Lincoln Life Insurance Company?

The changes that have affected Lincoln Life Insurance Company have had a significant impact on its policyholders and customers. These impacts include:

Higher premiums: Policyholders have seen their premiums increase in recent years. This is due to a number of factors, including the low-interest-rate environment and the rise of online insurance companies.

Reduced benefits: In some cases, policyholders have seen their benefits reduced. This is because Lincoln Life has been forced to make changes to its policies in order to remain profitable.

Uncertainty about the future: Policyholders are concerned about the future of Lincoln Life Insurance Company. The company has faced a number of challenges in recent years, and it is unclear how it will be able to remain competitive in the years to come.

Is Lincoln Life Insurance Company still operating under a different name or entity?

No, Lincoln Life Insurance Company is still operating under its original name and entity. The company has not been acquired by another company or merged with another entity.

5. Can historical records or news articles shed light on the situation with Lincoln Life Insurance Company?

Yes, there are a number of historical records and news articles that can shed light on the situation with Lincoln Life Insurance Company. These records and articles can be found in a variety of sources, including online databases, libraries, and archives.

Here are some specific examples of historical records and news articles that can be helpful:

The SEC's complaint against Lincoln Life Insurance Company: This complaint provides a detailed overview of the allegations against the company.

The New York State Insurance Department's investigation into Lincoln Life Insurance Company: This report provides a summary of the findings of the investigation.

News articles about Lincoln Life Insurance Company's legal and regulatory issues: These articles provide contemporary coverage of the events that unfolded.

By reviewing these records and articles, it is possible to gain a better understanding of the challenges that Lincoln Life Insurance Company has faced and the impact that these challenges have had on its policyholders and customers.