How are TRS benefits you?

TRS (Teachers' Retirement System) benefits educators and other eligible employees in several ways:

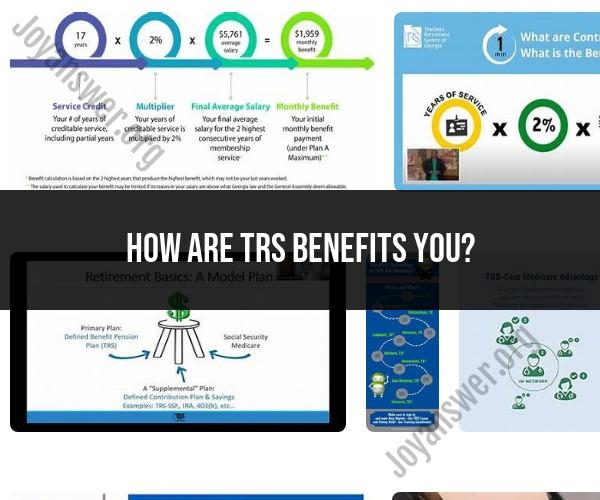

Retirement Income: TRS provides retired educators with a reliable source of income during their retirement years. This income is typically based on factors like years of service, final average salary (FAS), and the specific benefit formula of the TRS plan. It allows retirees to maintain their financial security and enjoy a comfortable retirement.

Financial Security: TRS benefits offer financial security to educators by providing a predictable monthly income. This financial stability helps retirees cover their living expenses, including housing, healthcare, and daily necessities, without the need to rely solely on savings or other sources of income.

Credited Service Recognition: TRS recognizes and rewards educators for their years of dedicated service in the field of education. The longer an educator works and contributes to the TRS system, the higher their potential retirement benefit.

Survivor Benefits: TRS often provides survivor benefits to the spouses or beneficiaries of retired educators in the event of the retiree's death. These benefits can help ensure that surviving family members continue to receive financial support.

Early Retirement Options: Some TRS systems offer early retirement options for educators who wish to retire before reaching the standard retirement age. These options may have reduced benefits but provide flexibility for those who want to retire earlier.

Healthcare Benefits: In addition to retirement income, TRS systems may offer healthcare benefits or access to retiree healthcare plans. This helps retirees manage their medical expenses during retirement.

Disability Benefits: TRS systems often provide disability benefits to eligible educators who are unable to work due to a disabling condition. These benefits offer financial support and peace of mind during challenging times.

Deferred Compensation Plans: Some TRS systems offer deferred compensation plans, such as 403(b) or 457 plans, which allow educators to save additional funds for retirement on a tax-advantaged basis.

Contributions and Investment Earnings: TRS benefits from both employee and employer contributions, as well as investment earnings on those contributions. This enables TRS to generate funds to support retirement benefits for its members.

Educational Opportunities: Many TRS systems provide educational resources and retirement planning tools to help educators make informed decisions about their retirement. This includes seminars, workshops, and online resources.

Retirement Planning Support: TRS administrators and counselors are available to assist educators in planning for retirement, calculating retirement benefits, and understanding the options available to them.

Overall, TRS benefits educators by providing a retirement safety net, financial stability, and recognition for their dedicated service in the field of education. It plays a crucial role in supporting educators throughout their careers and into their retirement years. However, the specific benefits and eligibility criteria can vary by state or country, so educators should consult their TRS plan documents and administrators for accurate and up-to-date information.

How TRS Benefits You: A Comprehensive Overview

Teacher Retirement System (TRS) benefits are a valuable tool for teachers and other public education employees to save for retirement. TRS plans provide a number of benefits, including:

- Guaranteed income: TRS pensions provide a guaranteed monthly income for the rest of a TRS member's life, regardless of market conditions. This can provide TRS members with financial security in retirement.

- Portability: TRS plans are portable, meaning that TRS members can take their TRS benefits with them if they move to another state. This can be helpful for TRS members who relocate for work or other reasons.

- Tax advantages: TRS contributions are typically tax-deferred, meaning that TRS members do not have to pay taxes on their contributions until they withdraw them in retirement. This can help TRS members save money on taxes.

- Health insurance: TRS plans may offer health insurance benefits to TRS members and their families. This can help TRS members save money on health insurance costs in retirement.

- Other benefits: TRS plans may also offer other benefits, such as life insurance, long-term care insurance, and disability benefits. These benefits can help TRS members protect themselves and their families financially.

The Advantages of TRS Benefits

TRS benefits offer a number of advantages over other retirement savings options, such as individual retirement accounts (IRAs) and 401(k) plans.

- Guaranteed income: TRS pensions provide a guaranteed monthly income for the rest of a TRS member's life. This can provide TRS members with financial security in retirement, even in the event of a market downturn.

- Portability: TRS plans are portable, meaning that TRS members can take their TRS benefits with them if they move to another state. This can be helpful for TRS members who relocate for work or other reasons.

- Tax advantages: TRS contributions are typically tax-deferred, meaning that TRS members do not have to pay taxes on their contributions until they withdraw them in retirement. This can help TRS members save money on taxes.

- Employer contributions: Most TRS plans require employers to contribute to their employees' TRS accounts. This can help TRS members save more money for retirement.

- Professional management: TRS plans are managed by professional investment professionals. This can help TRS members ensure that their retirement savings are invested wisely.

Maximizing Your Future: The Value of TRS Benefits

TRS benefits can be a valuable tool for teachers and other public education employees to save for retirement. By taking advantage of TRS benefits, TRS members can build a secure financial future for themselves and their families.

Here are some tips for maximizing your TRS benefits:

- Start contributing to TRS as early as possible. The earlier you start contributing, the more time your money has to grow.

- Increase your TRS contributions each year, if possible. This will help you save more money for retirement.

- Take advantage of the tax advantages of TRS plans.

- Review your TRS benefits regularly and make sure that you understand your options.

- Seek financial advice from a qualified professional to help you develop a retirement plan that meets your individual needs.

TRS benefits can be a valuable part of your overall retirement planning strategy. By taking advantage of TRS benefits, you can build a secure financial future for yourself and your family.