Should retirees rent or buy a home?

The decision between renting and buying a home during retirement is a complex one and depends on various factors, including personal preferences, financial considerations, and individual circumstances. Both renting and buying have their pros and cons, and what might be suitable for one retiree may not be the best choice for another. Here are some factors to consider:

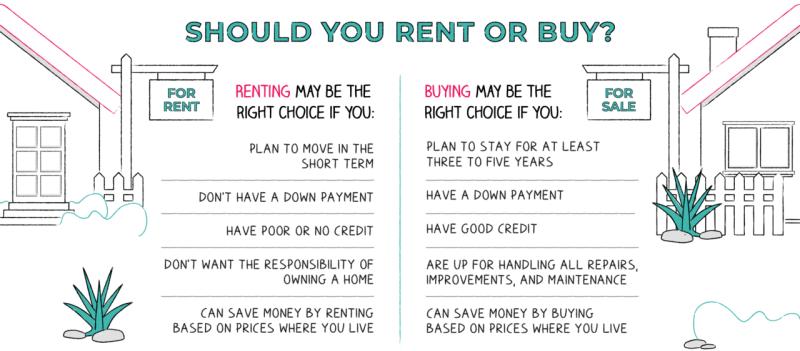

Reasons to Consider Renting:

Flexibility:Renting provides flexibility, allowing retirees to easily relocate if their circumstances or preferences change. This can be advantageous for those who want the freedom to explore different locations or downsize without the responsibilities of homeownership.

Maintenance and Repairs:Renting typically means that the responsibility for maintenance and repairs lies with the landlord. Retirees may appreciate not having to deal with the costs and physical demands of home maintenance.

Financial Considerations:Renting may be financially advantageous in certain situations. Retirees can avoid upfront costs, property taxes, and ongoing maintenance expenses associated with homeownership.

Reasons to Consider Buying:

Equity and Ownership:Homeownership allows retirees to build equity over time. Paying a mortgage can be viewed as a form of forced savings, and the home itself becomes an asset that may appreciate in value.

Stability and Control:Owning a home provides a sense of stability and control over living arrangements. Retirees who value having a permanent residence and the ability to make modifications to the property may prefer homeownership.

Predictable Housing Costs:With a fixed-rate mortgage, retirees can benefit from predictable housing costs over the long term. Rent, on the other hand, may be subject to increases over time.

Legacy for Heirs:Homeownership allows retirees to leave a property as part of their legacy to heirs. This can be an important consideration for some individuals.

Considerations for Both Options:

Financial Situation:Assess your financial situation, including retirement savings, income, and any potential future healthcare costs. Consider consulting with a financial advisor to determine the affordability of homeownership.

Health and Mobility:Consider your current health and mobility. Homeownership may involve more physical demands, such as maintenance and yard work, which could become challenging as you age.

Location Preferences:Your desired location and lifestyle preferences can influence the decision. Some retirees may prefer urban living, while others may want a quieter suburban or rural setting.

Housing Market Conditions:Evaluate the local housing market conditions. In some areas, renting may be more cost-effective than buying, while in others, homeownership might be more financially attractive.

Ultimately, the decision between renting and buying during retirement is highly individual. It's advisable to weigh the pros and cons, consider personal preferences, and seek advice from financial professionals to make an informed decision based on your unique circumstances.

Should retirees choose to rent or buy a home?

There is no one-size-fits-all answer to the question of whether retirees should choose to rent or buy a home. The decision depends on a number of factors, including the retiree's financial situation, lifestyle, and personal preferences.

Considerations for retirees in deciding between homeownership and renting

Here are some of the key considerations for retirees in deciding between homeownership and renting:

- Financial situation: Homeownership can be a significant financial commitment. Retirees need to consider whether they can afford the down payment, mortgage payments, property taxes, and other costs associated with homeownership.

- Lifestyle: Retirees need to think about their lifestyle and how it will change in retirement. For example, if they plan to travel extensively, they may want to consider renting so that they don't have to worry about maintaining a home while they're away.

- Personal preferences: Some retirees may simply prefer to rent. They may enjoy the flexibility of being able to move easily if they need to, or they may not want to deal with the maintenance and repairs associated with homeownership.

Retirement lifestyle factors that influence the decision to buy or rent

Here are some specific retirement lifestyle factors that can influence the decision to buy or rent a home:

- Health: Retirees with health problems may want to consider renting so that they don't have to worry about maintaining a home if they become unable to do so.

- Mobility: Retirees who have mobility issues may want to consider renting a home that is designed for accessibility.

- Social life: Retirees who want to live in a community with other retirees may want to consider buying a home in a retirement community.

- Long-term plans: Retirees who plan to stay in the same area for the long term may want to consider buying a home. However, retirees who are unsure of their future plans may want to consider renting so that they have the flexibility to move if they need to.

Ultimately, the decision of whether to rent or buy a home in retirement is a personal one. Retirees should weigh all of the factors involved and make the decision that is best for them.

Here are some additional tips for retirees who are deciding whether to rent or buy a home:

- Create a budget and track your spending. This will help you to determine how much you can afford to spend on housing each month.

- Consider your current and future needs. What kind of home do you need now? What kind of home might you need in the future?

- Research the different housing options in your area. What are the current rental rates? What are the home prices?

- Talk to a financial advisor. They can help you to assess your financial situation and make the best decision for you.