Are high yield bond funds a safe investment?

High-yield bond funds, also known as junk bond funds, are not typically considered as safe an investment as some other types of fixed-income investments, such as U.S. Treasury bonds or investment-grade corporate bonds. Here are some key points to consider when evaluating the safety of high-yield bond funds:

Risk of Default: High-yield bonds are issued by companies with lower credit ratings, which means they have a higher risk of defaulting on their interest or principal payments. This elevated default risk is why they are often referred to as "junk" bonds. When a company defaults on its bond payments, bondholders may incur losses.

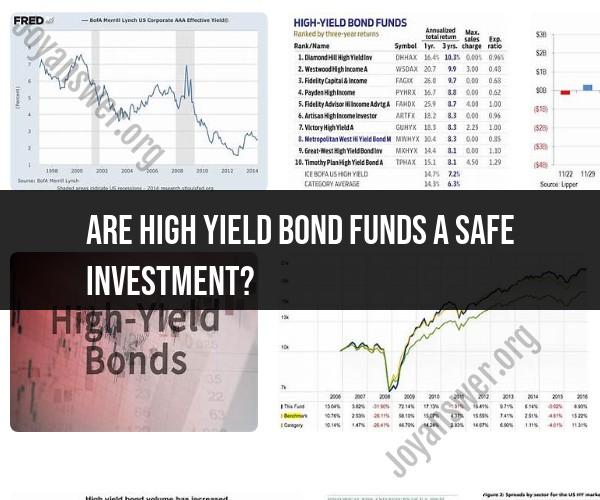

Higher Yields: The primary attraction of high-yield bond funds is their potential for higher yields compared to safer bond investments. However, these higher yields come with higher risk. Investors are compensated for taking on more risk in the form of increased yield.

Market Volatility: High-yield bond funds can be more susceptible to market volatility and economic downturns. During times of economic stress, the default rates for lower-rated bonds tend to rise, which can negatively impact the performance of high-yield bond funds.

Interest Rate Risk: Like all fixed-income investments, high-yield bonds and bond funds are sensitive to changes in interest rates. If interest rates rise, the market value of existing bonds may decline, potentially resulting in capital losses for investors.

Diversification: Investing in a high-yield bond fund can provide diversification benefits because the fund typically holds a portfolio of different bonds from various issuers. Diversification can help spread risk, but it does not eliminate it entirely.

Credit Analysis: The expertise of the fund manager and their ability to conduct thorough credit analysis is crucial. Skilled fund managers aim to select bonds issued by companies with a higher likelihood of meeting their debt obligations.

Income vs. Safety: Investors looking for safety and capital preservation may find that high-yield bond funds do not align with their investment objectives. These funds are more suitable for investors seeking income with a higher tolerance for risk.

Duration: High-yield bond funds may have shorter durations compared to traditional bond funds. A shorter duration can reduce interest rate risk but may not fully offset the credit risk associated with lower-quality bonds.

It's essential for investors to assess their risk tolerance and investment goals when considering high-yield bond funds. While they offer the potential for higher yields, they also come with increased risk, and their safety is relative to an investor's risk tolerance and overall portfolio diversification.

Investors who are interested in high-yield bonds should consider consulting with a financial advisor or conducting thorough research to understand the specific risks associated with the bonds held in a particular fund. Additionally, diversifying across different asset classes and bond types can help manage risk within a broader investment portfolio.

High-Yield Bond Funds: Weighing the Safety and Risk

High-yield bond funds are a type of mutual fund or exchange-traded fund (ETF) that invests in high-yield bonds, also known as junk bonds. These bonds are issued by companies with lower credit ratings, and therefore have a higher risk of default. However, high-yield bonds also offer higher potential returns than investment-grade bonds.

Diving into High-Yield Bonds: Understanding the Investment Landscape

High-yield bond funds offer a number of potential benefits to investors, including:

- Higher potential returns: High-yield bonds have a higher risk of default, but they also offer higher potential returns than investment-grade bonds. This is because investors demand a higher yield to compensate them for the added risk.

- Diversification: High-yield bonds can help to diversify an investment portfolio, as they are not correlated to other asset classes, such as stocks and real estate.

- Income: High-yield bonds typically pay higher interest payments than investment-grade bonds, providing investors with a steady stream of income.

However, it is important to note that high-yield bond funds also carry a number of risks, including:

- Credit risk: High-yield bonds have a higher risk of default than investment-grade bonds. This means that investors could lose some or all of their investment if the bond issuer defaults.

- Interest rate risk: Rising interest rates can cause the prices of high-yield bonds to fall. This is because investors can buy new high-yield bonds with higher interest rates, making older bonds with lower interest rates less attractive.

- Liquidity risk: High-yield bonds may be less liquid than investment-grade bonds, meaning that it may be more difficult to sell them quickly.

Assessing Risk Tolerance: Should You Invest in High-Yield Bond Funds?

Whether or not you should invest in high-yield bond funds depends on your individual investment goals and risk tolerance. If you are looking for a higher-risk, higher-reward investment option, high-yield bond funds may be a good fit for you. However, it is important to understand the risks involved before investing.

Here are some things to consider when deciding whether or not to invest in high-yield bond funds:

- Investment goals: What are your investment goals? Are you looking to generate income, grow your wealth, or preserve your capital?

- Risk tolerance: How much risk are you comfortable with? High-yield bond funds are a riskier investment than investment-grade bond funds.

- Time horizon: How long do you plan to invest for? High-yield bond funds can be volatile in the short term, but they have historically performed well over the long term.

If you are considering investing in high-yield bond funds, it is important to do your research and choose a fund with a good track record. You should also speak to a financial advisor to determine if high-yield bond funds are right for you.