Is Federal Reserve System part of US Treasury?

No, the Federal Reserve System (often referred to as the Fed) is not part of the U.S. Treasury.

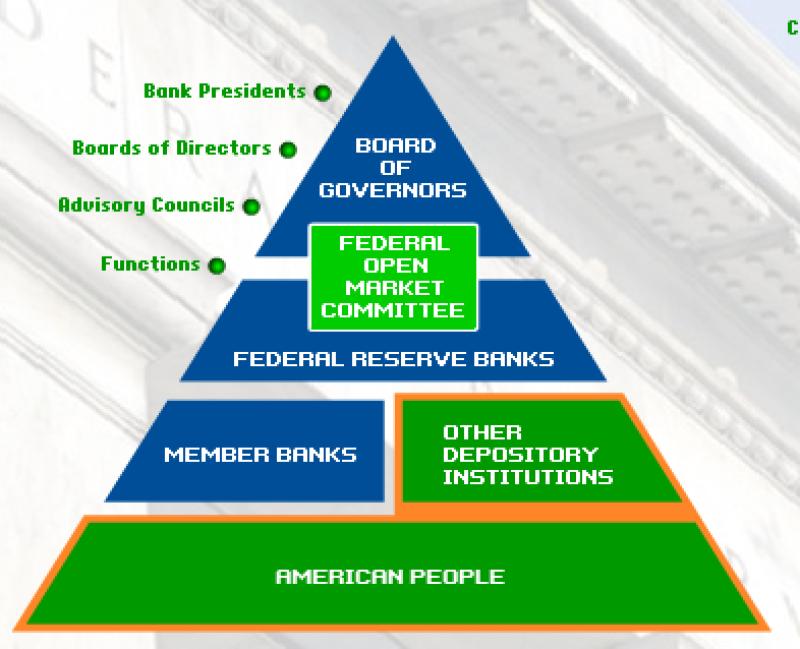

The Federal Reserve System is an independent entity created by Congress in 1913 through the Federal Reserve Act. It operates as the central banking system of the United States and functions independently from the U.S. government's executive branch, which includes the Department of the Treasury.

The Federal Reserve has several key responsibilities, including:

Monetary Policy: Formulating and implementing monetary policy to promote stable prices, maximum sustainable employment, and moderate long-term interest rates.

Bank Supervision and Regulation: Overseeing and regulating banks and financial institutions to ensure the safety and soundness of the banking system.

Financial Services: Providing various financial services to banks, the U.S. government, and foreign official institutions, such as processing payments and currency distribution.

Economic Research and Data Collection: Conducting economic research, collecting data, and providing economic analysis to support informed policymaking.

The Department of the Treasury, on the other hand, is a cabinet-level department of the U.S. federal government responsible for managing government finances, revenue collection (such as taxation), issuing debt securities, and formulating economic and fiscal policies.

While they are separate entities, the Federal Reserve and the Department of the Treasury do collaborate on certain matters, especially during periods of financial crisis or when their functions intersect, but they maintain distinct roles and responsibilities within the U.S. financial system.

The Federal Reserve System (Fed) is the central bank of the United States, responsible for maintaining economic stability and fostering sustainable growth. It operates independently from the Treasury Department, ensuring its objectivity in carrying out its critical functions.

Independence of the Federal Reserve System from the Treasury Department

The Fed's independence from the Treasury Department is a crucial aspect of its structure. This separation ensures that the Fed can make monetary policy decisions without political interference, prioritizing long-term economic stability over short-term political considerations.

Key responsibilities of the Federal Reserve System

The Fed's primary responsibilities include:

Conducting Monetary Policy: The Fed sets monetary policy, which influences the availability and cost of credit in the economy. This involves setting interest rates and managing the money supply.

Overseeing Financial Institutions: The Fed supervises and regulates banks and other financial institutions to maintain financial stability and protect consumers.

Promoting Economic Growth: The Fed aims to promote sustainable economic growth by fostering stable prices, low unemployment, and a sound financial system.

Maintaining Financial Stability: The Fed acts as a lender of last resort, providing financial assistance to banks and other institutions during times of crisis.

Serving as the Government's Banker: The Fed serves as the fiscal agent of the U.S. government, handling its financial transactions and issuing currency.

Monetary policy tools used by the Federal Reserve

The Fed utilizes various monetary policy tools to achieve its objectives:

Open Market Operations: The Fed buys or sells government securities in the open market, influencing interest rates and the money supply.

Discount Rate: The Fed sets the discount rate, the interest rate at which banks borrow from the Fed.

Reserve Requirements: The Fed sets the reserve requirements, the amount of money banks must hold in reserve against deposits.

Forward Guidance: The Fed communicates its future monetary policy plans to influence market expectations.

Moral Suasion: The Fed informally persuades banks and financial institutions to follow its policy objectives.

Role of the Federal Reserve in maintaining economic stability

The Fed plays a pivotal role in maintaining economic stability by:

Controlling Inflation: The Fed aims to keep inflation low and stable, preventing the erosion of purchasing power and promoting economic stability.

Promoting Full Employment: The Fed strives to maintain full employment, minimizing unemployment and ensuring that individuals have opportunities to contribute to the economy.

Mitigating Economic Cycles: The Fed works to mitigate the ups and downs of economic cycles, preventing excessive booms and recessions.

Enhancing Financial Stability: The Fed's regulatory role helps maintain financial stability, reducing risks and protecting the financial system from crises.

Impact of the Federal Reserve on the U.S. Economy and Global Financial Markets

The Fed's actions have a profound impact on the U.S. economy and global financial markets:

Interest Rates: The Fed's interest rate decisions influence borrowing costs, consumer spending, and investment decisions across the economy.

Asset Prices: The Fed's monetary policy can affect asset prices, such as stock and bond prices, which can impact wealth distribution and investment decisions.

International Financial Markets: The Fed's actions can influence global interest rates, currency exchange rates, and capital flows, impacting economies worldwide.

Global Economic Conditions: The Fed's monetary policy can influence global economic conditions, affecting trade, growth, and financial stability around the world.

In conclusion, the Federal Reserve System plays a central role in maintaining economic stability and fostering sustainable growth in the United States and globally. Its independence, broad responsibilities, and diverse monetary policy tools empower it to address economic challenges and promote a sound financial system. The Fed's actions have far-reaching implications, affecting individuals, businesses, and economies worldwide.