Where can I take fiscal law courses?

Fiscal law courses are offered in various institutions worldwide, including:

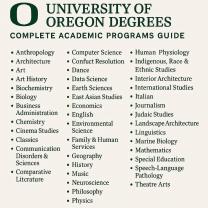

Law Schools and Universities: Many law schools and universities offer specialized courses in fiscal law as part of their law programs or in specific legal studies departments. Institutions like Harvard Law School, Yale Law School, University of Oxford, University of Cambridge, Stanford Law School, and others often have courses or programs focusing on fiscal law.

Graduate Programs: Postgraduate programs in taxation law, financial law, or public finance often include modules or courses dedicated to fiscal law. Institutions like New York University School of Law, London School of Economics (LSE), University of California, Berkeley (UC Berkeley), and others offer specialized programs in fiscal law.

Online Platforms: Various online platforms offer courses in fiscal law, catering to individuals seeking flexible learning options. Websites like Coursera, edX, and Khan Academy might have courses on fiscal law or related topics.

Professional Organizations and Institutes: Bodies like the International Fiscal Association (IFA), American Bar Association (ABA), or International Bar Association (IBA) sometimes conduct workshops, seminars, or courses focusing on fiscal law.

Government Institutions: Some government institutions or agencies responsible for fiscal policies may offer training programs or workshops related to fiscal law and taxation.

When exploring courses in fiscal law, consider factors like the curriculum, faculty expertise, practical applications, and the institution's reputation. Additionally, online resources can be a valuable supplement to traditional courses, providing flexibility and accessibility for learning about fiscal law concepts and developments.

What institutions or platforms offer courses specifically in fiscal law?

Finding the right platform for fiscal law courses depends on several factors, including your preferred learning format, desired level of expertise, and budget. Here are some options to consider:

Traditional Universities and Law Schools:

- Many universities and law schools offer programs and courses in tax law, public finance law, and other fiscal law specialties. These programs are usually designed for postgraduate students aiming for careers in law, accounting, or finance. Some prominent examples include:

- Harvard Law School: Offers various tax law courses and a Graduate Program in Taxation.

- New York University School of Law: Features a Graduate Tax Program and specialized courses in public finance law.

- Georgetown University Law Center: Hosts a Master of Laws (LL.M.) in Taxation program and courses in various fiscal law areas.

Professional Organizations and Institutes:

- Professional organizations like the American Bar Association (ABA) and the American Institute of Certified Public Accountants (AICPA) offer continuing education courses and certificate programs in tax law and related fields. These programs are ideal for professionals seeking to update their knowledge and skills.

- ABA Section of Taxation: Provides online and in-person courses on various tax topics.

- AICPA Continuing Education: Offers tax and financial planning courses for accountants and financial professionals.

Online Platforms and Learning Management Systems (LMS):

- Several online platforms and LMS offer self-paced and instructor-led courses in fiscal law. These platforms cater to a wider audience with flexible learning formats and affordable options. Some popular options include:

- Udemy: Offers numerous courses on tax law, international tax, and public finance.

- Coursera: Features specialized courses from top universities and institutions like Stanford University and the International Monetary Fund (IMF).

- edX: Provides micro-courses and professional certificates in various tax and financial management areas.

Additional Resources:

- Barbri: Offers comprehensive online and in-person bar exam preparation courses, including sections on tax law.

- The National Bureau of Economic Research (NBER): Provides working papers and research on fiscal policy and related topics.

- International Monetary Fund (IMF): Offers online courses and training programs on taxation, public finance, and debt management.

Remember to consider your specific learning goals and budget when choosing a platform or course. Some platforms offer free introductory courses, while others require paid subscriptions or course fees.