What is 12th grade Finance and economics?

12th-grade Finance and Economics is an educational course or curriculum typically offered to high school seniors. It is designed to provide students with a foundational understanding of financial principles, economic concepts, and real-world financial literacy skills. The course covers various topics related to personal finance, economics, and the global economy. Here's an overview of what students may learn in 12th-grade Finance and Economics:

Personal Finance:

- Budgeting: Creating and managing a personal budget, tracking expenses, and setting financial goals.

- Banking and Saving: Understanding banking services, savings accounts, and the importance of saving money.

- Credit and Debt: Learning about credit cards, loans, interest rates, and responsible borrowing.

- Taxes: An introduction to income taxes, tax forms, and the tax implications of financial decisions.

- Investments: Basics of investing in stocks, bonds, mutual funds, and retirement accounts.

Economics:

- Microeconomics: Fundamental economic concepts, supply and demand, market structures, and consumer behavior.

- Macroeconomics: Key macroeconomic indicators (GDP, inflation, unemployment), fiscal and monetary policy, and economic systems.

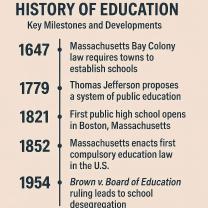

- Economic History: An overview of economic history and the evolution of economic thought.

- Global Economics: International trade, globalization, and economic interdependence among nations.

Financial Literacy:

- Financial Decision-Making: Evaluating financial choices, risk assessment, and making informed financial decisions.

- Consumer Rights and Responsibilities: Understanding consumer protection laws and rights.

- Financial Institutions: Exploring the roles and functions of financial institutions like banks and credit unions.

Current Economic Issues:

- Analyzing current events and economic issues affecting the local, national, and global economy.

- Debates on economic policy, such as government spending, taxation, and monetary policy.

Career and College Readiness:

- Exploring career opportunities related to finance and economics.

- Preparing for college and understanding the financial aspects of higher education, including scholarships and student loans.

The specific curriculum and depth of coverage may vary from one school or educational institution to another. The goal of 12th-grade Finance and Economics courses is to equip students with the knowledge and skills they need to make informed financial decisions, understand economic principles, and prepare for financial independence as they transition to college or the workforce. It also helps students become responsible and financially literate citizens who can navigate the complexities of the modern financial world.