How do I list depreciation as a business expense?

Depreciation is a fundamental concept in accounting that allows businesses to allocate the cost of tangible assets over their useful lives. It's an essential aspect of financial reporting and tax planning. This guide provides a comprehensive overview of listing and calculating depreciation as a business expense:

1. Understanding Depreciation

Depreciation is the systematic reduction in the value of an asset over time. It reflects the wear and tear, obsolescence, or other factors that cause an asset's value to decrease. While the asset's physical condition may deteriorate, its financial value is allocated as an expense.

2. Types of Depreciation Methods

There are several methods to calculate depreciation. Common methods include:

Straight-Line Depreciation

This method allocates an equal amount of depreciation expense over the asset's useful life. It's straightforward and provides a consistent expense each year.

Declining Balance Depreciation

Also known as accelerated depreciation, this method allocates higher depreciation expenses in the earlier years of the asset's life and reduces them over time.

Units of Production Depreciation

This method allocates depreciation based on the asset's usage or production output. It's particularly useful for assets that experience varying levels of activity.

Sum-of-the-Years-Digits Depreciation

This method assigns higher depreciation expenses in the early years and decreases them over the asset's useful life, creating a more accelerated pattern than straight-line depreciation.

3. Listing Depreciable Assets

Start by creating a list of depreciable assets owned by your business. These assets could include vehicles, machinery, equipment, buildings, and computers. Each asset should have a purchase date, cost, estimated useful life, and method of depreciation chosen.

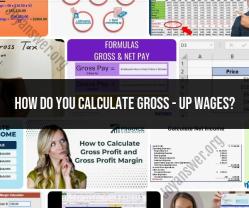

4. Calculating Depreciation

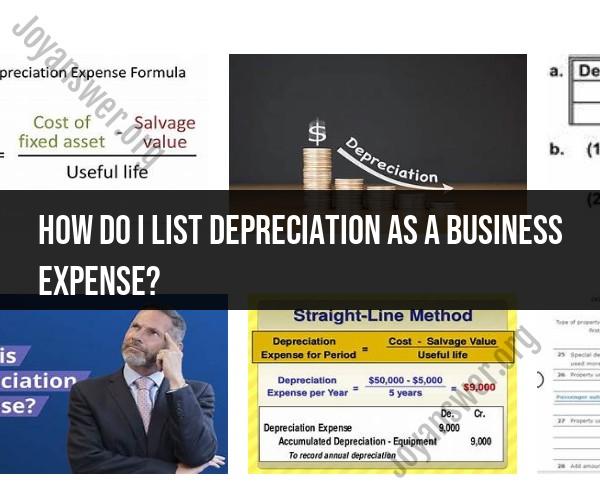

Depending on the chosen method, calculate depreciation for each asset. The formula for straight-line depreciation is:

Annual Depreciation Expense = (Cost of Asset - Salvage Value) / Useful Life

For other methods, research the specific formulas associated with those methods.

5. Recording Depreciation

Depreciation is recorded as an expense on the income statement and as an accumulated depreciation contra-account on the balance sheet. The accumulated depreciation account offsets the original asset's value to reflect its current book value.

6. Tax Implications

Depreciation affects taxable income. Businesses can claim depreciation as a deduction on their tax returns, reducing their taxable income and potentially lowering their tax liability. Tax laws and regulations surrounding depreciation can vary, so consult a tax professional for guidance.

7. Periodic Review

Regularly review and update the list of depreciable assets, their useful lives, and their depreciation methods. As assets age or business needs change, adjustments may be necessary to ensure accurate financial reporting.

8. Conclusion

Depreciation is a vital tool for businesses to accurately reflect the consumption of assets' value over time. By understanding and properly listing and calculating depreciation, businesses can make informed financial decisions and maintain accurate financial records.