How to understand Debits and credits?

Understanding debits and credits is fundamental in accounting, as they form the foundation of the double-entry accounting system. Here's how to comprehend debits and credits in accounting:

Know the Basic Accounting Equation:

- At the heart of double-entry accounting is the accounting equation: Assets = Liabilities + Equity. This equation must always remain in balance.

Understand Debits and Credits:

- In the double-entry system, every transaction is recorded with at least one debit and one credit. Debits and credits have specific meanings:

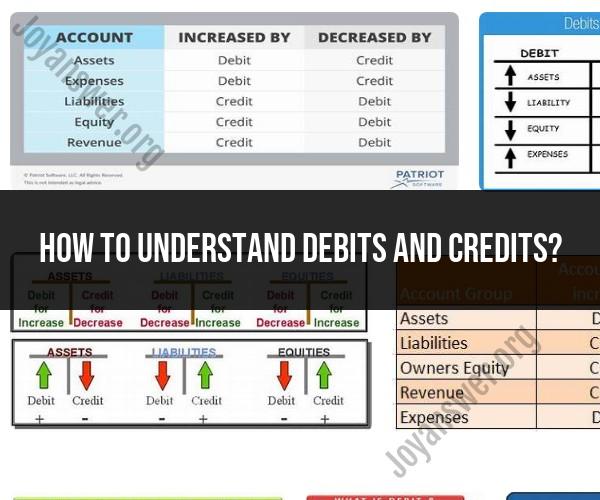

- Debit: It refers to the left side of an account. Debits increase asset and expense accounts but decrease liability, equity, and revenue accounts.

- Credit: It refers to the right side of an account. Credits increase liability, equity, and revenue accounts but decrease asset and expense accounts.

- In the double-entry system, every transaction is recorded with at least one debit and one credit. Debits and credits have specific meanings:

Apply Debits and Credits to Account Types:

- Different types of accounts are categorized into five main groups: assets, liabilities, equity, revenue, and expenses. To apply debits and credits correctly:

- Debit an asset to increase its value or reduce a liability or equity account.

- Credit an asset to decrease its value or increase a liability or equity account.

- Debit an expense to increase it, which reduces equity.

- Credit an expense to decrease it, which increases equity.

- Debit equity to decrease it.

- Credit equity to increase it.

- Debit a liability to decrease it.

- Credit a liability to increase it.

- Debit revenue to decrease it.

- Credit revenue to increase it.

- Different types of accounts are categorized into five main groups: assets, liabilities, equity, revenue, and expenses. To apply debits and credits correctly:

Learn How Transactions Affect Accounts:

- When recording transactions, it's essential to understand how they impact different accounts. For example, when you make a sale, you credit the revenue account, increasing your income, and debit the asset account, increasing the cash or accounts receivable.

Use T-Accounts:

- T-Accounts are a visual representation of individual accounts and help you see how debits and credits affect them. Draw a "T" shape on paper and label the top of the "T" with the account name. Record debits on the left side and credits on the right side of the "T."

Remember the Accounting Equation:

- The accounting equation (Assets = Liabilities + Equity) can be a useful tool to ensure your debits and credits are balanced for every transaction. If the equation remains balanced, you've recorded the transaction correctly.

Practice and Review:

- Practice is essential for mastering debits and credits. Work through accounting problems and scenarios to reinforce your understanding.

Use Accounting Software:

- Modern accounting software often automates the process of recording transactions, but it's still important to understand the underlying principles of debits and credits.

Seek Professional Guidance:

- If you're unsure about recording a complex or significant transaction, consult with a certified accountant or financial advisor for guidance.

Understanding debits and credits is a critical skill for anyone involved in accounting or financial management. It ensures accurate and consistent financial record-keeping, which is essential for making informed business decisions and meeting regulatory requirements.

Demystifying Debits and Credits in Accounting

Debits and credits are the two fundamental accounting concepts that are used to record financial transactions. They are used to track the flow of money into and out of a business.

- Debits: Debits are used to increase asset accounts, expense accounts, and loss accounts.

- Credits: Credits are used to increase liability accounts, equity accounts, and revenue accounts.

The Core Principles of Double-Entry Accounting

Double-entry accounting is a system of accounting that records every financial transaction as two equal and opposite entries. This means that for every debit, there must be a corresponding credit.

The double-entry accounting system is based on the following principles:

- Assets: Assets are the resources that a business owns, such as cash, inventory, and equipment. Asset accounts are increased with debits and decreased with credits.

- Liabilities: Liabilities are the debts that a business owes, such as accounts payable and loans payable. Liability accounts are increased with credits and decreased with debits.

- Equity: Equity is the ownership interest in a business. Equity accounts are increased with credits and decreased with debits.

- Income: Income is the revenue that a business generates from its activities. Income accounts are increased with credits and decreased with debits.

- Expenses: Expenses are the costs that a business incurs in order to generate revenue. Expense accounts are increased with debits and decreased with credits.

Navigating Financial Transactions with Debits and Credits

When recording a financial transaction in double-entry accounting, you must identify the following:

- The accounts affected by the transaction

- Whether the transaction increases or decreases each account

- The amount of the transaction

Once you have identified this information, you can record the transaction with debits and credits.

For example, if a business sells inventory for cash, the following accounting entries would be recorded:

- Debit: Cash account

- Credit: Sales account

This transaction increases the cash account (asset) and decreases the sales account (revenue).

Practical Examples and Exercises for Learning Debits and Credits

There are many practical examples and exercises that you can use to learn debits and credits. Here are a few examples:

Example 1: A business purchases inventory for $10,000 on credit.

Debit: Inventory account

Credit: Accounts payable account

This transaction increases the inventory account (asset) and decreases the accounts payable account (liability).

Example 2: A business provides services to a customer and invoices them for $5,000.

Debit: Accounts receivable account

Credit: Revenue account

This transaction increases the accounts receivable account (asset) and decreases the revenue account (equity).

Advanced Concepts and Nuances in Debits and Credits

There are a number of advanced concepts and nuances in debits and credits. For example, some accounts have normal balances and other accounts have contra balances.

- Normal balances: Asset accounts and expense accounts have normal debit balances. Liability accounts, equity accounts, and revenue accounts have normal credit balances.

- Contra balances: Contra accounts are used to reduce the balances of other accounts. For example, the contra asset account, Accumulated Depreciation, is used to reduce the balance of the asset account, Equipment.

If you are interested in learning more about advanced debits and credits, there are a number of resources available online and in libraries.

Debits and credits are essential concepts for understanding accounting and finance. By mastering debits and credits, you will be well on your way to becoming a skilled accountant or financial analyst.