How do you convert yearly salary into hourly wage?

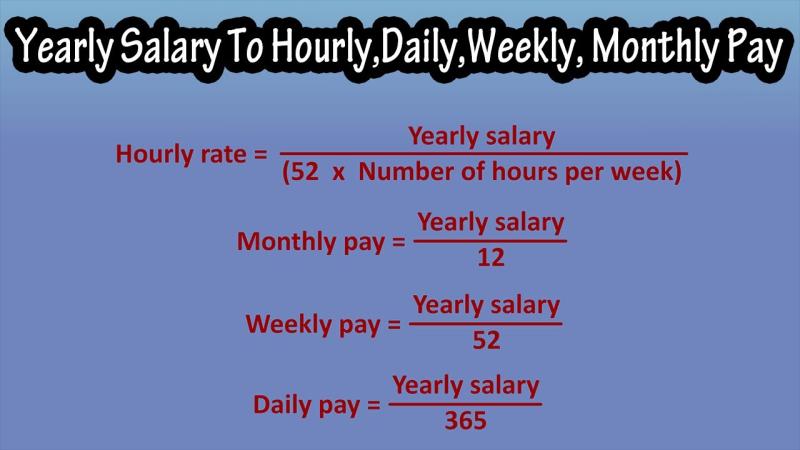

To convert a yearly salary to an hourly wage, you can use the following formula:

Here are the steps to perform the conversion:

Determine the Number of Work Hours per Week:

- A standard full-time workweek is often considered to be 40 hours. However, the number of work hours per week may vary based on your employment agreement or industry standards.

Determine the Number of Weeks per Year:

- The number of weeks per year is typically considered to be 52 for full-time employment. This assumes that you work every week of the year. If your employment agreement includes vacation days or other time off, you may need to adjust this number accordingly.

Plug the Values into the Formula:

Substitute the values into the formula:

For example, if the yearly salary is $50,000, and you work 40 hours per week for 52 weeks per year, the calculation would be:

Perform the Calculation:

Use a calculator to perform the calculation. In the example above, it would be:

The result is the hourly wage.

Keep in mind that this calculation provides an estimate and assumes that you work a consistent number of hours each week throughout the year. If your work hours vary, you may want to calculate your hourly wage based on a more detailed analysis of your work schedule.

Additionally, if you have additional income sources, benefits, or deductions, the calculation may need to be adjusted accordingly. Always refer to your employment contract and relevant financial documents for accurate information about your salary and employment terms.

What formula is used to convert a yearly salary into an hourly wage?

The basic formula to convert a yearly salary into an hourly wage is:

Hourly Wage = Yearly Salary / (Total Work Hours per Year)

Where:

Yearly Salary is the annual compensation paid to an employee.

Total Work Hours per Year is the estimated number of hours an employee works in a year. This typically includes the standard 40-hour workweek for 52 weeks, amounting to 2,080 hours per year.

For instance, if an employee has a yearly salary of $50,000 and works a standard 40-hour workweek, their hourly wage would be:

Hourly Wage = $50,000 / 2,080 hours = $24.04 per hour

Are there variations in calculating hourly wage based on different work schedules?

Yes, there can be variations in calculating hourly wage based on different work schedules. The standard formula assumes a 40-hour workweek and 2,080 work hours per year. However, many employees have different work schedules, such as working part-time, overtime, or irregular hours.

For part-time employees, the calculation would involve using the actual number of hours worked per year instead of the standard 2,080. For instance, a part-time employee working 20 hours per week would have an hourly wage of:

Hourly Wage = Yearly Salary / (20 hours/week * 52 weeks/year)

For overtime hours, the hourly wage is typically calculated at a higher rate, often 1.5 or double the standard hourly wage. For irregular work schedules, the average hourly wage can be calculated by dividing the total yearly salary by the total number of hours worked in a year, regardless of the specific work schedule.

How do benefits and bonuses factor into the conversion of yearly salary to hourly wage?

Benefits and bonuses are typically not directly factored into the calculation of hourly wage. This is because they are considered additional forms of compensation that are not directly tied to the number of hours worked. However, benefits and bonuses can indirectly influence the overall compensation package and may be considered when negotiating a salary or comparing different job offers.

In some cases, employers may prorate benefits or bonuses into an hourly wage for the purpose of calculating overtime pay or determining eligibility for certain benefits. However, this is not a standard practice, and the calculation of hourly wage typically focuses on the base salary and regular work hours.