What is the Consumer Price Index report?

The Consumer Price Index (CPI) report is a widely used economic indicator that measures changes in the average prices paid by urban consumers for a basket of goods and services over time. It is published regularly by government agencies in many countries, including the United States, and serves as an important tool for assessing inflation and price trends in an economy.

Here are key points to understand about the Consumer Price Index report:

Purpose: The CPI report is designed to track and quantify the changes in the cost of living for the average consumer. It helps policymakers, economists, businesses, and individuals gauge inflation or deflation and make informed decisions based on price trends.

Composition: The CPI is calculated based on a "basket" of goods and services that represents the typical spending patterns of an urban household. This basket includes items such as food, housing, transportation, clothing, healthcare, and entertainment.

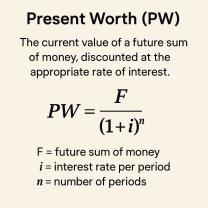

Measurement: To calculate the CPI, the prices of the items in the basket are collected at regular intervals, typically monthly. These prices are then compared to a base year's prices to determine the percentage change in prices over time.

Core CPI: The CPI is often reported in two forms: the headline CPI, which includes all items in the basket, and the core CPI, which excludes volatile components like food and energy. Core CPI is used to provide a clearer picture of underlying inflation trends.

Inflation and Deflation Indicator: A rising CPI indicates inflation, meaning that, on average, prices for the basket of goods and services are increasing. Conversely, a falling CPI suggests deflation, indicating that prices are decreasing.

Policy Implications: Central banks, such as the Federal Reserve in the United States, use CPI data to make decisions about monetary policy. They aim to maintain price stability and target a specific level of inflation, often around 2%, as part of their economic goals.

Cost-of-Living Adjustments: Some government benefits and private contracts, like Social Security payments, pension plans, and wage agreements, may be adjusted based on changes in the CPI. These adjustments are made to help individuals maintain their purchasing power in the face of inflation.

Market and Investment Impact: Investors and financial markets pay close attention to CPI reports as they can influence interest rates, bond yields, and investment decisions. High inflation may lead to higher interest rates, affecting borrowing costs and investment returns.

Regional Variations: CPI reports can vary by region or city within a country, reflecting differences in the cost of living in different areas.

Overall, the Consumer Price Index report is a critical economic indicator that provides insights into the price stability of an economy. It helps individuals and organizations make financial and investment decisions and assists policymakers in setting economic policies that aim to balance inflation and economic growth.

Understanding the Consumer Price Index Report

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The CPI is calculated by the Bureau of Labor Statistics (BLS) and released monthly.

The CPI report is important because it is one of the most widely used measures of inflation. Inflation is the rate at which the prices of goods and services are rising. A high inflation rate can erode the purchasing power of consumers and businesses.

The CPI report is also used to adjust Social Security benefits, federal income tax brackets, and other government programs.

Deciphering Economic Trends: The Significance of the Consumer Price Index

The CPI report is a significant economic indicator because it can provide insights into the following:

- The overall health of the economy: A rising CPI indicates that inflation is increasing. This can be a sign of a strong economy, but it can also lead to higher prices for consumers and businesses.

- The purchasing power of consumers: A rising CPI means that consumers can buy less with the same amount of money. This can lead to a decline in consumer spending and economic growth.

- The impact of government policies: The CPI report can be used to assess the impact of government policies, such as tax cuts and spending increases.

CPI Report Demystified: What You Need to Know

The CPI report is a complex document, but there are a few key things that you need to know:

- The CPI is calculated using a basket of goods and services that are representative of the spending habits of urban consumers. The basket is updated every two years to reflect changes in spending patterns.

- The CPI is not a perfect measure of inflation. There are a number of factors that can affect the CPI, such as changes in the quality of goods and services, and changes in the way that people consume goods and services.

- The CPI report is released monthly. The report includes headline CPI, which is the most widely reported measure of inflation, and core CPI, which excludes food and energy prices.

The CPI report is an important economic indicator that can provide insights into the health of the economy, the purchasing power of consumers, and the impact of government policies. By understanding the key takeaways from the CPI report, you can make informed decisions about your personal finances and your business.