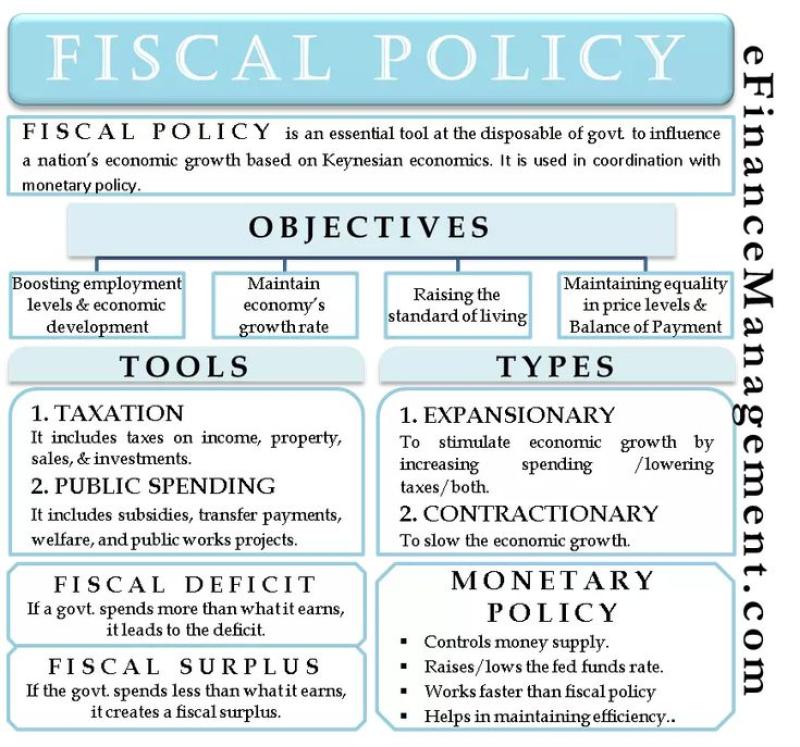

What are the components of fiscal policy?

Fiscal policy is a set of government measures aimed at influencing the economy through changes in government spending, taxation, and borrowing. The components of fiscal policy include:

Government Spending:

- Discretionary Spending: This is the portion of the government budget that is decided through the regular budgetary process. It includes expenditures on defense, education, infrastructure, and other government programs.

- Automatic Stabilizers: These are government expenditures that automatically increase or decrease in response to economic conditions. Examples include unemployment benefits and welfare programs.

Taxation:

- Tax Cuts: Governments can implement tax cuts to stimulate economic activity. This puts more money into the hands of consumers and businesses, encouraging spending and investment.

- Tax Hikes: Conversely, governments can increase taxes to reduce spending and cool down an overheated economy. This is often used during periods of high inflation.

Transfer Payments:

- These are payments from the government to individuals, such as Social Security, unemployment benefits, and welfare. Adjusting the levels of transfer payments can impact disposable income and, consequently, consumer spending.

Borrowing and Deficit Spending:

- Deficit Spending: If the government spends more money than it collects in revenue during a specific period, it incurs a budget deficit. Deficit spending can be used to stimulate economic activity during a recession.

- Surplus: Conversely, if the government collects more revenue than it spends, it incurs a budget surplus. Surpluses can be used to pay down debt or saved for future use.

Government Debt Management:

- Governments can manage their overall debt levels through fiscal policy. High levels of debt may lead to higher interest payments, potentially crowding out other important government spending. Conversely, reducing debt can free up resources for other uses.

Counter-Cyclical Fiscal Policies:

- Expansionary Policies: These policies are used to stimulate economic growth during a recession. This can involve increasing government spending, cutting taxes, or both.

- Contractionary Policies: In times of high inflation or economic overheating, governments may implement contractionary fiscal policies to cool down the economy. This can involve reducing government spending or increasing taxes.

Fiscal Rules and Frameworks:

- Some countries implement fiscal rules or frameworks to guide fiscal policy decisions. These rules may include targets for budget deficits, debt levels, or other fiscal indicators.

Infrastructure Investment:

- Governments may use fiscal policy to boost economic growth by investing in infrastructure projects such as roads, bridges, and public facilities. This not only stimulates economic activity in the short term but can also contribute to long-term productivity.

The effectiveness of fiscal policy depends on various factors, including the economic context, the magnitude of the policy changes, and the speed at which they are implemented. Fiscal policy is often used in conjunction with monetary policy to achieve broader economic objectives, such as full employment, price stability, and economic growth.

Fiscal Policy Components and its Influence on Economic Growth

1. Components of Fiscal Policy:

Fiscal policy uses two main tools to influence the economy:

- Government Spending: The level of government expenditure on goods and services directly affects aggregate demand in the economy. Increased spending injects money into the economy, stimulating economic activity and potentially leading to economic growth. Conversely, decreased spending reduces aggregate demand, potentially slowing down the economy.

- Taxation: The level and structure of taxes levied by the government influence the disposable income of individuals and businesses. Lower taxes leave more money in the hands of individuals and businesses, potentially encouraging spending and investment, thereby stimulating economic activity. Conversely, higher taxes reduce disposable income, potentially leading to decreased spending and investment, slowing down the economy.

2. Influence on Economic Growth and Stability:

Fiscal policy can influence economic growth and stability in several ways:

- Stimulating or Stabilizing Aggregate Demand: By adjusting government spending and taxation, fiscal policy can influence the overall level of demand in the economy. Increased government spending and lower taxes can stimulate aggregate demand, leading to economic growth. Conversely, reduced spending and higher taxes can dampen aggregate demand, contributing to economic stability by preventing inflation and overheating.

- Influencing Investment and Consumption: Fiscal policy can impact investment and consumption decisions. Lower taxes and targeted incentives can encourage businesses to invest and individuals to spend, boosting economic activity.

- Managing Inflation: Fiscal policy can help control inflation by reducing government spending and increasing taxes, thereby reducing the amount of money circulating in the economy.

3. Primary Goals of Fiscal Policy:

The primary goals of fiscal policy are typically:

- Economic Growth: Promoting long-term economic growth by creating a favorable environment for business investment and innovation.

- Economic Stability: Maintaining a stable economy by preventing inflation and managing economic fluctuations.

- Distributional Fairness: Achieving a fair distribution of income and wealth in society through targeted tax and spending policies.

- Full Employment: Promoting full employment by encouraging job creation and reducing unemployment.

The relative emphasis placed on these goals can vary depending on the specific economic circumstances and priorities of the government. However, a well-designed fiscal policy can contribute significantly to achieving a healthy, stable, and equitable economy.