What are the benefits of seller financing?

Seller financing can offer several benefits for both buyers and sellers in a real estate transaction, making it a potentially advantageous and flexible option. Here are the key benefits of seller financing:

For Buyers:

Increased Accessibility to Homeownership: Seller financing can help buyers who may not qualify for traditional mortgage loans, such as those with less-than-perfect credit, self-employed individuals, or those with irregular income.

Lower Down Payment: Sellers may be more flexible with down payment requirements, allowing buyers to purchase a home with a smaller upfront cash outlay compared to conventional mortgages.

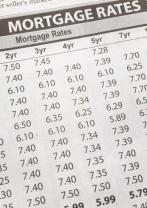

Negotiable Terms: Buyers and sellers can negotiate the terms of the financing arrangement, including the interest rate, loan term, and repayment schedule, providing more flexibility to meet the specific needs of both parties.

Faster Closing: Seller financing transactions may have shorter closing times compared to traditional mortgage loans since they often involve less extensive paperwork and lender requirements.

Less Stringent Qualification Criteria: Buyers may encounter fewer stringent qualification criteria, as the seller can base the decision on their own evaluation of the buyer's financial situation.

Potential for Lower Closing Costs: Seller financing transactions may have lower closing costs compared to traditional mortgages, as they do not involve certain fees associated with lender-originated loans.

For Sellers:

Attractive Selling Option: Seller financing can make a property more appealing to potential buyers. It can expand the pool of prospective purchasers and potentially lead to a quicker sale.

Income Stream: Sellers can earn a consistent income stream from the interest payments on the financed portion of the sale. This can be especially attractive in low-interest-rate environments.

Tax Advantages: Sellers may benefit from certain tax advantages, including the potential to spread capital gains over time rather than receiving a lump-sum payment upon the sale.

Competitive Interest Rates: Sellers can offer competitive interest rates to buyers, potentially attracting more interest and making their property more attractive in the market.

Collateral Security: Sellers retain a lien on the property, which can serve as collateral security for the loan. In the event of default, the seller has the option to foreclose and regain ownership of the property.

Flexibility: Sellers have the flexibility to negotiate and customize the terms of the financing arrangement, tailoring them to their financial goals and circumstances.

It's important to note that while seller financing can offer various benefits, it also comes with certain risks and complexities. Both buyers and sellers should carefully consider the terms, conduct due diligence, and seek legal and financial advice to ensure that the transaction is structured appropriately and in accordance with local laws and regulations. Additionally, both parties should have a clear understanding of their rights and responsibilities throughout the financing agreement.

Seller Financing Benefits in Real Estate Transactions

Seller financing, also known as owner financing or purchase-money mortgage, is an alternative to traditional mortgage financing where the seller of a property provides the financing directly to the buyer. This arrangement offers several benefits for both buyers and sellers in real estate transactions.

2. Advantages of Seller Financing for Home Buyers

For buyers, seller financing can provide:

Greater access to homeownership: Seller financing can open up homeownership opportunities for buyers who may not qualify for traditional mortgages due to credit issues or limited down payments.

Flexible terms and conditions: Buyers may have more flexibility in negotiating terms such as the interest rate, repayment schedule, and down payment, potentially securing a more favorable arrangement.

Quicker closing process: Seller financing can streamline the closing process, avoiding the lengthy underwriting and approval procedures of traditional mortgages.

Direct relationship with the lender: Buyers interact directly with the seller, potentially fostering a more personalized and understanding relationship compared to dealing with a traditional lender.

3. Advantages of Seller Financing for Sellers

For sellers, seller financing can provide:

Expanded pool of potential buyers: Seller financing can attract a wider range of buyers, including those who may not have access to traditional financing, potentially leading to a faster sale.

Additional income stream: Sellers receive regular payments from the buyer, providing a steady source of income and potentially contributing to retirement savings or investment goals.

Retention of property title: Sellers maintain ownership of the property until the loan is fully repaid, ensuring that their investment is secured.

Control over the transaction: Sellers have more control over the sale process, including selecting the buyer and negotiating terms that align with their objectives.

Real Estate Seller Financing: A Win-Win Solution

When structured appropriately, seller financing can be a mutually beneficial arrangement for both buyers and sellers. Buyers gain access to homeownership and potentially more favorable financing terms, while sellers expand their buyer pool, generate additional income, and maintain control over the transaction. However, it's crucial to carefully consider the risks and implications involved, such as potential defaults, legal complexities, and tax considerations. Consulting with real estate attorneys, financial advisors, and experienced real estate agents can help both parties navigate the process effectively and protect their interests.

Conclusion

Seller financing offers a unique and potentially rewarding alternative to traditional mortgage financing in real estate transactions. By understanding the benefits, risks, and implications, buyers and sellers can make informed decisions and potentially achieve their respective goals in the real estate market.