What are the best programs for first time home buyer?

The best programs for first-time home buyers can vary depending on your location, financial situation, and specific needs. However, there are several common programs and assistance options that are often available to help first-time home buyers in the United States. Here are some of the most popular ones:

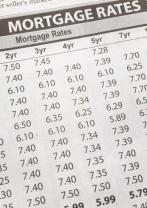

FHA Loans: The Federal Housing Administration (FHA) offers loans with low down payment requirements (typically around 3.5%), making it more accessible for first-time home buyers. FHA loans are backed by the government, which can make it easier to qualify for them.

VA Loans: If you are a qualified veteran or an active-duty service member, the Department of Veterans Affairs (VA) provides VA loans with low or even no down payment requirements and competitive interest rates.

USDA Loans: The U.S. Department of Agriculture (USDA) offers loans to eligible rural and suburban homebuyers who meet income requirements. These loans often come with low or no down payment options.

State and Local Programs: Many states and local governments offer various assistance programs for first-time home buyers, including down payment assistance, grants, and low-interest loans. These programs can vary widely from one location to another, so it's essential to check with your local housing authority or government website.

Good Neighbor Next Door Program: This program is designed for teachers, law enforcement officers, firefighters, and emergency medical technicians. It offers a 50% discount on the list price of a home in revitalization areas.

HomeReady and Home Possible Loans: These programs are offered by Fannie Mae and Freddie Mac, respectively. They provide low down payment options and flexible underwriting criteria for first-time home buyers.

Homebuyer Education Courses: Many states and organizations require or recommend homebuyer education courses, which can help you better understand the home buying process and may qualify you for certain assistance programs.

Down Payment Assistance Programs: Numerous organizations, nonprofits, and lenders offer down payment assistance programs that can help you cover the initial costs of buying a home.

Mortgage Credit Certificates (MCCs): MCCs are tax credits that reduce the amount of federal income tax you owe, increasing your disposable income. These can be used in conjunction with a first-time homebuyer loan.

Energy-Efficient Mortgage Programs: These programs allow first-time home buyers to finance energy-efficient upgrades and improvements in their homes.

To determine which programs are best for you, you should start by:

- Researching and comparing available programs in your area.

- Speaking with a local housing counselor or real estate agent who specializes in helping first-time home buyers.

- Assessing your financial situation to determine which program aligns with your budget and needs.

It's also essential to consider your long-term financial goals and how various programs will affect your mortgage payments and overall homeownership experience. Keep in mind that program availability and eligibility criteria may change over time, so it's a good idea to stay informed by consulting with local experts and financial professionals.

Programs and Resources for First-Time Homebuyers

Navigating the process of buying a home for the first time can be overwhelming, but there are numerous programs and resources available to assist you. These programs can provide financial assistance, education, and guidance to help you make informed decisions and achieve your homeownership goals.

Government-Sponsored First-Time Homebuyer Programs

The Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the Department of Agriculture (USDA) offer various programs specifically designed for first-time homebuyers. These programs typically feature lower down payment requirements, more flexible credit score qualifications, and competitive interest rates.

Examples of Government-Sponsored Programs:

FHA Loans: FHA loans require a minimum down payment of 3.5% and accept credit scores as low as 580.

VA Loans: VA loans are available to eligible veterans, service members, and their spouses. They offer no down payment requirement and competitive interest rates.

USDA Loans: USDA loans are designed for low- and moderate-income borrowers in rural areas. They offer zero down payment options and flexible credit score requirements.

Financial Assistance and Grants for Homebuyers

In addition to government-backed programs, there are various state, local, and non-profit organizations that offer financial assistance and grants to first-time homebuyers. These programs may provide down payment assistance, closing cost assistance, or tax credits.

Examples of Financial Assistance Programs:

Down Payment Assistance Programs: These programs provide funds to help borrowers cover their down payment, typically in the form of grants or low-interest loans.

Closing Cost Assistance Programs: These programs help borrowers cover the upfront costs associated with buying a home, such as appraisal fees, title insurance, and lender fees.

Tax Credits: Some states offer tax credits to first-time homebuyers, reducing their tax liability and effectively increasing their purchasing power.

Preparing and Qualifying for First-Time Homebuyer Programs

To qualify for first-time homebuyer programs, you typically need to meet specific income, credit score, and residency requirements. It's essential to gather your financial documents, establish a solid credit history, and research available programs in your area.

Essential Steps for Preparing and Qualifying:

Assess Your Financial Readiness: Evaluate your income, savings, and debt obligations to determine your affordability.

Check Your Credit Score: Obtain your credit report and address any negative items to improve your creditworthiness.

Research Available Programs: Explore government-sponsored programs, state and local assistance, and non-profit options.

Consult with a Housing Counselor: Seek guidance from a HUD-approved housing counselor to understand program eligibility and navigate the homebuying process.

Success Stories of First-Time Homebuyers Using Support Programs

Numerous success stories demonstrate the effectiveness of first-time homebuyer programs. These programs have helped countless individuals and families achieve their dream of homeownership by providing the necessary financial support and guidance.

Examples of Success Stories:

Single parent achieves homeownership with down payment assistance: A single parent struggling with childcare expenses received down payment assistance through a local housing agency, enabling them to purchase a home for their family.

Military veteran utilizes VA loan program: A veteran returning from service used a VA loan to purchase a home without the burden of a down payment, providing stability and security for their family.

Low-income family benefits from USDA loan: A low-income family in a rural area qualified for a USDA loan, allowing them to purchase a home in their community without a down payment, improving their quality of life.